File between “No Sh*t Sherlock” and “You Don’t Say?”

The IMF’s “Chart of the Week” just dropped, promising a glimpse into how carbon taxes can be “less regressive”, “socially fair” and “economically efficient”.

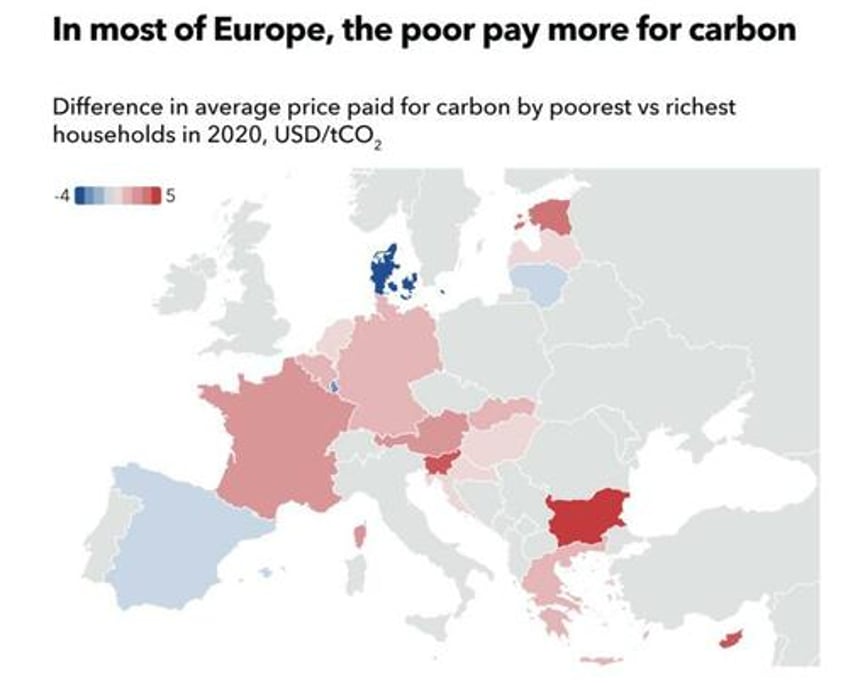

Citing a new research paper, the chart of the week comes from research findings that carbon taxes inordinately penalize the poors,

“lower-income groups are affected disproportionately, because they spend a smaller share of their expenditure on products that benefit from exemptions than their higher-income counterparts.”

Finding that low-income households pay anywhere between $1.26 USD and $4.95 USD more per tonne of CO2 than the rich and affluent,

“Our incidence calculations for the EU in 2020 show that average price paid for carbon across all emission sources were around 11.35 USD, which was 60% lower than the EU ETS price of that year (28.22 USD). The difference between this average price paid for carbon and the EU ETS price is due to incomplete carbon price coverage in the value chains behind the products that EU consumers buy.”

The paper is called Distributional Impacts of Heterogenous Carbon Prices in the EU and looked at European countries, however, the findings around the discrepancy apply anywhere – why?

Because “incomplete carbon price coverage in the value chain”, and numerous other references throughout the paper to that “heterogeneity” all mean the same thing:

Carbon taxes aren’t uniform across all countries, and aren’t uniformly applied across all industries – and that leaves differentials and gaps that the IMF claims are being exploited by rich people to the exclusion of low income households.

The solution? A global carbon tax.

“Therefore, imposing uniform carbon prices both within and across countries would reduce carbon pricing regressivity on household expenditure in the EU”

Even better:

“A global price would be most effective in this regard, as it would raise carbon prices embodied in EU imports. Further, because EU economies are open and apply higher average carbon prices than their trade partners, the domestic revenues exceed the costs embodied in EU household consumptions bundles. This increases the scope for reducing the burden of carbon pricing on lower-income households through revenue redistribution.

Our results would imply that the ongoing extension of carbon pricing to more sectors through the EU ETS II and the introduction of the EU’s CBAM should make carbon pricing less regressive, all else equal”

The EU ETS II is the European Union Emissions Trading System II, the current carbon “cap and trade” system, while the CBAM is the Carbon Border Adjustment Mechanism – which is an existing mechanism that tries to “adjust” the price of goods coming into the Eurozone from places where the carbon taxes aren’t high enough, or don’t exist at all.

In other words, the IMF is recommending a global carbon tax, across all industries – to alleviate carbon price “heterogeneity” (which simply means: not all the same), under the guise of helping the poor, who are disproportionately affected by carbon taxes. 🤡

“Revenue Recycling”: Turning regressive policies into progressive taxation

The paper goes on to posit that when member nations have higher carbon taxes than their trading partners – a kind of “surplus” revenue accrues – which can be redistributed to lower income households and in most cases, exceed the amount paid in carbon taxes:

The mechanism we apply is a lump-sum redistribution system, according to which all fiscal income generated from carbon pricing policies applied on domestic sectors are redistributed equally across households within the country at hand.

Those groups who emit above proportion would incur a net positive cost. Those groups who emit below proportion would incur a net surplus, meaning negative cost, as the lump sum transfer exceeds the money spent on paying for carbon.

In a closed economy (the models say) the carbon taxes paid across income groups would net out to zero, but we don’t really lived in a closed economy.

In open economies such as those of EU countries where consumers buy products that are imported as well as domestic products that result from international value chains, the total carbon costs paid by households are not equal to the carbon costs that accumulate in domestic sectors. As soon as household expenditure bundles are affected by production abroad that is subject to lower carbon prices than those applied domestically, the carbon pricing revenue collected domestically may exceed the carbon costs that households are incurring through their consumption of products.

The result is most households will get back more than they pay in carbon taxes:

The main finding is that in all EU countries in 2020 in the baseline scenario, carbon costs for the lower- income household groups become net negative, implying that the redistribution mechanism returns more money to these households than the costs they incur from carbon pricing.

And after a global carbon tax comes in, everybody gets back more money than they pay in, except the top decile of households.

“As soon as we price carbon uniformly across the globe, all tenth decile household groups with the exception of Estonia, have positive carbon costs, but the lower-income household groups continue to receive more revenue than their incurred costs.”

Here in Canada, we’ve seen this movie already. It’s The Big Lie of carbon tax rebates.

The Big Lie of carbon tax rebates is that you end up with more money than you paid in carbon taxes. pic.twitter.com/LeXwSHC27y

— Mark Jeftovic, The ₿itcoin Capitalist (@StuntPope) September 27, 2024

The ruling Liberal/NDP coalition incessantly attacks any notion of “axing the tax” as something that would make Canadians poorer – because doing away with the reviled carbon tax would eliminate the need for rebates.

However, multiple studies including one from Canada’s own Parliamentary Budget Office in 2023 and another from the Frasier Institute in 2021 found that most Canadian households lost money, even after the rebates, IMF “models” aside.

If it were true that a uniformly applied global carbon tax could give net rebates to all but the very wealthiest households, then after we distill everything down past the climate rhetoric, what we are left with is basically an elaborately camouflaged wealth redistribution scheme called carbon communism.

That may work on whiteboard, but in reality it’ll just continue to hit low income families the hardest, as increased taxation always does (and that includes inflation).

This came into my inbox just as I was working on the upcoming issue of The Bitcoin Capitalist, and I’ll have more to say about this in there, particularly around how I see the findings and recommendations will relate to future deployment of CBDCs (which I’ve already said, will most likely be a UBI scheme based on personal carbon emissions quotas).

* * *

Sign up to the Bombthrower Mailing list today and get a free copy of the aforementioned Crypto Capitalist Manifesto – I’ll also send you my forthcoming e-book The CBDC Survival Guide when it drops this fall.

Follow me on Twitter here, or Nostr: npub1elwpzsul8d9k4tgxqdjuzxp0wa94ysr4zu9xeudrcxe2h3sazqkq5mehan