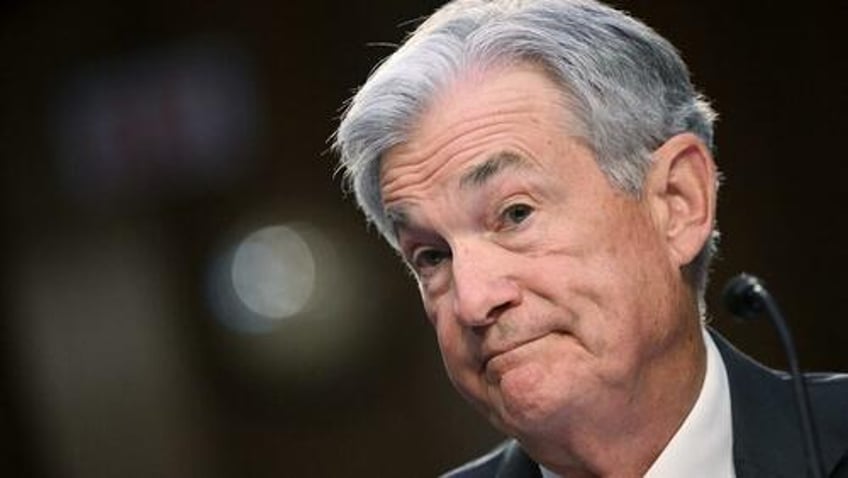

Senator Warren and her pals pressed Powell this morning to cut rates today (he didn't - instead choosing the 'waiting for more confidence' route).

But the political pressure is building for the always apolitical Fed to do something "for democracy" or whatever it is that The Fed is battling now.

GDP growing fast, home prices at record highs, jobless claims not falling apart, inflation (supercore) sticky high... but hey it's time to cut rates "pre-emptively"...

And Powell once again walks the high-wire between sounding like an idiot ignoring (some of) the data and a partisan dove just doing the deep-state's bidding...

Win Thin, global head of markets strategy at BBH, says:

“I think many were hoping for some sort of softening here, along the lines of ‘we have somewhat greater confidence’ but the Fed did not tip a September cut, by any stretch. I think they will cut, but the Fed is playing its cards close to its chest. Marginally less dovish than expected.”

Even if Powell doesn’t explicitly set up a September rate cut, Neil Dutta at Renaissance Macro points out that the minutes of today’s meeting, along with the Jackson Hole central banking conference in August, will offer further opportunities.

Watch the press conference here (due to start at 1430ET):