House and Senate Republicans are pushing to repeal the federal 'death tax'

Republicans closer to extending Trump tax cuts after meeting at White House

Rep. Jeff Van Drew, R-N.J., discusses the importance of getting the budget deal done, his reaction to a judge extending the buyout deadline for federal workers and concerns about a Chinese-linked company's billion-dollar E-ZPass contract.

FIRST ON FOX: Republican lawmakers are mounting a massive effort to repeal the federal inheritance tax, colloquially known as the "death tax."

Rep. Randy Feenstra, R-Iowa, is leading more than 170 House Republicans on the "Death Tax Repeal Act," which is also backed by the House’s top tax writer, Ways & Means Chairman Jason Smith, R-Mo.

An inheritance or estate tax is levied upon the beneficiary who receives assets upon a person's death. Republicans have long criticized the estate tax as a needless financial burden on grieving families, particularly hitting small family-owned businesses.

It comes as Republicans work on extending President Donald Trump’s 2017 Tax Cuts and Jobs Act, whose provisions expire at the end of this year. Among the measures sunsetting in 2026 is a doubling of the estate tax exemption.

SCOOP: KEY CONSERVATIVE CAUCUS DRAWS RED LINE ON HOUSE BUDGET PLAN

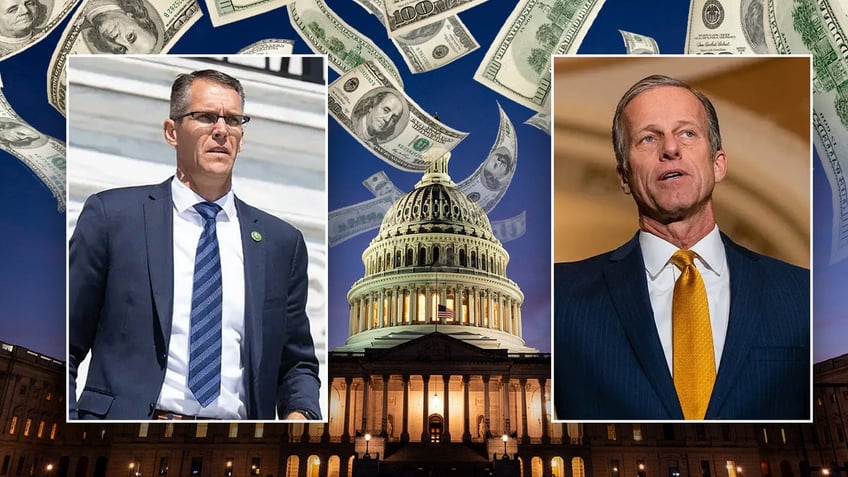

Rep. Randy Feenstra and Senate Majority Leader John Thune are leading a new effort to repeal the federal estate tax (Getty Images)

Supporters of the federal estate tax point out that it affects a relatively small number of estates. Penalties are triggered for estates worth roughly $13.9 million at the time of death, according to the latest IRS data.

A counterpart bill in the Senate is being led by Majority Leader John Thune, R-S.D., and is backed by 44 senators.

Both Feenstra and Thune argued it was an unnecessary tax that unfairly affected family farms and small businesses in their home states of Iowa, South Dakota and elsewhere.

BLACK CAUCUS CHAIR ACCUSES TRUMP OF 'PURGE' OF 'MINORITY' FEDERAL WORKERS

It comes as Republicans work to extend President Trump's 2017 tax cuts (AP/Alex Brandon)

"The death tax is an egregious double tax that unfairly targets American family farms and small businesses and directly threatens long-held farming traditions in rural Iowa and across the country," Feenstra told Fox News Digital. "It is ridiculous that the federal government sends grieving families a massive tax bill when a loved one passes away."

He said it amounted to "double taxation."

"Family farms and ranches play a vital role in our economy and are the lifeblood of rural communities in South Dakota," Thune told Fox News Digital.

"Losing even one of them to the death tax is one too many. It’s time to put an end to this punishing, burdensome tax once and for all so that family farms, ranches and small businesses can grow and thrive without costly estate planning or massive tax burdens that can threaten their viability."

If Republicans fail to extend Trump’s tax cuts before the end of this year, the estate tax would affect any estates worth roughly $7 million or more, according to Modern Wealth Law.

House Ways & Means Committee Republicans shared a memo late last year that said everyday American households could see taxes rise by over 20% if the tax cuts expired.

Feenstra and Thune’s bill would abolish the tax altogether, however.

Elizabeth Elkind is a politics reporter for Fox News Digital leading coverage of the House of Representatives. Previous digital bylines seen at Daily Mail and CBS News.

Follow on Twitter at @liz_elkind and send tips to