In what was the week's second biggest surprise - the first one being China'a bazooka stimulus announcement - Shigeru Ishiba, who was widely viewed as an underdog in today's LDP leadership election, was elected leader of Japan’s ruling Liberal Democratic party, handing national power to a noted China and monetary policy hawk who wants a more equal defense relationship with the US and has vowed to fight to prevent the nation falling back into deflation.

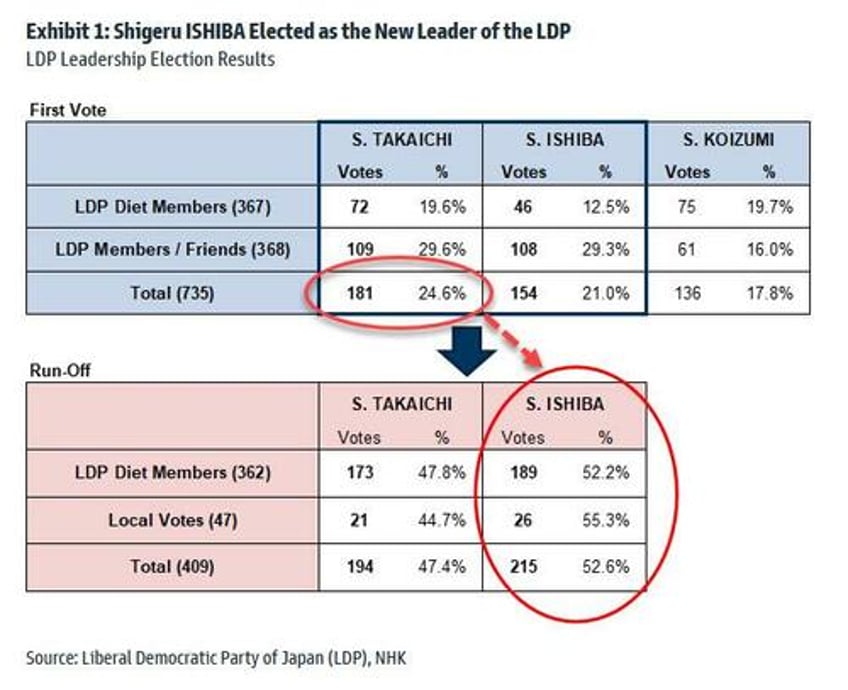

Ishiba, the 67-year-old former defense and agriculture minister, was elected LDP president on his fifth attempt and will succeed Fumio Kishida as Japan’s prime minister after a parliamentary vote on October 1. His biggest competitor for the leadership role, Sanae Takaichi, a popular follower of Abenomics and monetary dove who was expected to put an end to the BOJ's monetary tightening, was widely expected to win and in fact won the first first vote round, sending the yen plunging in the morning's early hours, but then unexpectedly lost the runoff, sending the yen soaring.

Ishiba’s victory followed a highly unusual LDP leadership race contested by a record nine candidates. The competition was intensified by the party’s declaration this year that it was disbanding most of the factions that have historically controlled internal votes.

What was even more surprising is that the stated frontrunner Sanae Takaichi had a firm lead after the first round, in which she got 181 or 25% of the vote, leading both Ishiba and Koizumi. And yet, in the runoff round, she ended up losing, having barely picked up any votes.

Immediately after Ishiba’s victory was declared on Friday, the yen surged more than 1 per cent against the dollar on market perceptions that he would not resist efforts by the Bank of Japan to normalize monetary policy and to push ahead with interest rate increases (that said, even with Ishiba as PM, the BOJ will have no choice but to cut rates soon as the latest Japanese inflation figures confirmed the country's inflation rate is now tumbling fast and it's only a matter of time before the global easing wave sweeps over Japan as well).

Ahead of the vote outcome, the yen's sharp fall accelerated after it was revealed that Takaichi had a clear lead in the first vote round, making her a clear favorite to become the next LDP leader, and first female PM of Japan. The first round of voting also eliminated Shinjiro Koizumi, the son of former prime minister Junichiro Koizumi, who would have become Japan’s youngest prime minister. Hours before the votes were counted, Koizumi remained the narrow favourite among political analysts which may explain why he won the fewest number of votes in the first round.

But in the end it was not meant to be, and whether rigged or otherwise, Ishiba's victory sent the USDJPY plunging.

Ishiba, who has been a consistent hawk on China, has also bridled against what he sees as Japan’s structurally unequal alliance with the US, according to the FT. In recent years, he has proposed changes to the relationship, including shared access to US bases on Japanese soil.

“Trusting in the people and speaking the truth with courage and sincerity, I will do my utmost to make this nation of Japan a safe and secure country where everyone can once again live with a smile,” Ishiba told an assembly of ruling party MPs after the result.

Ishiba, whose father was governor of Tottori prefecture and later home affairs minister, entered politics after a brief career in banking. He entered parliament at the age of 29 in 1986, making him Japan’s youngest-ever lower-house member at the time.

He will inherit a stagnating economy emerging from years of deflation, but facing the headwinds of an ageing and shrinking population, and still hot inflation. He said during the campaign that he favored companies shouldering a greater part of the tax burden. At a press conference on Friday evening, Ishiba described the “great anxiety” of ordinary Japanese people and the need to ensure the country does not fall back into deflation. Of course, the flipside to overtightening monetary policy is another stock market crash, and the new PM will soon find out just which outcome the people prefer.

Katsuhiko Aiba, chief economist at Citi, said the new prime minister’s economic policy was unlikely to be significantly different from that of Kishida. Ishiba would probably put together a new economic package aimed at combating higher prices and promoting wage hikes before the year-end, said Aiba.

An intellectual known widely as an otaku — or geek — for his interest in trains and military vehicles, Ishiba’s campaign proposals included the creation of an “Asian NATO” to counter the rise of China. He told the press conference that Japan “must play a proactive role in building peace in this region”, but gave few details of any specific plans to change Japanese security strategy.

Yu Uchiyama, a political scientist at Tokyo University, said the importance Ishiba placed on security meant he would continue Japan’s recent push to strengthen its military capabilities. “In one sense, Ishiba will probably be successful in presenting the image of change in the LDP. But faced with a changing world order, he will just take over Kishida’s defence policies, so there should be no significant difference there,” said Uchiyama.

As well as a stronger focus on revitalising Japan’s regions, Ishiba’s clearest break with his predecessor is likely to be the creation of a full ministry to handle disaster management in a country regularly hit by earthquakes and increasingly dealing with large-scale flooding and other extreme weather events.

According to the FT, during his long career in parliament, Ishiba has gained a reputation as an outspoken rebel unafraid of making enemies within his own party. In a brief speech to LDP members ahead of vote counting on Friday, he apologised for the “unpleasant experiences” he had caused over the years.

Japanese equities had risen earlier in the day amid expectations that one of Ishiba’s more market-friendly rivals would win. But Nikkei 225 futures slumped more than 3% in the first hours of trading in Chicago, suggesting share prices could come under pressure when the Tokyo market reopens on Monday.