GA House Speaker Jon Burns' suggestion comes on top of other planned tax cuts as the state piles up billions in surplus cash

Market analyst says US debt situation 'bad news' for taxpayers left to foot the bill

CPA and market analyst Dan Gertrude explains why the IRS's new tax brackets could put more money in Americans' pockets and startling numbers showing that America comprises approximately one-third of the global debt.

Georgia House Republicans are proposing an additional tax cut for parents.

House Speaker Jon Burns on Wednesday said his GOP caucus will back a plan to raise the amount that parents can deduct per child from their yearly state income taxes to $4,000 from the current $3,000. With Georgia's income tax rate currently at 5.49%, that works out to as much as $55 more per child, or about $150 million statewide.

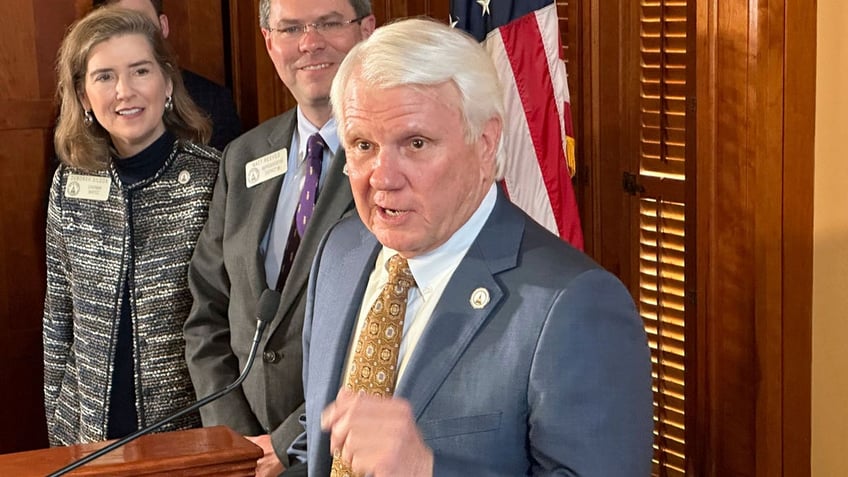

"While rising child care costs are here with us every day, we’re hoping this extra $1,000 deduction per child will help alleviate some of those costs for the parents," Burns, of Newington, told reporters at a news conference.

ATTEMPT BY GEORGIA ELECTIONS BOARD TO INVESTIGATE SECRETARY OF STATE SPARKS LEGAL DEBATE

The new tax cut proposal comes as Burns and the other 235 representatives and senators face reelection later this year.

The speaker also reiterated his earlier proposal to increase the state homestead exemption from $2,000 to $4,000. That amount could save homeowners nearly $100 million statewide, according to projections. Senators have countered with a plan that would cap the rate at which assessed property values could rise for tax purposes, which could limit future property tax increases.

Voters statewide would have to approve the increased exemption in a November referendum if the measure passes.

Georgia House Speaker Jon Burns is seen here announcing plans for further state income tax deductions for parents, which could save them about $55 more per child per year, on Jan. 24, 2024, at the state Capitol in Atlanta. (AP Photo/Jeff Amy)

Burns is also backing a plan announced by Republican Gov. Brian Kemp in December to speed up an already-planned cut in the state income tax rate. As of Jan. 1, Georgia has a flat income tax rate of 5.49%, passed under a 2022 law that transitioned away from a series of income brackets that topped out at 5.75%.

The income tax rate is supposed to drop 0.1% a year until reaching 4.99%, if state revenues hold up. The plan announced in December would retroactively drop the rate to 5.39% as of Jan. 1. The total change is projected to cost the state $1.1 billion in foregone revenue, including an extra $300 million for the cut from 5.49% to 5.39%.

Burns also unveiled a plan to move all of Georgia's unallocated surplus cash into its rainy day account, a bill also being pushed by Kemp. Georgia had $10.7 billion in unallocated surplus at the end of the last budget year, in addition to a rainy day fund filled to the legal limit of $5.4 billion, or 15% of the prior year's tax revenue.

Burns said the move would "allow the state to save responsibly, build our reserves, and provide more taxpayer relief to Georgia families both in the short term and the long term when our financial situation may not be as strong."

Garrison Douglas, a spokesperson for Kemp, said in a statement that by designating the money as savings "we are keeping to our commitment to the smart fiscal management that allows us to responsibly address future needs and priorities."

It's unclear what the practical effect of putting all the surplus cash into the rainy day fund would be. Lawmakers can only spend up to the amount Kemp allows, whether from the rainy day fund, the unallocated surplus, or regular revenue.

However, it could reduce political pressure to spend the unallocated surplus, a move Kemp has mostly resisted before allocating $2 billion of it for spending in his current budget proposal. Democrats have attacked the surplus, saying the state is piling up cash while ignoring critical needs.

"We’re starting this year with a $16 billion surplus, $11 billion in unallocated funds," Democratic Sen. Nabilah Islam Parkes of Lawrenceville said at a news conference last week. "This isn’t Monopoly money. This is hard-earned tax dollars that should be reinvested in improving the life of every Georgian."