Beware What Lurks Below

While Team Transitory was celebrating the August personal consumption expenditure inflation figures on Friday, the undercurrents of household prices suggest that the path to two percent is likely to be a long march and may require additional monetary tightening.

Both the headline and core personal consumption expenditure (PCE) price indexes came in below expectations for August. Headline PCE inflation rose by 0.4 percent for the month, below expectations for 0.5 percent. That was, however, enough to push up the year-over-year figure by a tenth to 3.5 percent.

Core PCE inflation slowed from the monthly pace of 0.2 percent in July to 0.1 percent in August. This dropped the year-over-year rate down four-tenths to 3.9 percent, which is the lowest pace of core PCE inflation since May of 2021.

Paul Krugman declared this a victory for “Team Long Transitory.”

Still no recession, but core PCE down to 2.2% on a three-month basis. Team Long Transitory for the win.

— Paul Krugman (@paulkrugman) September 29, 2023

We’re assuming this is meant somewhat ironically, since “long transitory” is an oxymoron. Our best guess is that the concept of “long transitory” is meant to refer to the idea that inflation will eventually decline on its own without the need for prolonged restrictive monetary policy, much less higher rates.

But it might not have been as big a victory as it looks. A large contributor to the decline in core inflation was a moderation in financial services price increases, from 2.5 percent in July to 0.5 percent in August, including a sizable decline in portfolio management and investment services. These move with the stock prices. With the S&P 500 dropping 1.8 percent in August, that brought down portfolio management inflation from 6.9 percent in July (when the S&P was up three percent) to 0.5 percent in August. With stocks down again in September, it’s likely this figure will turn negative in the next report.

While we are sure people are glad that the prices of their financial services are falling alongside their retirement savings, this is not really what people tend to think about when they say they want inflation to come down. Food inflation, which is excluded from “core” inflation but is at the core of much of the public’s dissatisfaction with inflation, rose 0.2 percent in August, the biggest increase since February.

Measures of underlying inflation suggested either a lack of progress on inflation or actual acceleration. The Federal Reserve Bank of Dallas calculates “trimmed mean” inflation, which excludes the items that rise or fall the most in the month. This rose at an annualized rate of 2.6 percent in August, exactly as it did in July and a tenth of a point faster than in June. The indication there is that inflation is becoming stuck at a level well above the Fed’s target.

The Cleveland Fed calculates median inflation. This had been running at 0.2 percent month-to-month for the prior three months. In August, it jumped to 0.3 percent. While one month does not make a trend, the break with the prior months at least suggests that the disinflationary weight of the Fed’s earlier rate hikes may have run their course.

It’s also important to note that an increase in energy prices, especially gasoline, may create an illusion of disinflation by holding back core prices. When households spend more at the gas pump, they have less to spend elsewhere. So, some of the disinflation in core PCE prices may really just be a shifting of inflation from core to energy.

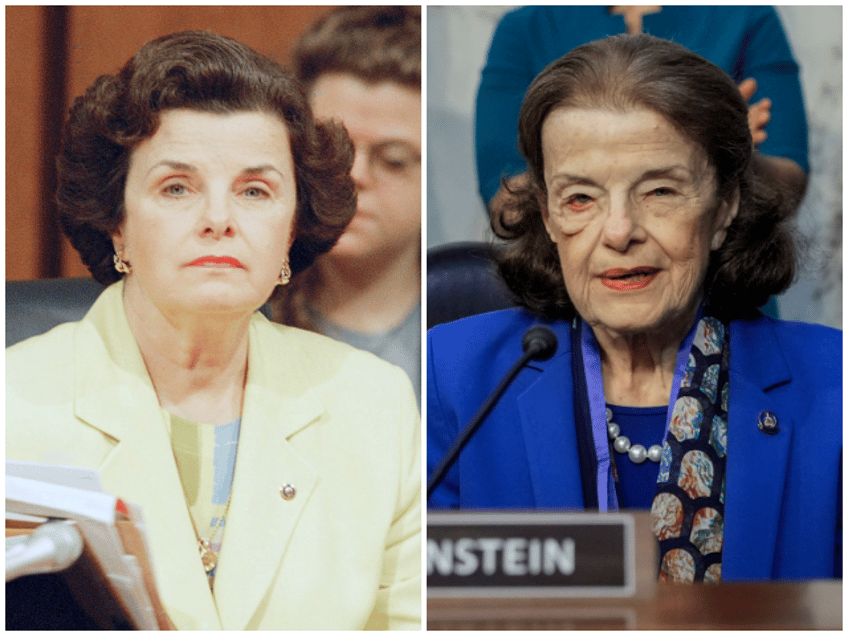

The Economic Effects of California’s Loss of Feinstein’s Seniority

Dianne Feinstein—the long-tenured California senator whose regal manner, coifed hair, and conservative suits barely masked a hard-edged leftism opposed to gun rights, the right to life of the unborn, conservative nominees to the Supreme Court, and border security—died Thursday. She was 90 and the oldest member of the U.S. Senate.

Democrat U.S. Senate candidate Dianne Feinstein celebrates her primary win in California on June 2, 1992. (John O’Hara/San Francisco Chronicle via Getty Images)

Feinstein was first elected to the U.S. Senate in 1992, which the establishment media had dubbed “The Year of the Woman.” The extreme length of her tenure in the Senate became one of the key reasons many California Democrats continued to support her. In a small legislative body where seniority often equals power and influence, Feinstein’s decades-long Senate reign not-so-subtly warped national policy and federal spending priorities to favor her home state.

Her death means she will be replaced by a freshman senator. As a result, California’s sway over the nation’s spending priorities can be expected to be diminished.

“If we lost her seniority … every other state benefits from California not having seniority, because our appropriations are so much larger,” Jeffrey Millman, Feinstein’s 2018 campaign manager, said in a 2022 interview with New York magazine.

By one estimate, California received $116 billion in state and local aid from the Federal government in 2020, dwarfing even New York’s $79.2 billion. The figure of total federal spending that flows into California is even higher if we include income earned by California businesses contracting with the federal government. At least some of that funding is likely to find itself flowing to states whose senators have now effectively received a seniority promotion.

Data from the Bureau of Economic Analysis put the size of California’s economy at $3.701 trillion as of the fourth quarter of 2022. That makes its economy larger than that of France, Brazil, and the United Kingdom. The economic result of the death of Feinstein is likely to be less economic growth in California and more elsewhere. As Millman said, “every other state benefits” from the loss of Feinstein’s seniority.

A big winner could be Texas. Many high tech businesses have already decided to move operations to Texas or relocate there entirely, most notably Tesla. With California deprived of the advantages that come with being represented by the longest sitting senator, more businesses may migrate to nearby states with more business-friendly policies.

Of course, this was bound to happen anyway. Feinstein had already announced that she was not going to seek re-election in 2024. So, the economic effect of her shuffling off her mortal coil this week is simply to advance the process by a year and quarter or so.