We recently spotlighted how Walmart remained America's "price discount juggernaut" retailer amid an ongoing value war with other supermarket retail chains. The latest high-frequency data indicates that consumers are increasingly trading down as the inflation storm triggered under the Biden-Harris regime continued to strain household finances in the early days of the Trump-Vance administration.

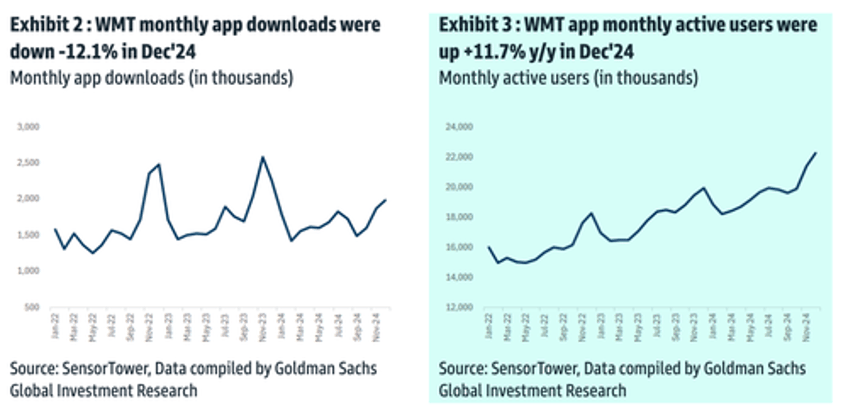

Goldman's Kate McShane, Emily Ghosh, and others cited Sensor Tower data that showed while Walmart's mobile app download growth slowed in December, active user engagement surged the most in years:

Using Sensor Tower, we also looked at WMT's app downloads and monthly active users. For Dec '24, WMT app downloads came in at 2.0mn, -12.1% y/y while increasing sequentially. WMT app monthly active users for Dec '24 came in at 22.3mn, +11.7% y/y and increasing sequentially, noting this is the highest level seen in the time period beginning Jan '22.

For several quarters, we have closely followed how the inflation storm has transformed all walks of life into a Walmart shopper for their everyday needs—especially groceries. This comes as the Federal Reserve holds interest rates high to combat the inflation monster while wages have not kept up, thus leaving households with depleted personal savings and maxed-out credit cards.

Last week, Goldman found that after analyzing 38 SKUs in dairy, frozen goods, dry grocery, HPC, and produce categories across Kroger, Albertsons (under Randalls), Walmart, Sprouts Farmers Market, Whole Foods, and Dollar General, Walmart "continued to have the lowest prices."

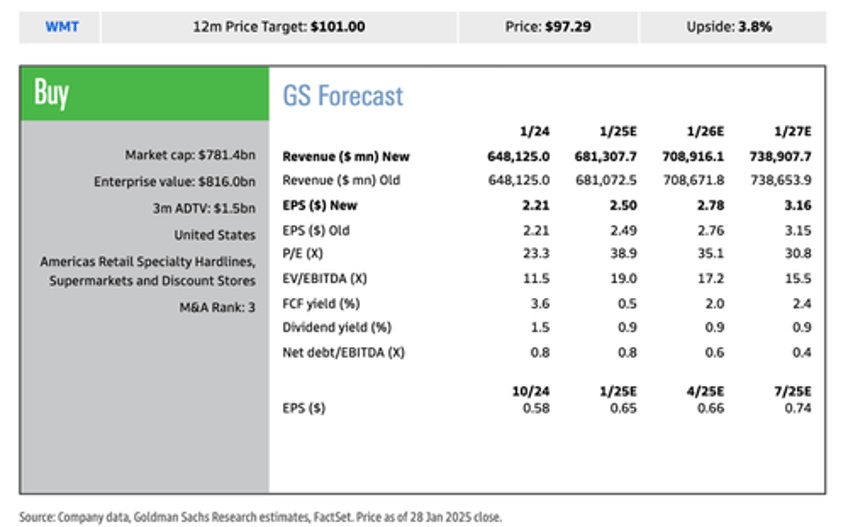

Given Walmart's trade-down tailwinds, the analysts noted ahead of fourth-quarter earnings set to be reported on Feb. 20:

We believe WMT is well positioned to continue driving solid earnings growth into 2025, supported by market share gains given its compelling proposition for value and convenience while its profitability profile should also improve, noting that operating income outpaced sales in 3Q. We reiterate our Buy rating for WMT with a price target of $101.

Goldman declared Walmart as the trade-down "winner" in the retail space. Shares have since erupted since 2023.

There can only be one winner.

Households can thank Bidenomics for forcing them to trade down to Walmart, while Wall Street celebrates the retailer giant as the winner in the value wars.