Since the October 2023 gold low of just over $1,600 gold is up but is anyone buying?

Well no, certainly none of the normal players.

Gold Depositories, Gold Funds and Gold ETFs have lost just under 1,400 tonnes of their gold holdings in the last 2 years since May 2022.

But not only gold funds are seeing weak buying but also mints such as the Perth Mint and the US Mint with its coin sales down 96% year on year.

Clearly gold knows something that the market hasn’t discovered yet.

RATES MUCH HIGHER

For the last few years I have been clear that there will be no lasting interest rate cuts.

As the chart shows below, the 40 year down trend in US rates bottomed in 2020 and since then rates are in a secular uptrend.

I have discussed this in many articles as well as in for example this interview from 2022 when I stated that rates will exceed 10% and potentially much higher in the coming inflationary environment, fuelled by escalating deficits and debt explosion.

“But the Fed will keep rates down” I hear all the experts call out!

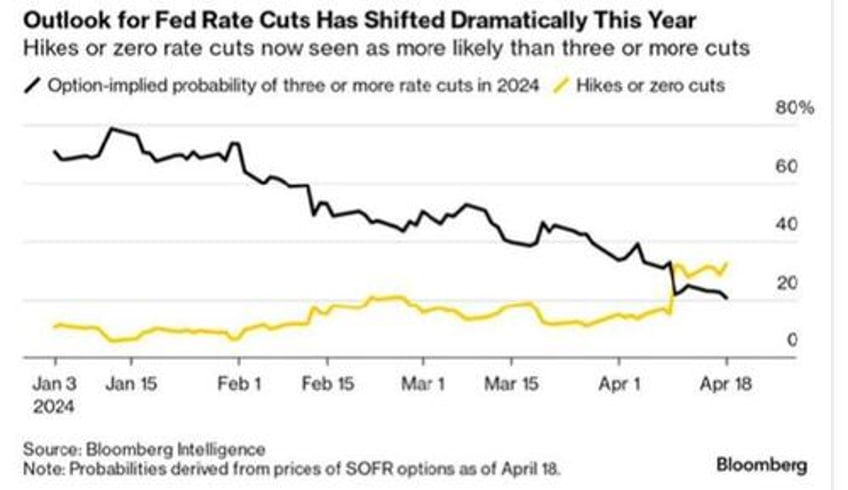

Finally the “experts” are changing their mind and believe that cuts will no longer happen.

No central bank can control interest rates when its government recklessly issues unlimited debt and the only buyer is the central bank itself.

PONZI SCHEME WORTHY OF A BANANA REPUBLIC

This is a Ponzi scheme only worthy of a Banana Republic. And this is where the US is heading.

So strongly rising long rates will pull short rates up.

And that’s when the fun panic starts.

As Niall Ferguson stated in a recent article:

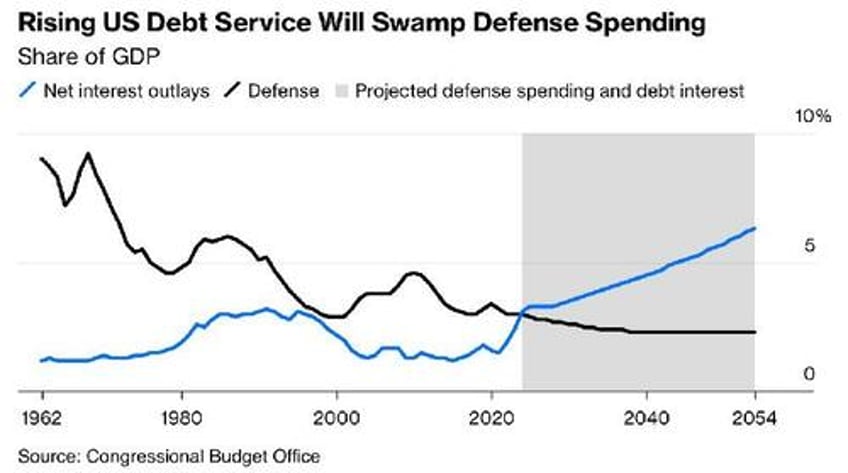

“Any great power that spends more on debt service (interest payments on the national debt) than on defence will not stay great for very long. True of Habsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire”.

So based on the CBO (Congressional Budget Office), the US will spend more on interest than defence already at the end of 2024 as this chart shows:

But as often is the case, the CBO prefers not to tell uncomfortable truths.

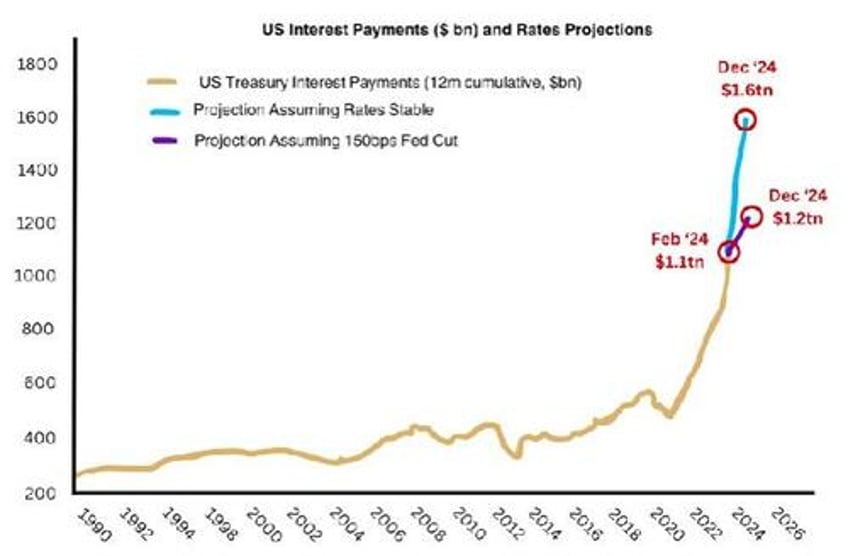

The CBO forecasts interest costs to reach $1.6 trillion by 2034. But if we extrapolate the trends of the deficit and apply current interest rate, the annualised interest cost will reach $1.6 trillion at the end of 2024 rather than in 2034.

Just look at the steepness of the interest cost curve above. It is clearly EXPONENTIAL.

Total Federal debt was below $1 trillion in 1980. Now, interest on the debt is $1.6 trillion.

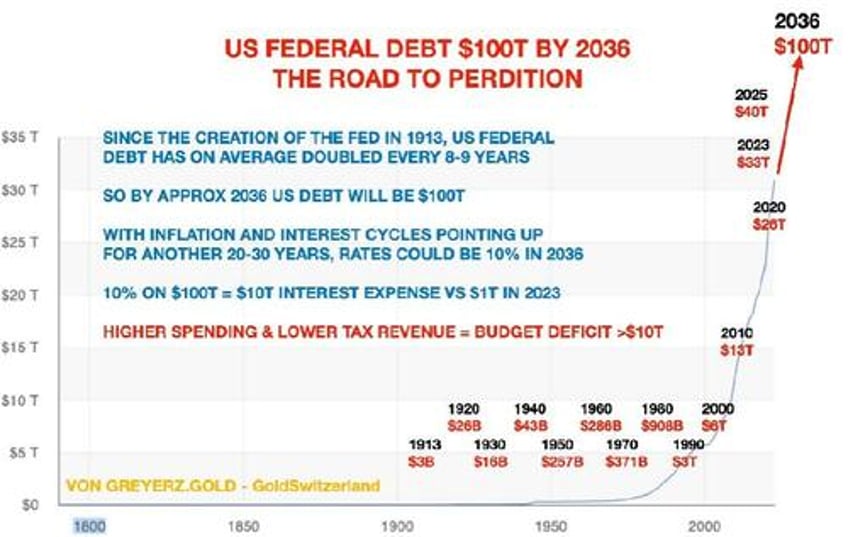

Debt today $35 trillion rising to $100 trillion by 2034.

The same with the US Federal Debt. Extrapolating the trend since 1980, the debt will be $100 trillion by 2036 and that is probably conservative.

With the interest trend up as explained above, a 10% rate in 2036 or before is not unrealistic. Remember rates back in the 1970s and early 1980s were well above 10% with a much lower debt and deficit.

US BONDS – BUY THEM AT YOUR PERIL

Let us analyse the current and future of a US treasury debt (and most sovereign debt):

Issuance will accelerate exponentially

It will never be repaid. At best only deferred or more probably defaulted on

The value of the currency will fall precipitously

HYPERINFLATION COMING

So where are we heading?

Most probably we are facing an inflationary period leading to probable hyperinflation

With global debt already up over 4x this century from $80 trillion to $350 trillion. Add to that a Derivative mountain of over $2 quadrillion plus unfunded liabilities and the total will exceed $3 quadrillion.

As central banks frenetically try to save the financial system, most of the 3 quadrillion will become debt as counterparties fail and banks will need to be saved with unlimited money printing.

BANCA ROTTA – BANKRUPT FINANCIAL SYSTEM

But a rotten system can never be saved. And this is where the expression Banca Rotta derives from – broken bench or broken bank as my article from April 2023 explained.

But neither a bank nor a sovereign state can be saved by issuing worthless pieces of paper or digital money.

In March 2023, four US banks collapsed within a matter of days. And soon thereafter Credit Suisse was in trouble and had to be rescued.

The problems in the banking system have just started. Falling bond prices and collapsing values of property loans are just the beginning.

This week Republic First Bancorp had to be saved.

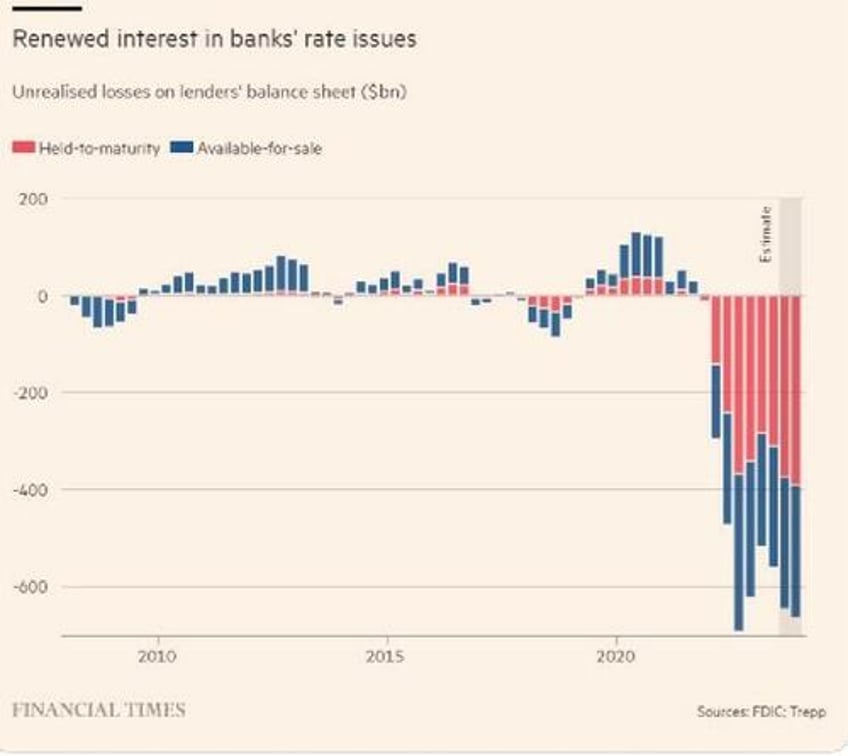

Just look at US banks’ unrealised losses on their bond portfolios in the graph below.

Unrealised losses on bonds held to maturity are $400 billion.

And losses on bonds available for sale are $250 billion. So the US banking system is sitting on identified losses of $650 billion just on their bond portfolios. As interest rates go up, these losses will increase.

Add to that, losses on loans against collapsing commercial property values and much more.

EXPONENTIAL MOVES

So we will see debt grow exponentially as it has already started to do. Exponential moves start gradually and then suddenly whether we talk about debt, inflation or population growth.

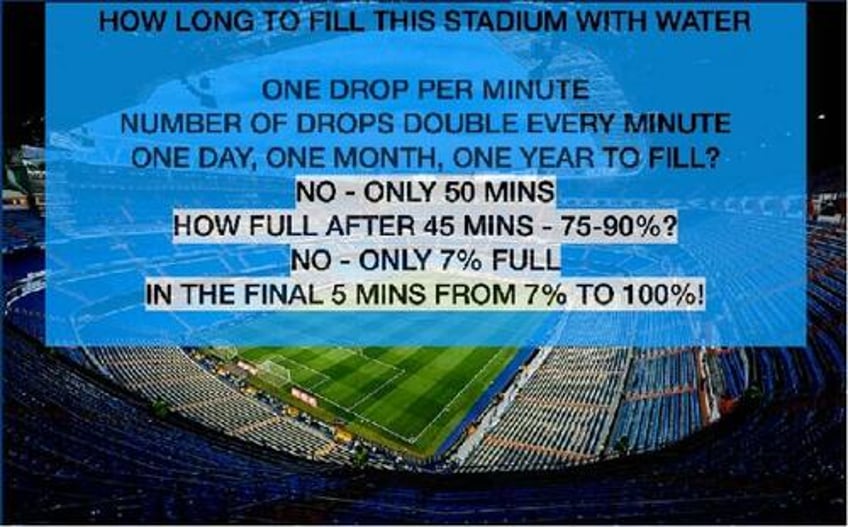

The stadium analogy below shows how it all develops:

It takes 50 minutes to fill a stadium with water, starting with one drop and doubling every minute – 1, 2, 4, 8 drops etc. After 45 minutes the stadium is only 7% full and the last 5 minutes it goes form 7% to 100%.

THE LAST 5 MINUTES OF THE FINANCIAL SYSTEM

So the world is most probably now in the last 5 minutes of our current financial system.

The coming final phase is likely to go very fast as all exponential moves do, just like in the Weimar Republic in 1923. In January 1923 one ounce of gold cost 372,000 marks and at the end of November in 1923 the price was 87 trillion marks!

The consequences of a collapse of the financial system and the global economy, especially in the West can take many decades to recover from. It will involve a debt and asset implosion plus a massive contraction of the economy and trade.

The East and South and especially the countries with major commodity reserves will recover much faster. Russia for example has $85 trillion in commodity reserves, the biggest in the world.

As US issuance of treasuries accelerate, the potential buyers will decline until there is only one bidder which is the Fed.

Even today no sane sovereign state would buy US treasuries. Actually no sane investor would buy US treasuries.

Here we have an already insolvent debtor that has no means of repaying his debt except for issuing more of the same rubbish which in future would only be good for toilet paper. But electronic paper is not even good for that.

This is a sign in a Zimbabwe toilet:

Let us analyse the current and future of a US treasury debt (and most sovereign debt):

Issuance will accelerate exponentially

It will never be repaid. At best only deferred or more probably defaulted on

The value of the currency will fall precipitously

That’s all there is to it. Thus anyone who buys US treasuries or other sovereign bonds has a 99.9% guarantee of not getting his money back.

So Bonds are no longer an asset of value but just a liability for the borrower that will or can not be repaid.

What about stocks or corporate bonds. Many companies won’t survive or experience a major decline in the stock price together with major cash flow pressures.

As I have discussed in many articles, we are entering the era of commodities and especially precious metals.

The coming era is not for speculation but for trying to keep as much of what you have as possible. For the investor who doesn’t protect himself, there will be a wealth destruction of an unprecedented magnitude.

There will no longer be a question what return you can get on your investment.

Instead it is a matter of losing as little as possible.

Holding stocks, bonds or property – all the bubble assets – are likely to lead to massive wealth erosion as we go into the “Everything Collapse”.

THE NEW ERA OF GOLD AND SILVER

For soon 25 years I have been urging investors to hold gold to preserve their wealth. Since the beginning of this century gold has outperformed most asset classes.

Between 2000 and today, the S&P, including reinvested dividends, has returned 7.7% per annum whilst gold has returned 9.2% per year or 8X.

In the next few years, all the factors discussed in this article will lead to major gains in the precious metals and falls in most conventional assets.

There are many other positive factors for gold.

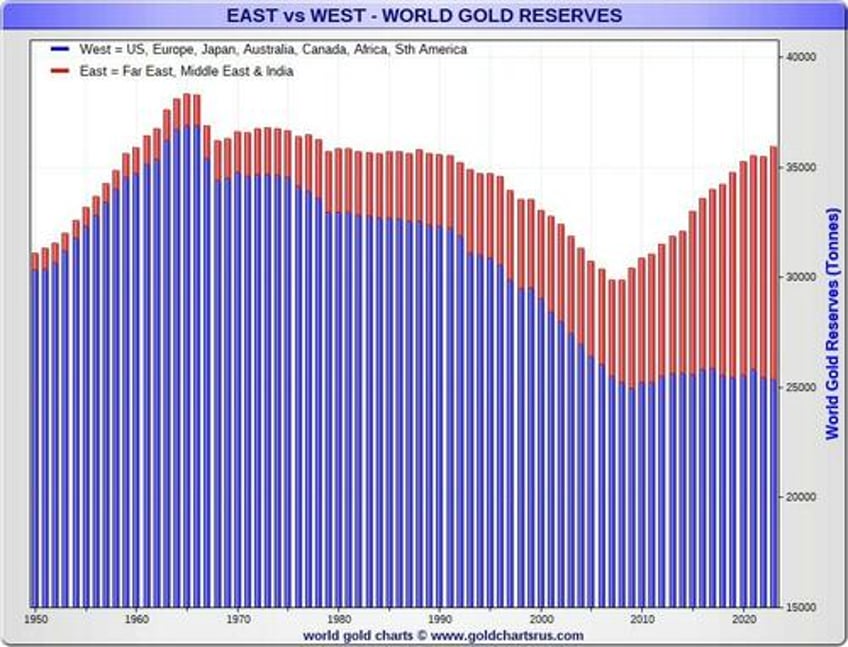

As the chart below shows, the West has reduced its gold reserves since the late 1960s, whilst the East is growing its gold reserves strongly. And we have just seen the beginning of this trend.

The US and EU sanctioning of Russia and the freezing/confiscation of the Russian assets in foreign banks are very beneficial for gold.

No sovereign states will hold their reserves in US dollars any more. Instead we will see central bank reserves move to gold. That shift has already started and is one of the reasons for gold’s rise.

In addition, gradually the BRICS countries are moving away from the dollar to trading in their local currencies. For commodity rich countries, gold will be an important part of their trading.

Thus there are major forces behind the gold move which has just started and will reach further both in price and time than anyone can imagine.

HOW TO OWN GOLD

But remember for investors, holding gold is for financial survival and protection of assets.

Therefore gold must be held in physical form outside the banking system with direct access for the investor.

Also gold must be held in safe jurisdictions with a long history of rule of law and stable government.

The cost of storing gold should not be the primary consideration for choosing a custodian. When you buy life insurance you mustn’t buy the cheapest but the best.

First consideration must be the owners and management. What is their reputation, background and previous history.

Thereafter secure servers, security, liquidity, location and insurance are very important.

Also, high level of personal service is paramount. Many vaults fail in this area.

Preferably gold should not be held in the country where you are resident, especially not in the US with its fragile financial system.

Neither gold nor silver has started the real move yet. Any major correction is likely to come from much higher levels.

Gold and silver are in a hurry so it is not too late to jump on the gold wagon.