Have a Florida condo? Can you afford a $100,000 or higher special assessment for new safety standards?

After the collapse of a Surfside Building on June 24, 2021that killed 98 people, the state passed a structural safety law that is now biting owners.

Not only are insurance rates soaring, but owners are hit with huge special assessments topping $100,000.

New Florida Law Roils Its Condo Market

The Wall Street Journal reports New Florida Law Roils Its Condo Market

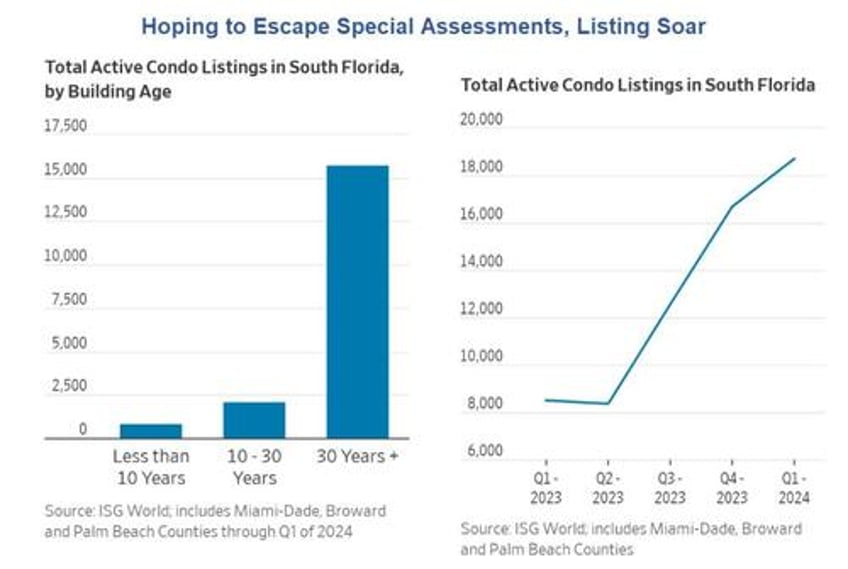

Condo inventory for sale in South Florida has more than doubled since the first quarter of last year, to more than 18,000 units. While the sharp rise in Florida home insurance costs is driving some to sell, most of the units on the market are in buildings 30 years or older. Under the new law, buildings must pass milestone structural inspections no later than 30 years after they are built.

In Miami, about 38% of the housing stock is condos, the highest of any major metropolitan area in the U.S., according to Zillow. Of those buildings, nearly three-quarters are at least 30 years old. For those that have large repairs looming, many owners are scrambling to sell before Jan. 1 when building reserves must be fully funded to be in compliance with the law.

“I think this is just the beginning,” said Greg Main-Baillie, an executive managing director at real-estate firm Colliers, who oversees 40 condo renovation projects across the state.

Owners are struggling to find all-cash buyers because mortgage lenders are increasingly unwilling to take on the risk associated with these units. “It’s not the buyers that aren’t qualifying,” said Craig Studnicky, chief executive at ISG World. “It’s the buildings that aren’t qualifying.”

State law previously allowed condos to waive reserve funding year after year, leading many buildings, including the nearly 50-year-old Cricket Club, to keep next to nothing in their coffers. Now, about 40 units in the building of 220 are listed for sale but are seeing little interest.

“These units are practically being given away,” said Sari Papir, a retired real-estate agent who has lived in the Cricket Club with her partner Shaul Szlaifer since 2018. “Even if we found a buyer, what could we buy with the pennies we’d receive for our unit?”

Some are worried developers may already be purchasing condos in the building for a potential takeover, where a developer tries to gain control of a building to knock it down and build a newer, more luxurious one. These condo terminations are happening up and down the state’s coastline. While the rules can vary by building, if enough people vote to sell their units, the others have to follow along.

No Way to Escape the Assessment

Those who cannot sell and don’t have the special assessment, will be evicted and their units seized for whatever the Associations can get for them.

South Florida listings have doubled in the past year to over 18,000. Few of those units will sell, and those that do sell will be at a huge haircut.

The Journal noted the plight of Ivan Rodriguez who liquidated his 401K to buy a condo for $190,000. He then faced a $134,000 special assessment. Eventually he sold the unit for $110,000.

Got the Insurance Blues?

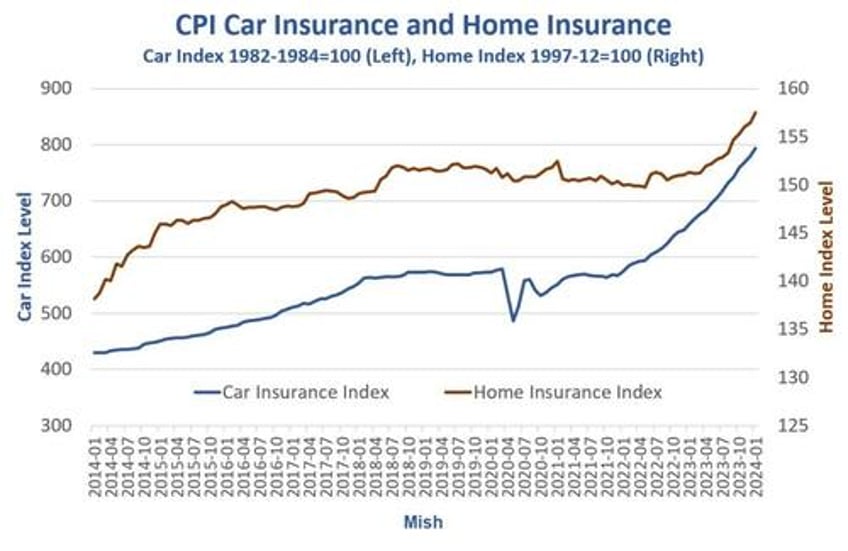

Auto insurance is up more than 20 percent from a year ago. In many places, private home insurance isn’t available at all. Consumers are steaming.

Insurance data from the BLS, chart by Mish

On February 17, 2024 I asked Got the Insurance Blues? Auto and Home Insurance Costs are Soaring

Car insurance is on an amazing run. For 13 straight months, insurance is up at least 1.0 percent. For 20 straight months car insurance is up at least 0.7 percent.

Home insurance, if you can get it at all from any private insurer, is also rising at a fast clip.

If you live in a flood zone, hurricane zone, or fire zone, insurance may be very difficult to get.

Proposition 103 Backfires, State Farm to Cancel 72,000 California Policies

Citing wildfire risk, State Farm will not renew policies on 30,000 homes and 42,000 business in California. Blame the state, not insurers.

On March 26, I noted Proposition 103 Backfires, State Farm to Cancel 72,000 California Policies

Proposition 103 limited the annual increases of insurance companies. State Farm responded by cancelling 72,000 policies.

The Idiot’s Response

Carmen Balber, the executive director of Consumer Watchdog, said “The industry is not going to start covering Californians again without a mandate.”

“That is why we think the legislature needs to step in and require insurance companies to cover people.”

Force companies to cover people. What a hoot. The insurers would all leave and everyone would be on the “FAIR” plan.

Think!

Think carefully about where you want to live. And if it’s a condo, you better be prepared for huge special assessments.

And most of all, know your builder. For discussion, please see America’s Homebuilder: D.R. Horton Homes Falling Apart in Months