Bud Light is recalibrating its target marketing audience as the 'Overton Window' shifts center-right. The brewer's latest ad features Peyton Manning, Post Malone, and Shane Gillis drinking beers in a suburbia neighborhood during a cul-de-sac party—a stark deviation from its woke marketing with transgender influencer Dylan Mulvaney, which nuked the brand after a nationwide uproar. Still, the brewer has not apologized.

Ahead of the most-watched sporting event in the country, the Super Bowl, Bud Light has published the new masculine ad on X.

"These beers are a metaphor for an invitation," Gillis said after he and Malone used leaf blowers to launch invitational beer cans to nearby neighbors.

Manning entered the picture as a partygoer and said, "This Cul-De-Sac is popping."

Big Men on Cul-de-Sac know how to get the party started… and that’s exactly what they’re doing in our new Super Bowl LIX commercial pic.twitter.com/ikXx4o7Fod

— Bud Light (@budlight) January 31, 2025

Todd Allen, SVP of Marketing for Bud Light, told People Magazine that the trio was chosen to star in the ad because they're masculine: "all undoubtedly deliver BMOC [Big Men on Cul-De-Sac] energy in their everyday lives."

What a seismic change from Bud Light in April 2023, featuring a man pretending to be a woman in a TikTok ad.

Dylan Mulvaney has become the new brand ambassador for Bud Light. 🍺

— Oli London (@OliLondonTV) April 1, 2023

The beer brand even made a special edition Dylan Mulvaney Can 🥤celebrating his 365 days of girlhood.

(This is not April Fools, it’s actually real)

🍺🍻🍺😒🍻🍺🍻 #dylanmulvaney #trans #transgender pic.twitter.com/xuu87WxrvZ

Despite the pivot into masculine advertising with a target audience of millennials in suburbia, Bud Light still faces mounting structural demand pressures after having lost the 'king of beers' title as consumers revolted and switched to other brands.

Here's a snippet from JPM's Celine Pannuti, Philip Spain, and others about lingering demand woes Bud Light faces:

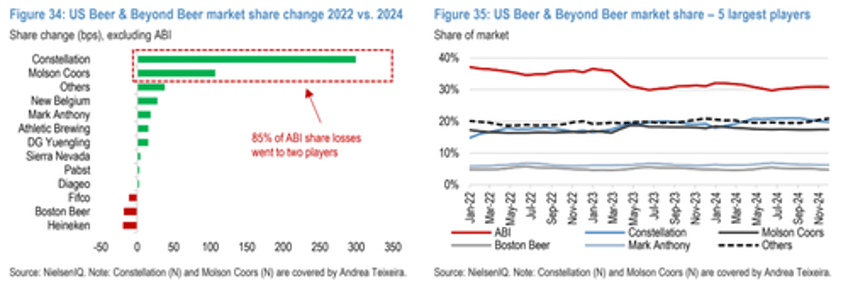

ABI's US Beer & Beyond Beer (excluding Spirits-based RTDs) market share in 2024 declined 480bps to 31% compared with 2022, as the business was hit by share loss at Bud Light (following controversy on social media). The vast majority (85%) of the lost share has moved to Constellation +300bps (N, covered by Andrea Teixeira – latest view here) and Molson Coors +105bps (N, covered by Andrea Teixeira – latest view here) with small gains for other companies and some share losses also for Heineken and Boston Beer. By brand, the biggest winners from ABI's share losses have been Modelo (owned by Constellation), which is benefiting also from consumer preference for Mexican beer (+240bps, the majority of Constellation share gains), Coors (+90bps, the majority of share gains for Molson Coors,), Twisted Tea (+85bps, alcoholic iced tea owned by Boston Beer), Miller (+50bps, owned by Molson Coors) and Pacifico (+35bps, a Mexican beer owned by Constellation).

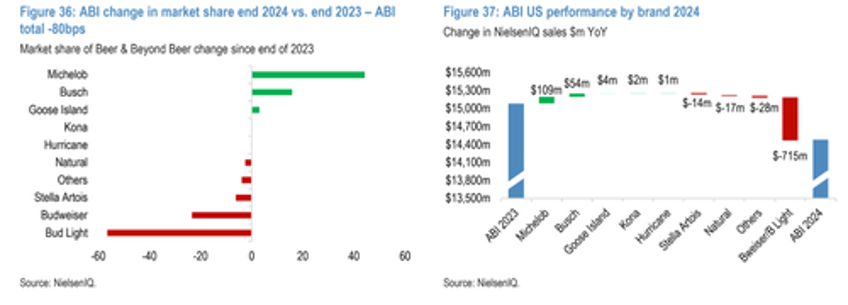

Pannuti and her team noted that AB InBev, the owner of Bud Light and several other beer brands, credited Michelob and Busch with supporting its US portfolio. The marketing blunder in April 2023 severely damaged demand for Bud Light and Budweiser across the US to this day.

AB shares in Europe have entered a bear market following the marketing blunder.

Bud Light's shift toward masculine advertising makes sense, given the brewer struggles amid a continued consumer revolt.

Corporate America learned a very valuable lesson: hiring workers infected with the woke mind virus into managerial spots is a liability.