A San Francisco Fed report highlights concern over Congressional spending that’s out of control, Social Security, Medicare, and rising interest on the national debt.

The Long-Run Fiscal Outlook in the United States

Please consider a report on the Long-Run Fiscal Outlook in the United States by the San Francisco Fed.

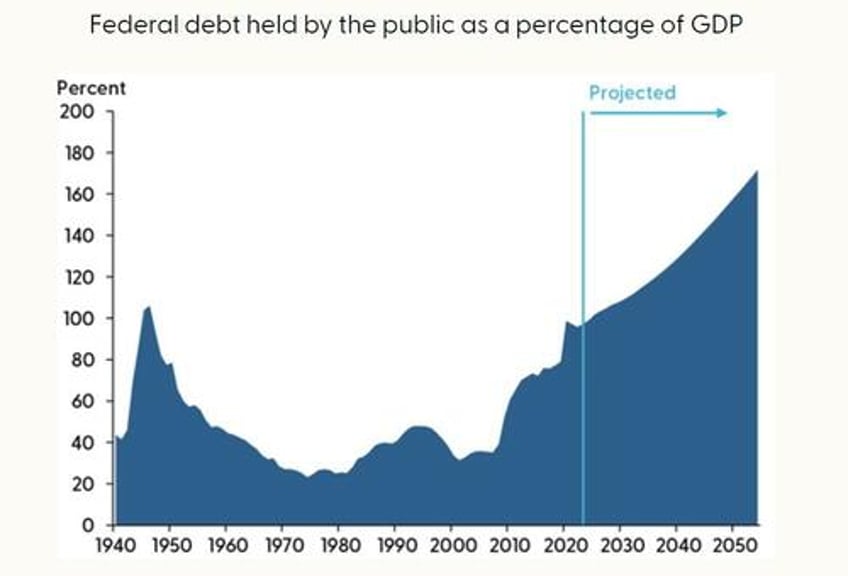

The U.S. federal debt is now roughly as large as the country’s annual GDP. A high and rising ratio of debt to GDP not only raises government borrowing costs but also risks pushing up long-run interest rates, which in turn can reduce investment and economic growth. The last time the debt as a share of GDP was this large was in 1945–1946, at the end of World War II (WWII). Over the following three decades, the debt-to-GDP ratio steadily fell, reaching roughly 25% by 1975. That 30-year decline contrasts sharply with the projected 30-year increase in the debt-to-GDP ratio, reaching 172%, over 2024 to 2054, according to the latest current Congressional Budget Office projections (see CBO 2024).

The Debt-to-GDP Ratio: Lessons from World War II

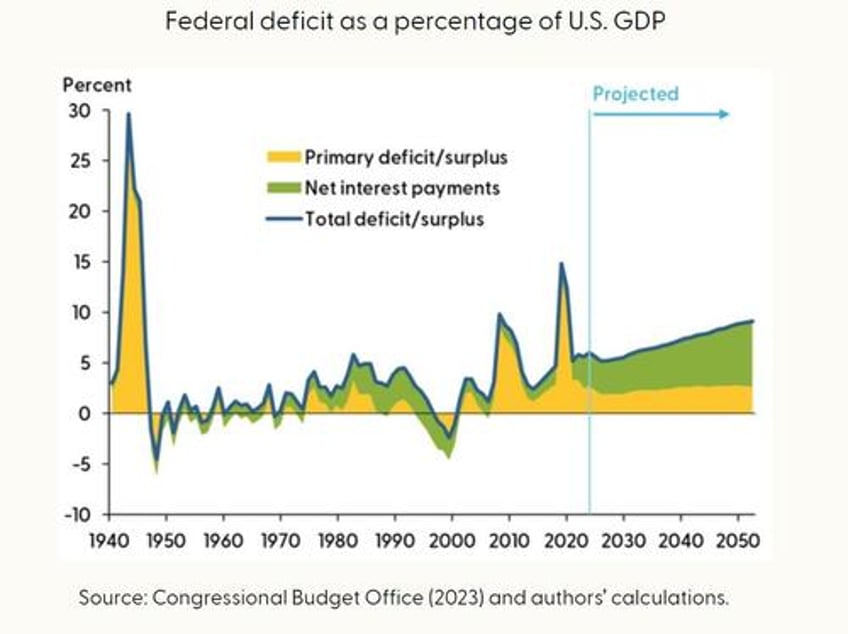

There are two strong parallels between the current era and the WWII era when it comes to the federal debt. The first parallel is the sharp run-up in the primary deficit. Figure 1 shows that the primary deficit skyrocketed between 1941 and 1945, driven mainly by defense spending, reaching a peak of nearly 30% of GDP in fiscal year 1943. The primary deficit also increased sharply during the pandemic, reaching around 12% of GDP in both 2020 and 2021. Moreover, it already had increased substantially during and right after the Great Recession. Indeed, the cumulative increase in the primary deficit as a share of GDP from 2008 to 2021 was almost three-fourths the size of the cumulative increase from 1940 to 1946.

With a near-zero primary deficit, the direction of the debt-to-GDP ratio is determined by the second component, which is the debt-to-GDP ratio times the difference between the interest rate paid on debt and the rate of economic growth. This component was generally negative between 1945 and 1975, pushing down the debt-to-GDP ratio.

In sum, the United States was able to reduce its post-WWII debt ratio from a historic high of over 100% in 1946 to a historic low of roughly 25% in 1975 by a combination of a balanced primary budget and economic growth that surpassed the interest rate on debt.

Current Long-Run Fiscal Outlook

In the near term, the primary deficit is projected to shrink modestly due to the projection’s assumptions that the post-pandemic economic recovery will continue and that certain tax provisions from the 2017 Tax Cuts and Jobs Act will be allowed to expire as scheduled.

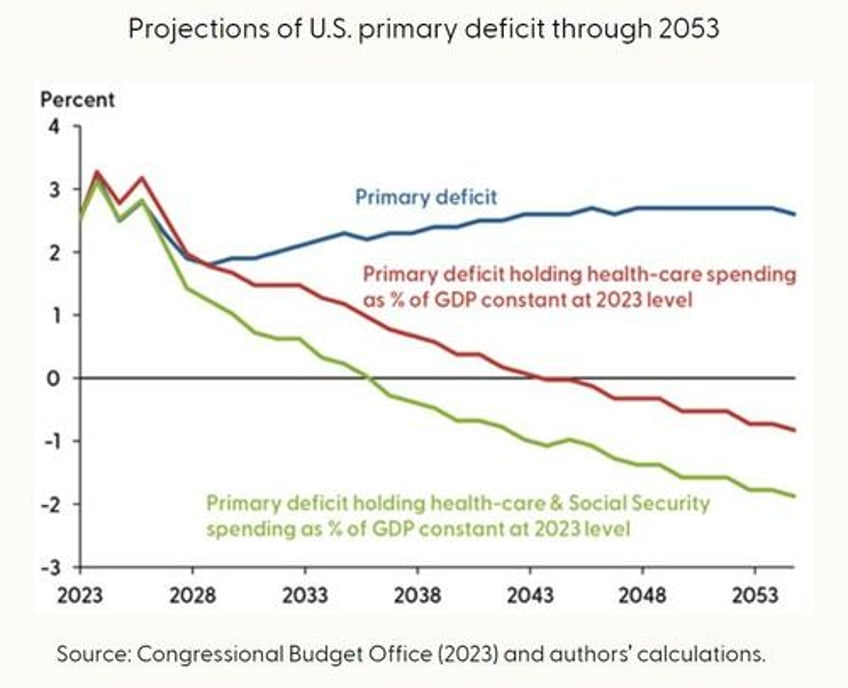

However, over the long run, the primary deficit is projected to increase gradually until the early 2040s before plateauing around 2.7% of GDP.

The main source of the long-run upward pressure on the primary deficit is spending on mandatory programs such as Social Security and Medicare. Current legislated formulas used to determine spending per recipient for Social Security benefits and government health-care programs, especially Medicare, combined with the projected aging of the population, point to large increases in spending for these programs as a share of GDP. This pressure was absent after WWII because the overall U.S. population was younger and because Medicare was not enacted until 1965.

Balancing the primary budget, which was a key factor in the decline of the debt-to-GDP ratio after WWII, would be likely to require major reforms to spending programs or large increases in tax revenue.

The long-run rates of GDP growth and interest are the subject of active empirical research and careful consideration by policymakers. For instance, four times a year Federal Open Market Committee participants provide their forecast for each of these rates in the Summary of Economic Projections (SEP).

As shown by the green shading in Figure 1 [second chart above], the CBO projects interest costs to grow as a share of GDP over the next 30 years. Two assessments underlie the CBO projections. First, investors in U.S. debt, expecting persistently high levels of borrowing from the government, would require relatively high interest rates to compensate for potential risk. And, second, those high interest rates increase borrowing costs for businesses, which discourages investment. Lower investment, in turn, could lead to slower growth for productivity and GDP.

Conclusion

Without major reforms to mandatory spending programs such as Social Security and Medicare, or large tax increases, the primary deficit is expected to persist. This leaves the rate of economic growth relative to interest rates as the crucial factor determining the path of the debt-to-GDP ratio over the next few decades. Current projections of GDP growth are relatively low—lower than after WWII. However, new technological advances, such as artificial intelligence, could fuel a productivity-led boost to long-run economic growth. Events abroad could also increase the foreign demand for U.S. Treasury notes as a safe asset, helping to stave off projected increases in long-run U.S. interest rates.

Mish Synopsis

The current setup is nothing like the situation following WWII. Don’t expect another baby boom.

Instead, expect a massive wave of boomer retirements (already started) that will pressure Medicare and Social Security.

Depending on the kindness of foreigners to increase demand for US treasuries is not exactly a great plan.

Artificial Intelligence (AI) will undoubtedly increase productivity. But that is not going to offset the willingness of Congress to spend more and more money on wars, defense, foreign aid, child tax credits, free education, and other free money handouts, while trying to be the world’s policeman.

The Fed is right to be concerned. It tried to list a couple of ways the problem is lessened, but counting on AI to be the savior seems far fetched.

Trump vs Biden on Social Security and Medicare

Reuters reported Trump Warns U.S. House Republicans Not to Touch Social Security, Medicare

“Under no circumstances should Republicans vote to cut a single penny from Medicare or Social Security,” Trump said in a two-minute video message posted to social media that could test his influence among Republicans who now control the U.S. House of Representatives.

Social Security, which provides retirement and disability payments, accounted for 17% of federal spending in the 2021 fiscal year, while Medicare, the health-insurance program for seniors, accounted for 13%, according to the Congressional Budget Office. Both programs are projected to grow dramatically in coming years due to an aging population.

On December 4, 2023, WRAL News reported Biden Says Republicans plan to Cut Social Security by 13%

“Their plan would cut Social Security benefits,” Biden said Nov. 27 during a White House event. “I thought (Republicans) agreed not to do this a couple times. But they’re back at it. Average benefit cut would be 13%.”

The Cost of Doing Nothing

Biden’s claim was based on a 2020 report that Trump did not embrace. Both Trump and Biden have stated they will not touch Social Security.

The Wall Street Journal comments on The Biden-Trump Plan to Cut Social Security.

Joe Biden and Donald Trump agree on one thing. “I guarantee you I will protect Social Security and Medicare without any change. Guaranteed,” Mr. Biden said in March. Mr. Trump has said: “I will do everything within my power not to touch Social Security, to leave it the way it is.”

Doing nothing won’t protect beneficiaries. It’ll subject them to automatic 23% cuts in 10 years.

Under existing law, doing nothing will result in automatic cuts of 23 percent based on CBO estimates.

But presidents cannot think past the current election cycle. It’s debatable if Biden can think at all.

Rosy Estimates

The CBO Estimates are too rosy. No one has bothered to factor in a recession as far as the eye can see.

Even without a recession, payroll data tells one story and employment another.

Nonfarm payrolls and employment levels from the BLS, chart by Mish.

For discussion, please see Jobs Soar but Full Time Employment Is Barely Changed Since May 2022

Payrolls are up by 5.77 million since May of 2022, but full time employment up only 457 thousand. No amount of BLS smoothing can hide this.

Even if there is no recession, where will the payroll tax receipts come from to support the promised payments?

Do the calculation again with a recession.

Meanwhile, both Trump and Biden propose doing nothing.