AI hardware giant Nvidia has overtaken Apple to become the world’s most valuable company, highlighting the growing dominance of artificial intelligence in the stock market.

Bloomberg reports that Nvidia has surpassed Apple to become the world’s largest company by market capitalization. Shares of the chipmaker rose early this week, resulting in a market value of $3.43 trillion, edging out Apple’s $3.38 trillion valuation. This milestone underscores the incredible momentum behind AI and its transformative impact on the tech industry and broader economy.

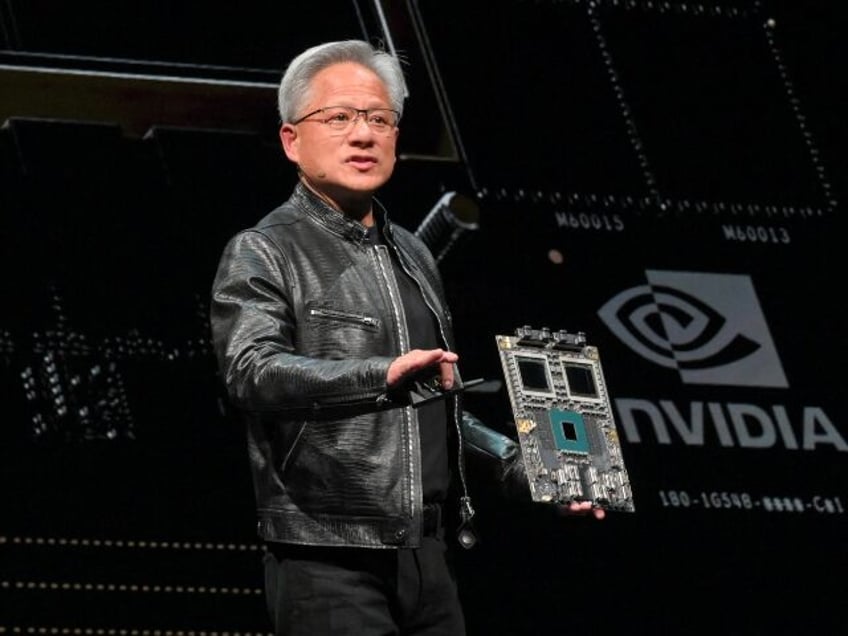

Nvidia’s ascent to the top spot is a testament to the company’s pivotal role in the AI revolution. The chipmaker’s powerful graphics processing units (GPUs) have become the backbone of AI infrastructure, powering everything from cloud computing and data centers to autonomous vehicles and robotics. Nvidia’s chips are in high demand from the world’s biggest tech giants, including Microsoft, Amazon, Google, and Meta, all of which are heavily investing in AI to drive innovation and growth.

The AI boom has fueled a remarkable rally in Nvidia’s stock, which has soared more than 850 percent since the end of 2022. The company now accounts for a staggering seven percent of the S&P 500 Index and has been responsible for about a quarter of the benchmark’s 21 percent gain this year. Nvidia’s dominance is so pronounced that some investors and analysts have quipped that the market revolves around “inflation numbers, job numbers, and Nvidia numbers.”

Analysts are bullish on Nvidia’s long-term prospects, with revenue projected to more than double in the current fiscal year and rise another 44 percent in the following year. The company has also calmed investor concerns about delays in its next-generation Blackwell chip, which had been hampered by engineering challenges. With the chip back on track and AI demand surging, Nvidia appears well-positioned to maintain its leadership position in the years ahead.

Of course, Nvidia’s success also raises important questions about the concentration of power in the tech industry and the potential risks of AI. As a handful of companies come to dominate the AI landscape, there are concerns about privacy, security, and the ethical implications of machine learning. Regulators and policymakers will need to grapple with these issues in the years ahead to ensure that the benefits of AI are widely shared and its risks are mitigated.

Read more at Bloomberg here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship.