President Joe Biden’s son, Hunter Biden, has been indicted on nine charges, including three felonies, for allegedly failing to file taxes, evading an assessment, and filing a fraudulent form.

The 56-page indictment filed in a federal court in Los Angeles on Thursday alleged that the president’s son “spent millions of dollars on an extravagant lifestyle” rather than pay his taxes, per NBC News. The indictment also alleges that Hunter Biden “willfully failed to pay his 2016, 2017, 2018, and 2019 taxes on time, despite having access to funds to pay some or all of these taxes.”

Hunter Biden hit with 9 new charges - filed in CA. Includes:

— Techno Fog (@Techno_Fog) December 8, 2023

Evasion of Taxes

Failure to File/Pay Taxes

False/Fraudulent Tax Return

Indictment details a "four-year scheme" to avoid his $1.4+ million tax obligations and to file false returns. pic.twitter.com/W4W3teGyky

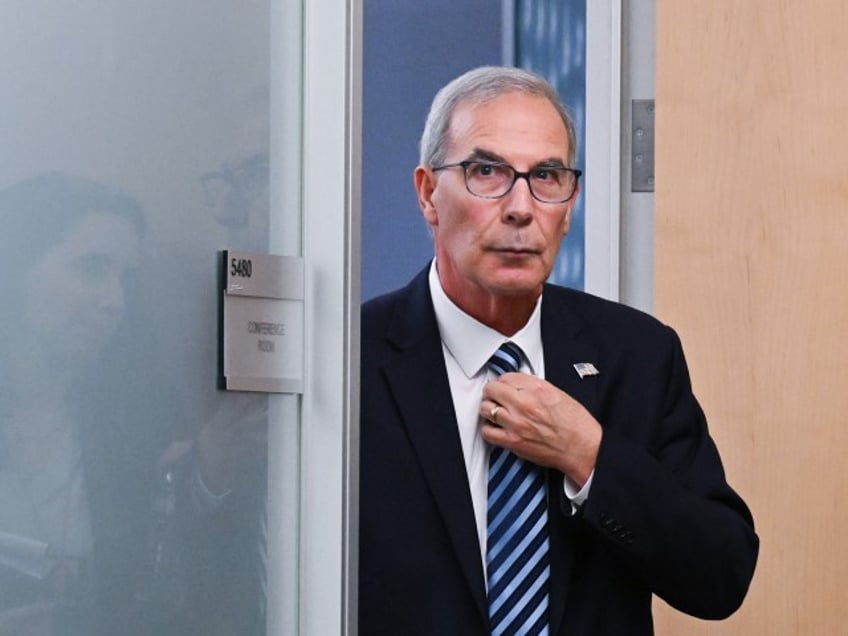

Special counsel David Weiss brought the charges, and the case was assigned to Donald Trump-appointee Judge Mark Scarsi.

Neither the White House nor Hunter Biden’s attorneys have responded to the indictment.

David Weiss, who started serving as U.S. attorney in Delaware following Trump’s appointment in 2017, said in a statement that Hunter Biden “engaged in a four-year scheme in which he chose not to pay at least $1.4 million in self-assessed federal taxes he owed for tax years 2016 through 2019 and to evade the assessment of taxes for tax year 2018 when he filed false returns.”

Attorney General Merrick Garland appointed Weiss as special counsel in August to oversee the investigation into Hunter Biden.

“As special counsel, he will continue to have the authority and responsibility that he has previously exercised to oversee the investigation and decide where, when and whether to file charges,” Garland said in August. “The special counsel will not be subject to the day-to-day supervision of any official of the Department, but he must comply with the regulations, procedures, and policies of the Department.”

Special Counsel David Weiss leaves a closed-door meeting with lawmakers surrounding the investigation into Hunter Biden on November 7, 2023, in Washington, DC. (Matt McClain/The Washington Post via Getty)

CNN noted that “though Hunter Biden did eventually pay his taxes from 2018, prosecutors allege that he included “false business deductions in order to evade assessment of taxes to reduce the substantial tax liabilities he faced.'”

“Prosecutors also allege in the indictment that he ‘subverted the payroll and tax withholding process of his own company’ by withdrawing millions of dollars outside of its payroll and tax withholding process,” noted the outlet.

The Justice Department said that Hunter Biden could face a maximum of 17 years in prison if convicted of the charges.

“The case had been close to being resolved in July when a plea deal fell apart,” noted CNN. “The new tax case stems from Hunter Biden’s lucrative overseas business dealings – including his involvement with Ukrainian energy company Burisma and a Chinese private equity fund.”

Paul Roland Bois directed the award-winning feature film, EXEMPLUM, which can be viewed for FREE on YouTube or Tubi. A high-quality, ad-free stream can also be purchased on Google Play or Vimeo on Demand. Follow him on Twitter @prolandfilms or Instagram @prolandfilms.