It’s a perfect time to do something really stupid, like offering zero percent down payments on mortgages.

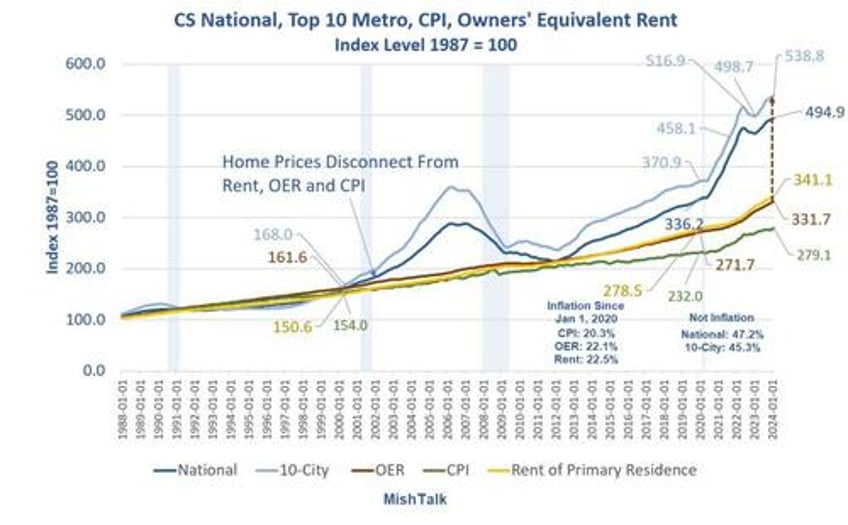

Case-Shiller national and 10-city indexes via St. Louis Fed, OER, CPI, and Rent from the BLS

Perfectly Stupid Timing

Morningstar reports One of the Biggest U.S. Lenders is Offering 0%-Down-Payment Mortgages for First-Time Home Buyers.

Home buyers will be able to buy a home without putting any money down under a new program launched by United Wholesale Mortgage, one of the largest U.S. mortgage lenders.

The Pontiac, Mich.-based company’s new program will be available to first-time home buyers and people earning at or below 80% of an area’s median income, the company said in a press release.

UWM (UWMC) will give eligible buyers a second-lien loan of up to $15,000, in the form of down-payment assistance, for 3% of the home’s purchase price. The loan will not accrue interest or require a monthly payment.

“Homeownership is something we’re very passionate about,” Melinda Wilner, chief operating officer at UWM, told MarketWatch.

The company had previously allowed buyers to put down as little as 1% on their homes, but it wanted to go further to help home buyers, she said. The lender is anticipating a higher volume of borrowers with its new zero-down program, Wilner added.

Poor underwriting practices were a key driver of the subprime-mortgage crisis in the U.S., the International Monetary Fund wrote in 2008. But unlike the low- and no-down-payment loans that proliferated during that time – when lenders made loans to people who eventually were unable to pay them and lost their homes – UWM’s program is different, Wilner said.

“The aspect of this program that makes me nervous is the silent second mortgage,” Anneliese Lederer, senior policy counsel at the nonprofit Center for Responsible Lending, told MarketWatch in an interview. “It’s great that there’s no interest on it, but it’s a balloon payment, and borrowers need to understand what a balloon payment is.”

A balloon payment refers to a bigger-than-usual one-time payment that is required by the lender at the end of the loan term, according to the Consumer Financial Protection Bureau.

On its website, UWM states in the fine print at the bottom of the page that the second loan “has no minimum monthly payment requirements, a term of 360 months and is fully due as a balloon payment upon the occurrence of either a refinance of the [first mortgage], [or] payoff of the [first mortgage] or the final payment.”

Not Like 2008?!

Housing prices are stretched

The economy is slowing

The lender has no cushion against falling home prices

There are indications of steeply falling homes in many markets.

OK, we don’t have massive liar loans like we did in 2008. But mortgage affordability is the lowest ever, and unemployment is starting to tick up.

Anything to Keep the Bubble Going

To top it off, these mortgages are explicitly for people who make 80% or less of an area’s median income.

How dumb is that? In general, such borrowers have no down payment, if any savings at all, and many are already likely on the edge.

It would make more sense giving these mortgages to those who make 120% or more of an area’s median income, provided they also have little debt, and just lack the down payment.

Vote Buying

President Joe Biden called on Congress to provide up to $25,000 in down-payment assistance to first-generation home buyers in his State of the Union Address.

These vote buying proposals to keep the economy humming long enough to win an election are always at the expense of those who fall for the scheme.

The loss of a job or any unexpected debt will throw these buyers right over the cliff.

There are many signs a slowdown is underway.

Economic Slowdown Underway

May 24, 2024: Another Massive Revision, This Time Durable Goods, What’s Going On

The Commerce Department revised March durable goods orders from +2.6 percent to +0.8 percent. Now it reports a 0.7 percent gain vs an expectation of -0.5 percent.

May 23, 2024: New Home Sales Sink 4.7 Percent on Top of Huge Negative Revisions

New Home Sales plunged. And the Census Department completely revised away last month’s fictional 8.8 percent rise.

May 22, 2024: Discretionary Spending Tumbles at Target, Shares Drop 10 Percent

Target CEO Brian Cornell said the results show “continued soft trends in discretionary categories.” [The key word above is continued.]

May 22, 2024: Existing-Home Sales Decline 1.9 Percent, Sales Mostly Stagnant for 17 Months

Existing-home sales fell 1.9 percent in April and are also down 1.9 percent from a year ago. Sales have not gone anywhere for 17 months.

Key Highlights

Existing-home sales faded 1.9% in April to a seasonally adjusted annual rate of 4.14 million. Sales also dipped 1.9% from one year ago.

The median existing-home sales price rose 4.8% from March 2023 to $393,500 – the ninth consecutive month of year-over-year price gains and the highest price ever for the month of March.

The inventory of unsold existing homes climbed 9% from one month ago to 1.21 million at the end of April, or the equivalent of 3.5 months’ supply at the current monthly sales pace.

Big Negative Revisions to BLS Monthly Jobs in 2023

On April 24 the BLS released a little-read jobs report that shows reported jobs in 2023 may be wildly overstated.

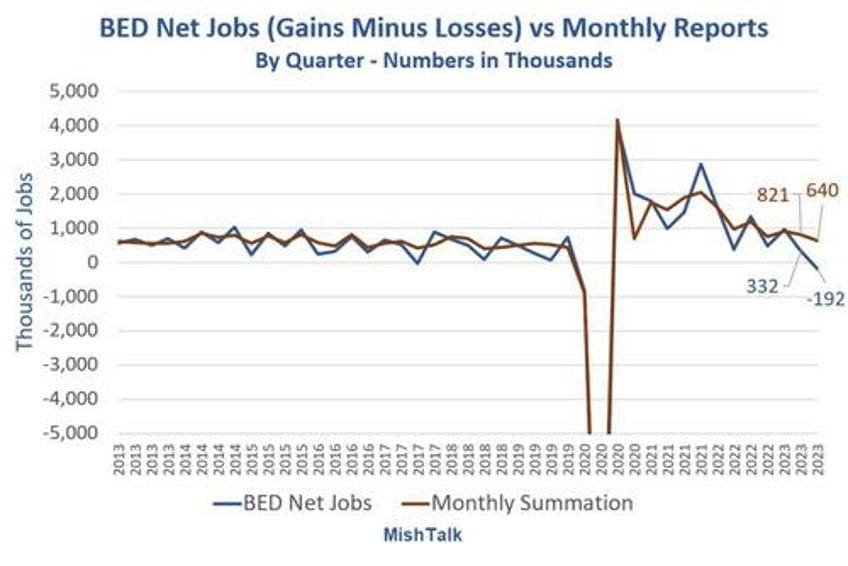

Business Employment Dynamics (BED) data and and Monthly Job Data both from the BLS, chart by Mish

On April 24, I commented Expect Big Negative Revisions to BLS Monthly Jobs in 2023, GDP Too

The BED report is based on records on 9.1 million private sector establishments. Current Employment Statistics (CES) is the monthly jobs report based on 670,000 establishments.

Obviously, the BED report is more timely, but it lags. CES provides an opportunity for economists (and the president) go gaga over numbers likely to be wildly wrong.

CES Overstatement

2023 Q2 CES Overstatement: 489,000 Jobs

2023 Q3 CES Overstatement: 832,000 Jobs

Q2+Q3 Overstatement: 1.321 Million Jobs

Thus, the BLS says that the BLS monthly job reports for 2023 Q2 and Q3 are overstated by a total of 1.321 million jobs.

Zero Percent Down Synopsis

An economic slowdown is underway (see five previous links).

Jobs are overstated by 1.3 million, discretionary spending is faltering, and UWM (UWMC) is offering zero percent down mortgages to buyers most likely to get in trouble if anything goes wrong.

For discussion of the lead chart, please see Home Prices Hit New Record High, Don’t Worry, It’s Not Inflation

The Case-Shiller national home price index hit a new high in February. That’s the latest data. Economists don’t count this as inflation.

Other than the late stages of the 2008 housing bubble, there has been no worse time in history to offer zero percent down mortgages.