Record-high credit card debt is brutalizing “mostly lower- and middle-income Americans, who tend to be renters,” the far-left Associated Press reported.

The AP piece itself is a joke. Over and over again, it attempts to gaslight the American people into voting for another term of failed Bidenomics with statements like… “While the U.S. economy is broadly healthy” — and — “The U.S. economy is currently performing better than most forecasters expected a year ago.”

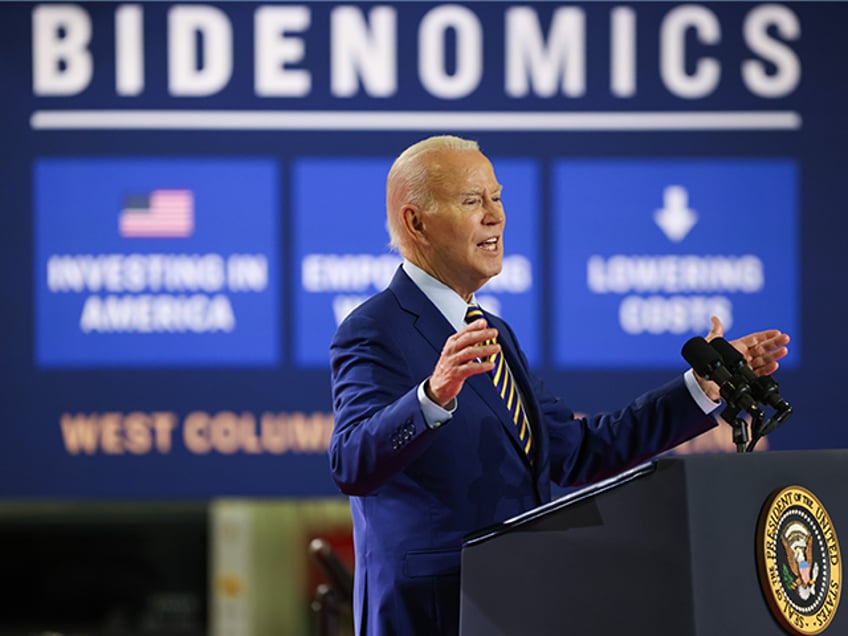

President Joe Biden during an event at the Flex facility in West Columbia, South Carolina, on July 6, 2023. (Sam Wolfe/Bloomberg via Getty Images)

The AP wants us to forget the truth of how Bidenflation has gutted everyone’s purchasing power and the consequences of that:

Americans held more than $1.05 trillion on their credit cards in the third quarter of 2023, a record, and a figure certain to grow once the fourth-quarter data is released by Federal Deposit Insurance Corp. next month. A recent report from the credit rating company Moody’s showed that credit card delinquency rates and charge-off rates, or the percent of loans that a bank believes will never be repaid, are now well above their 2019 levels and are expected to keep climbing.

These worrisome metrics coincide with the average interest rate on a bank credit card of roughly 21.5%, the highest it’s been since the Federal Reserve started tracking the data in 1994.

And then we get more of this: “Overall, the consumer is credit healthy[.]”

No one paying $4.50 for a dozen eggs, or who speeds off alone after dropping $16 at the Taco Bell drive-thru, believes anything is “healthy” about this economy.

This is the bottom line…

Biden flooded a country that already has a housing shortage with eight million illegal aliens… Biden flooded a country already dealing with crippling inflation with eight million illegal consumers… Biden flooded a country already dealing with stagnant wages with eight million illegal cheap employees…

What do you get in that situation? Read on…

“You have these noticeable pockets of consumers — mostly middle- and lower-income renters who have not benefitted from the wealth effect of higher housing prices and stock prices,” Warren Kornfeld, a senior vice president at Moody’s, told the AP. He added that these people “are feeling financial stress, and that’s driving up these delinquency levels. They’ve been hit very hard by inflation.”

Keyword: “renters.”

RELATED VIDEO — Dem Pollster Greenberg: Biden Must Stop Saying He’s Making Progress, Disposable Income Fell:

Owning a home is not one key to financial stability; it is THE key. On top of flooding the country with illegal Democrats, the left has done everything in its power, primarily through anti-science/reality environmental regulations, to discourage home ownership. Even if a builder can obtain the permits to build a single-family home, the regulations explode the price out of the reach of millions.

This is deliberate. Homeownership changes people. Issues such as crime, taxes, schools, zoning, and the desire to be left alone suddenly become important. Not a single one of these issues benefits Democrats. The Democrat party wants you to be poor, dependent, bitter, entitled, and angry. The last thing the left wants is you sitting on your porch, coming to the following epiphany: Why are all these people on welfare? I made it through hard work and sacrifice. They can too.

And then there’s the modern slavery of debt, especially credit card debt.

Someone famously said that Freedom’s just another word for nothing left to lose, but that’s not it. The ultimate freedom comes from not wanting or needing anything. If you’re buried in debt, be it credit card or student loan debt, you’re a slave. That debt owns you, which means you need to pay it off, and that compromises every part of your life — what kind of job you might have to work, how much you can save to buy a house, and your overall standard of living.

RELATED VIDEO — Fmr. Obama Official: Credit Card, Loan Defaults Are Increasing “a Good Bit” Due to Rate Hikes and That’s Worrisome:

Here’s what I mean… Let’s say you have $6,000 in credit card debt with a standard 18 percent interest rate, and you choose to make the minimum payment every month (three percent of the balance)… If you do not add another penny in debt to that card, you still won’t pay it off until the year 2039. Oh, and you will have paid $5,728 in interest on top of the $6,000 principle.

Think of everything you could have done with the $5,728 you just flushed down the toilet, including saving it towards a down payment on a house.

The money Americans squander paying interest is nuts. For example, if you have a $250,000, 30-year fixed mortgage at 6 percent interest and make the minimum payment over those 30 years, that $250,000 mortgage will cost you $540,000 or $290,000 in interest. That’s nearly $300,000 above the cost of your home. You’re flushing $10K a year down the toilet in interest payments. But…

If you add a measly $200 to your monthly mortgage payment, instead of paying it off in 30 years, it will be paid off in 22 years. And instead of paying $290,000 in interest, you will pay just $203,000. That’s an $83,000 savings over 22 years.

Debt is just another version of the Company Store — a way to keep you down, so you keep working every day, keep loading those 16 tons.

Get a FREE FREE FREE autographed bookplate if you purchase John Nolte’s debut novel, Borrowed Time (Bombardier Books).

“This novel is a high-wire narrative that meditates on life and death and God’s eternal presence.… I read this book in one sitting and look forward to reading it again… This is, quite simply, a great American novel.” — Robert Avrech, Emmy-winning Screenwriter Body Double, A Stranger Among Us.

After your purchase, email JJMNOLTE at HOTMAIL dot COM with your address and any personalization requests.