It costs more to be an American now than it did five years ago—more than 50 percent more. The U.S. government spent more than half again as much in 2024 as it did in 2019, and interest payments on the national debt more than doubled during that time, according to the Congressional Budget Office.

Since 2019, federal spending, the national debt, and the size of the federal bureaucracy have all grown rapidly. Federal regulations also increased over the half-decade, with some 290 additional rules and nearly 10 million words added to administrative law books.

President Donald Trump’s effort to reduce the size and scope of the federal government, mainly through the Department of Government Efficiency (DOGE), has met with some early success. There have also been roadblocks in the form of legal challenges and public protests.

Here’s an overview of recent trends in federal spending, borrowing, and staffing that lend perspective to the scope of current and planned reductions to the federal bureaucracy.

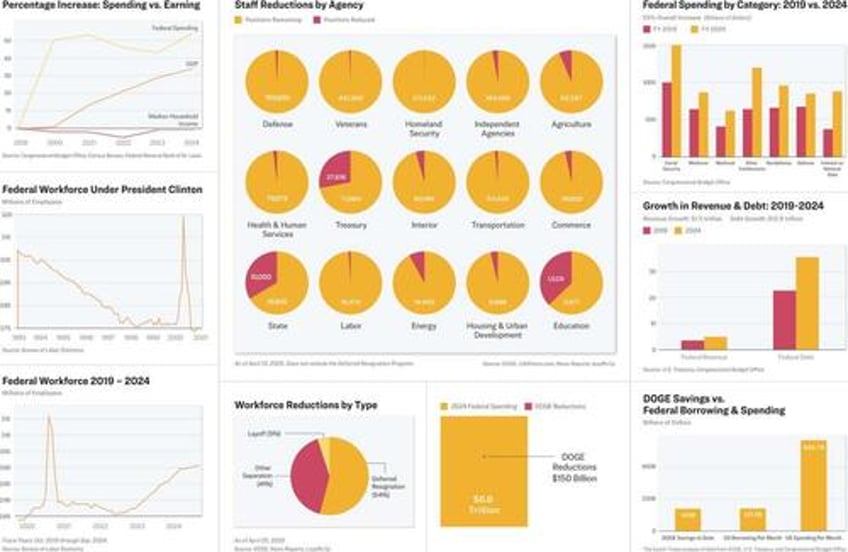

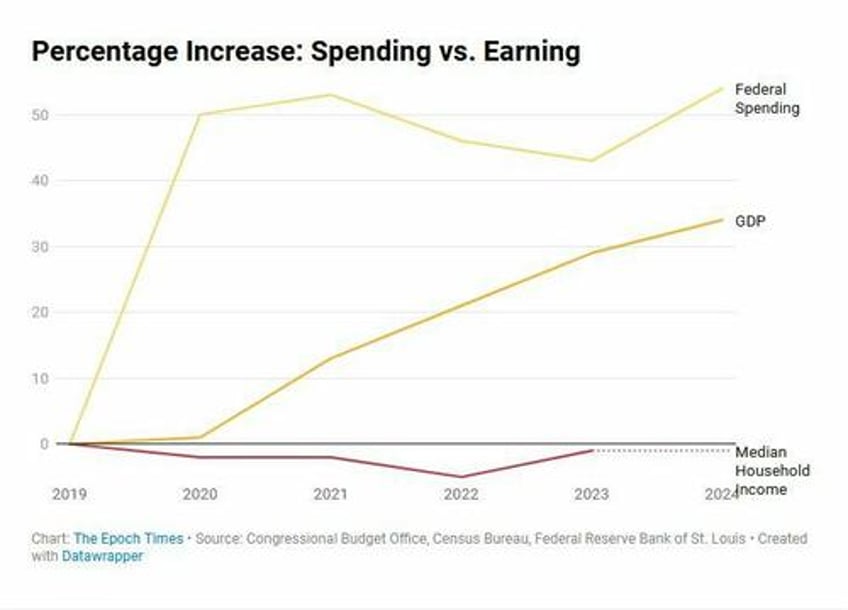

Federal spending grew by about 55 percent from 2019 to 2024. The initial increase appears to have been driven by COVID-19-related spending, which trended down beginning in 2021. Yet even before the public health emergency was declared over in May 2023, spending began to increase again.

Meanwhile, the median household income in the United States declined slightly over that period. At the end of 2023, the last date for which data is available, the typical American family was earning $600 less per year than in 2019.

Spending grew faster than the nation’s economy, measured as the gross domestic product; the total value of all goods and services sold.

The fastest-growing category of federal spending is interest on the national debt, which more than doubled during that period. Interest payments on the national debt (not including repaying the debt itself) now cost more than any single government program except Social Security. America pays more to its lenders than it pays for national defense, Medicaid, or Medicare.

Spending on Social Security, Medicare, Medicaid, other entitlement programs, and interest on the debt is mandatory because it is dictated by longstanding federal laws. Other defense spending and other non-defense spending are considered discretionary because Congress sets those amounts each year.

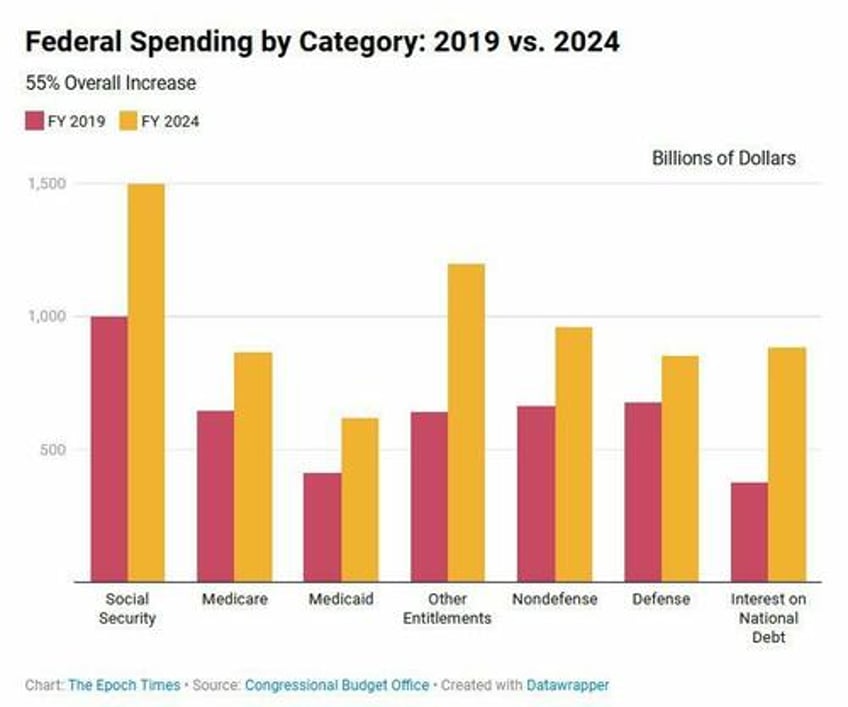

The national debt grew by 56 percent from 2019 to 2024, topping $35 trillion. Since 2012, it has exceeded the value of all goods and services sold in the United States, known as the gross domestic product. As of 2024, the federal debt was about 120 percent of the nation’s gross domestic product.

From 2019 to 2024, federal revenue increased by 40 percent from $3.5 trillion to $4.9 trillion.

To compare the changes in income and debt over that period in everyday terms, a family earning a household income of $60,000 in 2019 could have increased its salary to $72,000 by 2024. Over the same five years the family had credit card debt and student loans that increased from $390,000 to $520,000.

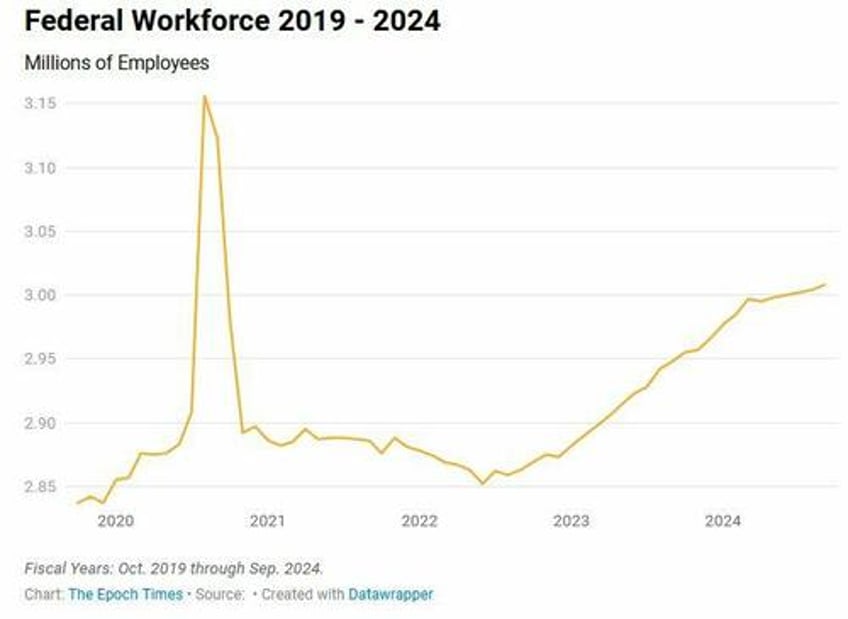

The federal workforce grew significantly from 2019 to 2024. Discounting the approximately 500,000 temporary employees hired to conduct the 2020 census, the federal government grew by about 150,000 during those five years. That increase is more than the total number of people employed by either Boeing or Verizon.

The federal government employs about 3.1 million people, not including the military or federal contractors. Contractors are people employed by private companies to perform work for the federal government, such as processing Medicare claims.

Uncle Sam employs more people than Walmart and nearly double that of Amazon. The federal government is the largest employer in 37 states.

Read the rest here...