Voters seem angry about inflation despite economists telling us how great things are. A few pictures explain.

Why Biden Is Losing on the Economy

The Wall Street Journal comments on Why Biden Is Losing on the Economy

Democrats and the press keep telling Americans that they don’t know how good they have it. The U.S. economy is great, Bidenomics is the reason, and don’t worry, be happy. Yet the voters, those numbskulls, keep telling pollsters they don’t feel the boom and they don’t approve of President Biden’s economic performance.

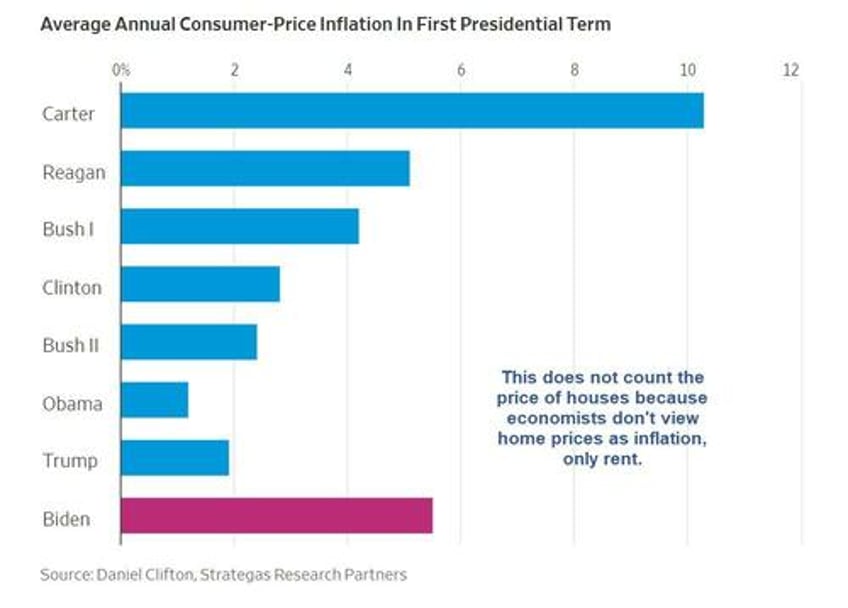

If our friends on the left want to stop berating voters and admit reality, they might look at the chart nearby from Dan Clifton of Strategas Research Partners. It compares the average annual consumer-price inflation rate across the first term of the last eight presidencies. As you can see, Mr. Biden’s average inflation rate of 5.5% is second only to Jimmy Carter’s average rate of 10.3%, and Mr. Carter wasn’t re-elected.

The President keeps telling voters that inflation has fallen on his watch to 3.5% from that peak, but voters remember how low inflation was for some 40 years before Mr. Biden took office and went on his historic spending spree. Americans can also see that prices aren’t falling back to where they were when Mr. Trump was President. They know their average real earnings have declined since Mr. Biden took office.

Voters aren’t stupid, and this is why they don’t like Mr. Biden’s economic record.

It's not the hand that Biden was dealt that mattered. It's how he played the hand he was dealt.

— Mike "Mish" Shedlock (@MishGEA) May 11, 2024

1. The biggest fiscal stimulus in the world, totally unwarranted

2. Student debt cancellation

3. Absurd energy policy

4. Rent moratoriums

5 The IRA

All massively inflationary

The Journal explains what I have been talking about for months.

But the article misses a big point. Neither the Fed nor economists in general view housing prices as inflation. The economic illiterates do not count asset prices in general as inflation.

Home Prices Hit New Record High, Don’t Worry

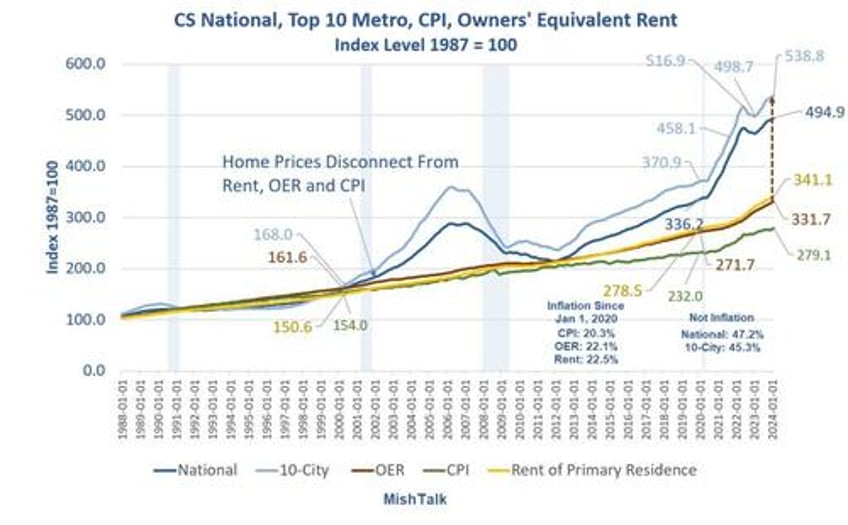

The Case-Shiller national home price index hit a new high in February. That’s the latest data. Economists don’t count this as inflation.

Case-Shiller national and 10-city indexes via St. Louis Fed, OER, CPI, and Rent from the BLS

On May 2, I commented Home Prices Hit New Record High, Don’t Worry, It’s Not Inflation

Not Inflation?!

Economists, including the Fed, consider homes a capital expense, not a consumer expense.

As a result, they all ignore economic bubbles and blatantly obvious inflation on grounds it’s not consumer inflation. This has gotten the Fed into trouble at least three times. The first was the dot-com bubble, then the Great Recession housing bubble and now.

It’s really pathetic when you make the same major mistake over and over and over. It’s a result of groupthink.

Inflation Since January 1, 2020

CPI: 20.3%

OER (Owners’ Equivalent Rent): 22.1%

Rent: 22.5%

Case-Shiller National Home Prices: 47.2%

Allegedly, the latter has nothing to do with inflation. And adding insult to injury for those seeking to buy a home, mortgage rates have sky rocketed.

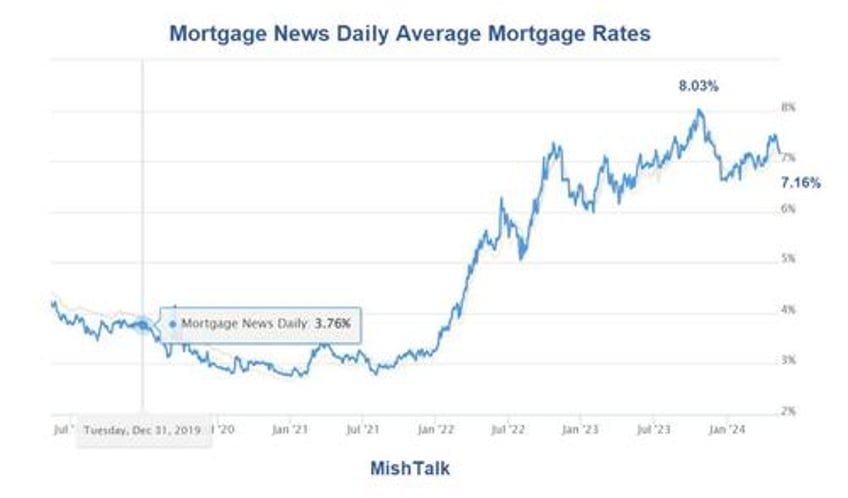

Mortgage News Daily Average Mortgage Rates

Image courtesy of Mortgage News Daily, anecdotes by Mish

On January 1, 2020 the mortgage rate was 3.76. Now it’s 7.16% with home prices up 47.2%.

But hey, let’s claim that this has nothing to do with inflation.

Trapped In Your House?

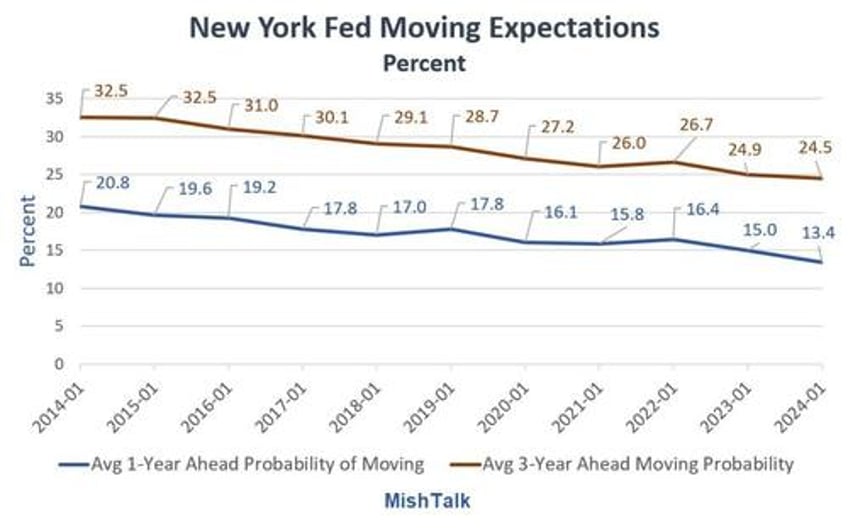

A New York Fed survey shows 1-year and 3-year look ahead moving expectations are at record lows.

Data download from the New York Fed, chart by Mish

On May 6, I commented Trapped In Your House? Moving Expectations Hit Record Low

The above post started some interesting discussion on Twitter. One person noted that expectations had been declining anyway.

OK but two things. From 2014 to 2022 expectations fell from 20.8 percent to 16.4 percent. A decline of 4.4 percentage points in 8 years. In the next two years, expectations fell another three percentage points,

Trapped offers a reasonable explanation for the acceleration.

Second, those are “expectations” not actual results. Unfortunately, we will not have 2024 data for two more years.

According to data from the U.S. Census Bureau, moving rates for Americans declined from 12.8% in 2021 to 12.6% in 2022. Thus, more people thought they would move than actually did.

I suggest 2023 and 2024 will be lower for obvious reasons. But if for some reason it’s higher it will be more renters moving around, not homeowners.

We do not have the precise data that proves homeowners are trapped, but we do have strong enough data to suggest that is the case.

Young Voters Bail on Biden

On March 7, I commented Polls Show Biden is Losing Black, Hispanic, and Young Voters to Trump

Q: Why is Biden losing black voters and young voters?

A:Those are the groups most likely to rent. In general, those are the groups most impacted by inflation whether you count home prices or not.

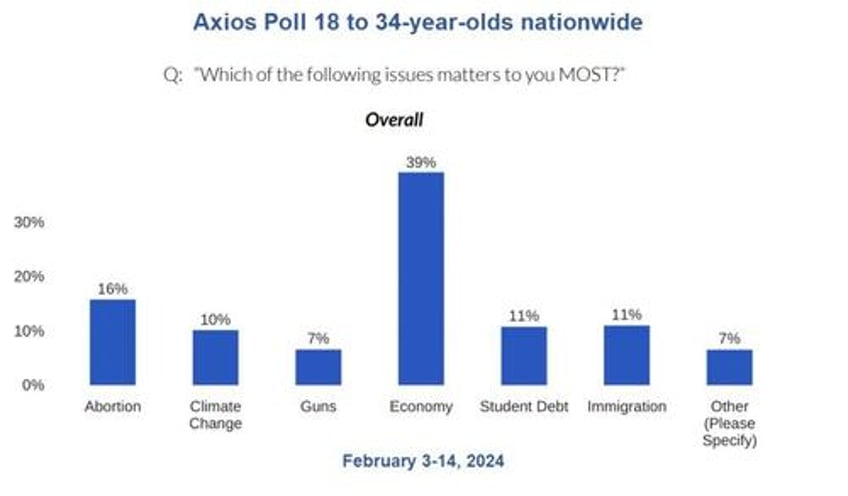

People Who Rent Will Decide the 2024 Presidential Election

Immigration won’t decide the election. Polls have not yet captured what will. This may come as a surprise, but the top issue housing. More explicitly, it’s shelter costs.

On April 30, I commented People Who Rent Will Decide the 2024 Presidential Election

The economy is a very broad category that encompasses inflation, jobs, unemployment, wages, rent, and housing.

Other polls split the economy in various pieces, such as inflation and jobs. Not a single poll mentioned housing specifically.

Q: What is it that young voters really have on their minds?

A: Rent – Unaffordable Housing

I said people who rent will decide the election. One might also say young voters and blacks will decide the election. It’s really the same issue, but none of the polls framed it the way I just did.

Trump would be wise to pick a candidate who appeals to young voters and also women for the abortion issue. Trump might win even if he doesn’t.

This was a discussion among several friends of mine recently.

One friend accurately noted that VP candidates don’t swing many voters. Yep, that’s true, but even half a percentage point could swing the election. It would behoove Trump to choose wisely.