The PGA Tour is now set to reap a $3 billion windfall with the Strategic Sports Group amid the pending merger with the Saudi-backed LIV Golf, according to an announcement on Wednesday.

The deal also makes a major change to the golf giant’s operations by switching from a non-profit status to a for-profit entity.

The announcement of some of the details of the for-profit deal was revealed by PGA Tour commissioner Jay Monahan in a telephone conference with Tour members on Wednesday morning. The conference, though, was a “listen-only” production, and Monahan did not allow PGA Tour members to ask questions during the call, the New York Post reported.

A major change will allow players to become “equity partners” in the new PGA Tour Enterprises and its partnership with LIV and Strategic Sports Group (SSG), a group of billionaire sports team owners.

“As part of this new partnership, we are launching a player equity program with current and future players, who will have access to over a billion and a half in interest,” Monahan told Tour members on the call.

PGA Tour Commissioner Jay Monahan looks on during Day Four of the Genesis Scottish Open at The Renaissance Club on July 10, 2022, in North Berwick, Scotland. (Kevin C. Cox/Getty Images)

“Members of the PGA Tour will become equity members of PGA Tour Enterprises. This strengthens our players’ connection to the PGA Tour and also creates a shared vision for organizational unity,” he added.

Monahan added that the equity deal is “historic, novel, transformational” and is not done in any other sport.

Despite his open antagonism against LIV Golf, Tiger Woods, who was also on the call, echoed Monahan’s exuberance for the deal with SSG.

“As the tour grows, we grow,” Woods said during the call. “The more we invest into the tour, the more we can get out of it, which has never happened in sports history. It’s exciting for me to be a part of that.”

SSG is owned jointly by Tom Werner and John Henry (Boston Red Sox owners), Steve Cohen (New York Mets), Mark Attanasio (Milwaukee Brewers), Arthur Blank (Atlanta Falcons), Wyc Grousbeck (Boston Celtics), Tom Ricketts (Chicago Cubs) and others.

This group is set to be minority investors in the PGA Tour, while the Tour will remain the majority shareholder.

While Monahan and Woods touted the deal with SSG, details on the rest of the still-developing deal with LIV were not provided. Indeed, Monahan noted that the SSG deal would not alter negotiations with Saudi Arabia’s Public Investment Fund (PIF) and the DP World Tour, which backs LIV Golf.

A “framework” agreement was signed with PIF last June, but details have remained under wraps. Both groups agreed to forego the initial Dec. 31 deadline in order to work on fine details. Monahan and PIF governor Yasir Al-Rumayyan met most recently in the third week of Jan.

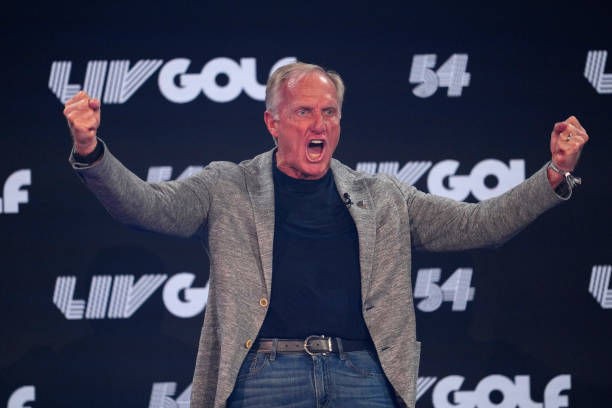

Greg Norman reacts during the LIV Golf Invitational – London Draft on June 07, 2022, in London, England. (Photo by Aitor Alcalde/LIV Golf/Getty Images)

Battle lines had been drawn for many in the PGA Tour when LIV first started recruiting PGA players. For instance, top PGA golfer Rory McIlroy had launched repeated broadsides against players who jumped to LIV and was a vehement detractor of LIV… until he wasn’t. With the merger talks, McIlroy suddenly became more accommodating of players who jumped ship.

Now, McIlroy is against punishing players who walked and joined LIV, a stance that is a 180-degree turn from the previous positions he took.

“Life is about choices,” McIlroy told reporters on Jan. 30. “Guys made choices to go and play LIV. Guys made choices to stay here. If people still have eligibility on this tour and they want to come back and play, let them come back. It’s hard to punish people. I don’t think there should be a punishment.”

McIlroy says that he now understands that keeping them separate and at odds is “bad for both parties” and leads to both sides being “diminished.”

Follow Warner Todd Huston on Facebook at: facebook.com/Warner.Todd.Huston, or Truth Social @WarnerToddHuston