According to a stock market analyst firm, the massive annual payment from Google to Apple to secure its status as the default search engine on iPhones and other Apple devices is now in the range of $18 to $20 billion, representing an incredible 14 to 16 percent of Apple’s annual operating profits. Market analyst Bernstein warned its clients that Apple’s Google gravy train may be altered forever by the landmark antitrust case against the internet giant.

The Register reports that in the world of tech industry agreements, one of the most lucrative deals has been quietly operating between two giants: Google and Apple. Google has been paying Apple between $18 billion and $20 billion per year to secure its position as the dominant search engine on the iPhone, according to research by analyst firm Bernstein. This deal, while financially beneficial for both parties, has recently come under scrutiny due to its potential anticompetitive nature.

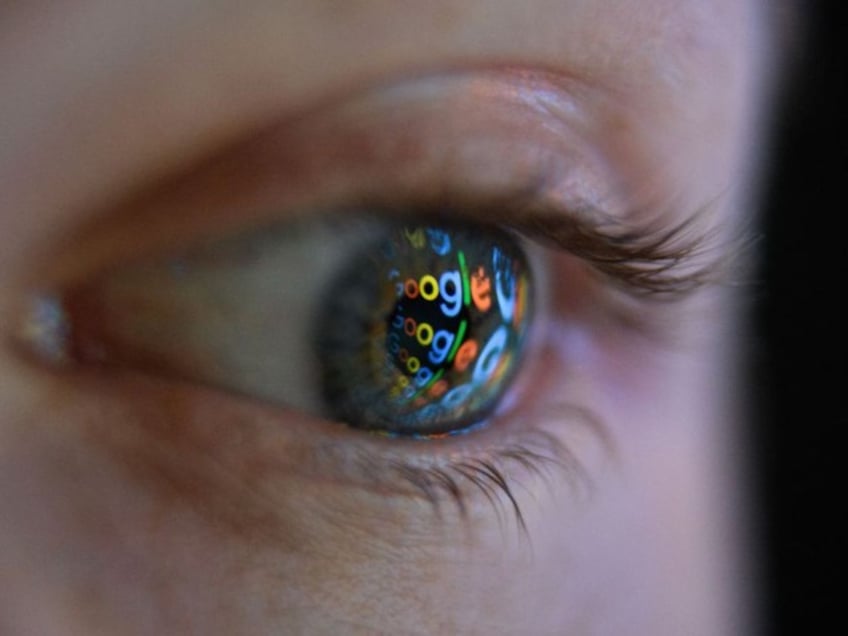

Leon Neal/Getty Images

The Information Services Agreement (ISA) between Apple and Google has been highlighted as a primary example of anticompetitive behavior in an ongoing civil antitrust lawsuit against Google by the DOJ. The lawsuit alleges monopolization of search and search advertising by Google, putting deals like the ISA under a magnifying glass.

Bernstein, which advises institutional investors, has delved into the potential repercussions for Apple should the DoJ’s lawsuit against Google succeed. The firm has expressed that there is a possibility that federal courts might rule against Google, forcing it to terminate its search deal with Apple.

“We estimate that the ISA is worth $18B-20B in annual payments from Google to Apple, accounting for 14-16 percent of Apple’s annual operating profits,” stated a report by Bernstein, highlighting the significant financial implications for Apple. The deal not only ensures that Google remains the default search engine on one of the world’s most popular smartphones but also represents a substantial portion of Apple’s annual operating profits.

The Register included further information from the Bernstein investor report:

“Importantly, Google is on trial, not Apple, and Apple could (in theory) partner with another search engine to be the default (and/or retain the agreement with Google outside the US),” the report states. “One more likely scenario is that Apple offers a choice screen. We note that Apple controls access to its installed base, which generates ~$60B + in advertising revenues, and accordingly, we believe that Apple would continue to command a commission (in the 25-30 percent range) for providing access to those search advertising revenues.

The DoJ has indicated that it believes Apple gains around $10 billion from the ISA with Google, although this figure is derived from external sources and not directly from Apple or Google. The trial has brought to light the intricate financial web spun by such agreements in the tech industry and has raised questions about the future of such deals, especially those that may be deemed anticompetitive.

Read more at the Register here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship.