Even if you are 100% convinced in man-made climate change, the idea the EV’s will help reduce CO2 emissions is nonsense...

The Impossible Dream

Hello climate change advocates, please open your minds and consider the Manhattan Institute report Electric Vehicles for Everyone? The Impossible Dream by Mark P. Mills, a Manhattan Institute senior fellow.

A dozen U.S. states, from California to New York, have joined dozens of countries, from Ireland to Spain, with plans to ban the sale of new cars with an internal combustion engine (ICE), many prohibitions taking effect within a decade. Meanwhile, the U.S. Environmental Protection Agency (EPA), in a feat of regulatory legerdemain, has proposed tailpipe emissions rules that would effectively force automakers to shift to producing mainly electric vehicles (EVs) by 2032.

To ensure compliance with ICE prohibitions and soften the economic impacts, policymakers are deploying lavish subsidies for manufacturers and consumers. Enthusiasts claim that EVs already have achieved economic and operational parity, if not superiority, with automobiles and trucks fueled by petroleum, so the bans and subsidies merely accelerate what they believe is an inevitable transition.

It is certainly true that EVs are practical and appealing for many drivers. Even without subsidies or mandates, millions more will be purchased by consumers, if mainly by wealthy ones. But the facts reveal a fatal flaw in the core motives for the prohibitions and mandates.

Executive Summary Key Points

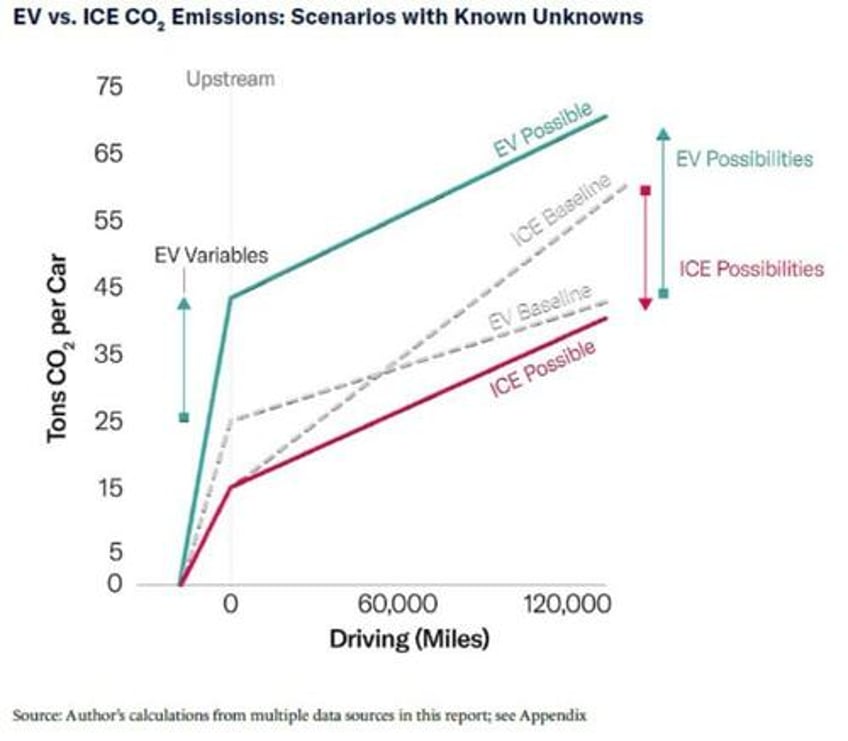

No one knows how much, if at all, CO2 emissions will decline as EV use rises. Every claim for EVs reducing emissions is a rough estimate or an outright guess based on averages, approximations, or aspirations. The variables and uncertainties in emissions from energy-intensive mining and processing of minerals used to make EV batteries are a big wild card in the emissions calculus. Those emissions substantially offset reductions from avoiding gasoline and, as the demand for battery minerals explodes, the net reductions will shrink, may vanish, and could even lead to a net increase in emissions. Similar emissions uncertainties are associated with producing the power for EV charging stations.

No one knows when or whether EVs will reach economic parity with the cars that most people drive. An EV’s higher price is dominated by the costs of the critical materials that are needed to build it and is thus dependent on guesses about the future of mining and minerals industries, which are mainly in foreign countries. The facts also show that, for the majority of drivers, there’s no visibility for when, if ever, EVs will reach parity in cost and fueling convenience, regardless of subsidies.

Ultimately, if implemented, bans on conventionally powered vehicles will lead to draconian impediments to affordable and convenient driving and a massive misallocation of capital in the world’s $4 trillion automotive industry.

Rarely has a government, at least the U.S. government, banned specific products or behaviors that are so widely used or undertaken. Indeed, there have been only two comparably far-reaching bans in U.S. history: the Eighteenth Amendment to the U.S. Constitution, which prohibited the consumption of alcohol (repealed by the Twenty-First Amendment); and the 1974 law prohibiting driving faster than 55 mph. Neither achieved its goals; both were widely flouted, and the first one engendered unintended consequences, not least of which was criminal behavior.

EV Emissions: Unclear, and Maybe Unknowable

In contrast to cars with internal combustion engines, it’s impossible to measure an EV’s CO2 emissions. While, self-evidently, there are no emissions while driving an EV, emissions occur elsewhere—before the first mile is ever driven and when the vehicle is parked to refuel.

The CO2 emissions directly associated with EVs begin with all the upstream industrial processes needed to acquire materials and fabricate the battery. The received wisdom that EVs will have a “huge impact” on reducing emissions is, whether the claimants know it or not, anchored in assumptions about the quantities and varieties of materials mined, processed, and refined to make the battery.

The scale of those upstream emissions emerges from the fact that a typical EV battery weighs about 1,000 pounds and replaces a fuel tank holding about 80 pounds of gasoline. That half-ton battery is made from a wide range of minerals, including copper, nickel, aluminum, graphite, cobalt, manganese, and, of course, lithium.

As researchers at the U.S. Argonne National Labs have pointed out, the relevant emissions data on such materials “remain meager to nonexistent, forcing researchers to resort to engineering calculations or approximations.” The fundamental fact to keep in mind: every claim for EVs reducing emissions is a rough estimate or an outright guess based on averages, approximations, or aspirations.

The critical factor for estimating upstream EV emissions starts with knowing the energy used to access and fabricate battery materials, all of which are more energy-intensive (and more expensive) than the iron and steel that make up 85% of the weight of a conventional vehicle.[36] The energy used to produce a pound of copper, nickel, and aluminum, for example, is two to three times greater than steel. Estimates of the aggregate energy cost to fabricate an EV battery vary threefold but, for context, on average, the energy equivalent of about 300 gallons of oil is used to fabricate a quantity of batteries capable of storing the energy contained in a single gallon of gasoline.

That so much upstream energy is necessarily used is understandable if one knows that hundreds of thousands of pounds of rock and materials are mined, moved, and processed to create the intermediate and final refined minerals to fabricate a single thousand-pound battery.

While there are dozens of variations, a typical EV battery weighs about 1,000 pounds and contains about 30 pounds of lithium, 60 pounds of cobalt, 130 pounds of nickel, 190 pounds of graphite, 90 pounds of copper,[a] and about 400 pounds of steel, aluminum, and various plastic components.

Sources of “Hidden” Energy to Mine and Process 500,000 Pounds per EV Battery

Lithium brines contain @ ~0.14% lithium, so that entails ~20,000 pounds of brines to yield 30 pounds of pure lithium.

Cobalt @ ~0.1% ore grades means ~60,000 pounds of ore dug up per battery

Nickel @ ~1.3% grade, means ~10,000 pounds of ore

Graphite @ ~10% leads to 2,000 pounds of ore

Copper @ ~0.6% yields about 12,000 pounds of ore

These five elements total ~100,000 pounds of ore to fabricate one EV battery. To properly account for all the earth moved, there’s also the overburden, the materials first dug up to get to the ore; depending on ore type and location, it averages three to seven tons of overburden removed to access each ton of ore, thus ~500,000 pounds total.

The energy used to obtain a pound of metal depends on the mineral ore grades, the size and nature of a mine, the distances that materials are transported, and the nature of the grids and fuels used at specific mines. For copper, that number can vary at least twofold and for nickel by threefold. Getting accurate information is complicated by the fact that 80%–90% of relevant minerals are mined outside the U.S. and EU.

Known Unknowns

Location and Other Known Unknowns

Location: A battery plant in Norway, where dams provide about 90% of electricity, adds very little to upstream emissions from mineral processing and assembly, while a lot is added for the same plant in China, where coal supplies two-thirds of grid power. Notably, half the world’s EVs in 2022 were built in China, and China is rapidly entering global markets, selling EVs across the world.

Chemistry: There are about a dozen variations in lithium chemistry. While these entail different ratios and types of some minerals, the overall quantity of materials, and thus mining, needed per battery remains roughly the same. The exception is with lower energy-density chemistries. For example, the lithium-iron-phosphate (LPO) chemistry, popular in China and with some automakers because it doesn’t use cobalt or nickel, has a 20% lower energy density. That translates into either a 20% lower driving range or building a bigger, heavier battery requiring more copper, aluminum, polymers, and lithium.

Electronics: An EV uses about 200% more electronics for power management. Silicon device fabrication is extremely energy-intensive (about 100x more, pound-for-pound, than steel), but, as one analysis put it, energy-use “data for electronics production still needs to become better.” The data available suggest that the uncounted CO2 emissions embodied in each EV’s power electronics roughly equal those from driving an ICE car 3,000 miles.

Life Span: Most analysts assume that a battery pack will last the EV’s lifetime, but life spans depend on how consumers charge the battery—fast or overnight. As one study put it, using “intensive,” i.e., on-road fast charging, rather than “light” overnight charging, typically cuts a battery’s life in half. Modeling the emissions from an EV fleet requires estimating what share of owners will need two batteries per car life span.

Fuel Efficiency: When EV emissions are presented as a percentage reduction over an ICE car, one assumes a fuel mileage for the latter. But realistic forecasts would incorporate future trends in combustion engine efficiency. An analysis of engine technology progress finds 30%–50% fuel efficiency gains will be on offer by 2030 and thus an equal reduction in CO2 emissions per mile. Using the performance of a future ICE for comparison with a future EV further closes any gap in estimated emissions savings

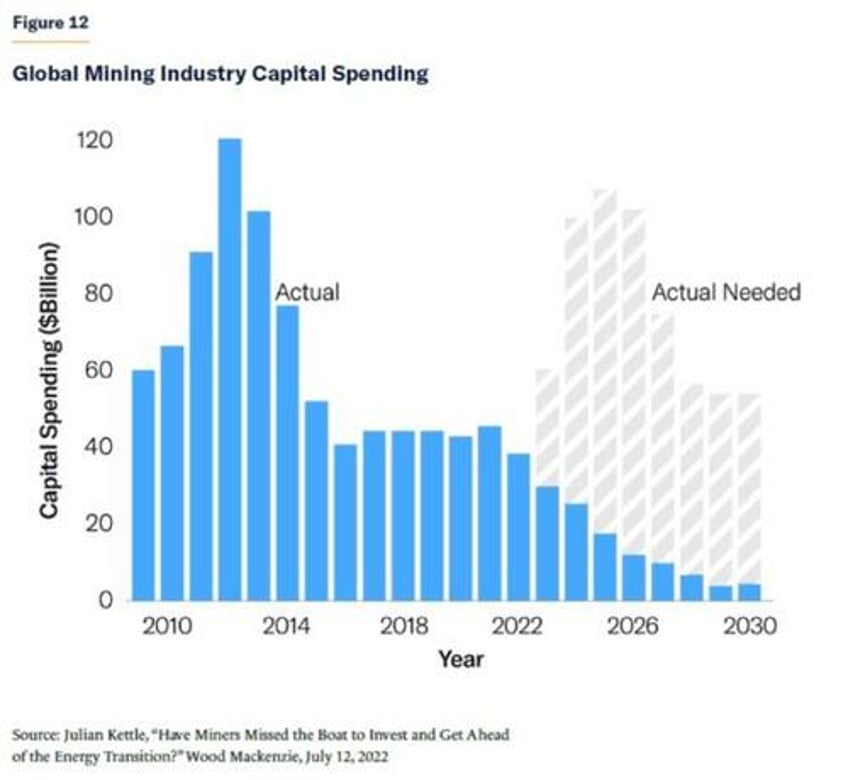

Recycling: Recycling will be irrelevant for a long time, as far as mitigating upstream minerals demands. Since manufacturers claim that EV batteries will last a decade, that means that there won’t be much of anything available to begin recycling until the early 2030s. The best that IEA could come up with is recycled minerals meeting 1%–2% of battery demand by 2030.[70] As for the following decades, enthusiasts’ unrealistic dream of perfect recycling, even were it feasible, would still leave the need for an astronomical rise in overall minerals supplied.

Alleged Breakthroughs: News stories serially claim a “breakthrough” in battery technology, but there are no commercially viable alternative battery chemistries that significantly change the magnitude of the physical materials needed. To meaningfully reduce primary mineral demands would require a nearly 10-fold leap in underlying electrochemistry efficiency. Such gains aren’t even theoretically feasible. Many processes are already operating near physics limits.

Heavy Duty Use: Batteries for most heavy equipment are not up to 24×7 performance and industrial-class demands—never mind costs. And as IEA has also pointed out, over half the electricity used in industry is not grid-connected but produced on-site, and much of it with diesel-fueled generators, especially at remote and small mines.

Temperature: EV mileage is about 30% worse when it’s 20oF outside, versus 80oF, because battery electrochemical reactions are unavoidably slow at lower temperatures.[91] There’s only a 5% drop in fuel efficiency for ICE cars over the same temperature range. On top of that, as road testers and consumers know, using an EV’s heater in winter can lower kWh mileage by as much as 50%.[92] (An ICE car scavenges free waste heat.) Such temperature factors are generally ignored, not only on EV “sticker” ratings but especially so in estimating national emissions impacts from EVs. Those factors matter, since one-third of the U.S. population lives in cold northern latitudes.

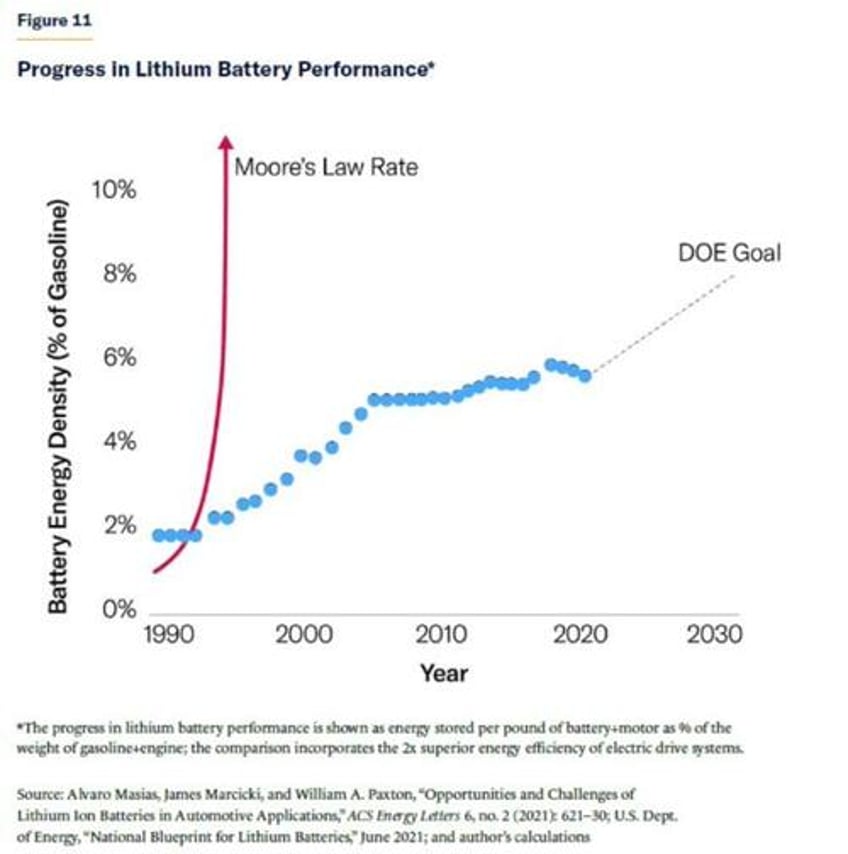

Moore’s Law and the Comic Book View

Only in comic books does energy tech advance at the pace of information tech, such as in Moore’s Law.

Similarly central to the inevitability and cheaper-better claims is the assertion that EVs are inherently simpler machines and that the “old” ICE technology is maxed out, with no innovation remaining.

The reality is otherwise. Yes, conventional cars do have a complex thermo-mechanical system, with the engine and automatic transmission made from hundreds of components, mated with a very simple fuel system, a tank holding a liquid with a one-moving-part pump. EVs, inversely, have a very simple motor made from just a few parts. However, the EV fuel tank is a complex electrochemical system made from hundreds of parts, sometimes thousands, including a cooling system, sensors, and control electronics. In addition, the EV drivetrain requires roughly double the quantity of microcontrollers and power electronics.

Greater advances are still possible with ICE tech than are with electric motors or batteries. In terms of overall mineral resource requirements, a 1% improvement in combustion efficiency equals a 10% advance in battery-electric tech.

Projection vs Needs

Where Are the Minerals?

The overwhelming majority of minerals supply is located outside the U.S. and EU.“None of the raw materials required for battery-cell manufacturing are currently mined in significant quantities in Europe,” a recent German government study noted.

For energy minerals, China has double the market share that OPEC has with oil. China is busily expanding mining investments in Africa and South America and is on track to raise its share of the refined lithium market from 24% last year to 32% within two years. Other countries are following Indonesia’s new policy (the world’s top nickel producer), wherein exports of raw mineral ore are prohibited, requiring the construction of local refineries. Meanwhile, in South America, where two-thirds of the world’s low-cost lithium resources are known (and one-third of current production), there’s talk of a Lithium cartel. The effect on prices of such market concentrations are well known. Strategies to form “buyers’ clubs” among nations, recently proposed by the U.S. government in collaboration with the EU, run up against their historical failure. Monopolies, cartels, or dominant sellers invariably have more price control.

Even if the energy-minerals market were to be uniquely free of price manipulation, the basic economics of supply and demand points to dramatic price increases for batteries—as well as other products dependent on these minerals. For many minerals, EV demand is transitioning from a marginal share to the dominant use. Competition for these minerals’ supply, and inevitably price pressures, will begin to have an impact on the cost of building everything from homes and buildings to appliances and computers. Five years ago, EV markets constituted, for example, 15%, 10%, and 2% of all uses for lithium, cobalt, and nickel, respectively; last year, those shares were 60%, 30%, and 10% and rising rapidly.

Refueling Infrastructure

So far, 90% of EVs in the U.S. have been purchased as a second or third car by wealthy households with a garage. While only one-third of American households have a garage, the fueling infrastructure challenges begin in those neighborhoods for an all-EV world. If all garage owners use home chargers, it will necessitate massive upgrades to residential electric networks. Otherwise, as one study showed, “more than 95 percent of residential transformers would be overloaded,” meaning that they fail or can blow up.

“Fast” charging is still far slower than the five to 10 minutes typical for gasoline fueling. Thus, to achieve the same convenience (avoiding waits in lines, etc.), a filling station will require about four chargers to replace each gasoline pump. Quite aside from the land-use implications, this translates into at least a doubling of the overall cost to build the average filling station (counting land, buildings, and other infrastructures as well).

In addition, installing two dozen or more superchargers at a filling station creates a grid power demand comparable to a small town or a steel mill instead of a convenience-store demand level of today’s filling stations. At the same time, the higher power levels from EV chargers will radically decrease the life span of the existing power transformers on utility poles, coming at a time when costs for new transformers have inflated about fivefold.

In Europe, where there’s more experience with on-road fast charging, the cost of a fast-charge fill-up is already higher than diesel for the same distances driven. In the U.S., Consumer Reports notes that the cost to fill up with a Tesla supercharger is over triple the (usually assumed) cost of at-home overnight charging.

Refueling Math

As for a “big reset” for EV infrastructure based on the 2022 Inflation Reduction Act’s $7.5 billion in subsidies to fund “thousands” of on-road chargers: consider the math. The all-EV future will need to replace most, if not all, of America’s roughly 1 million gasoline pumps located at the existing 145,000 filling stations.

The calculus of overall societal costs for an all-EV future also requires including the dramatic expansion of power generation and long-distance transmission. Replacing all the gasoline used in America with electricity would require at least 50% more electricity generation than exists or is planned, along with an even greater increase in electric power distribution. Such power-plant and grid requirements represent multitrillion-dollar levels of spending.

An analysis from the Boston Consulting Group puts the utility grid improvement costs—never mind power generation—at $1,700–$5,800 per EV put on the market. Do the math: that’s $400 billion to over $1 trillion for an all-EV American car fleet. While those costs would be divorced from car prices, it would constitute “sticker shock” for household electricity or tax bills.

Conclusion: There’s No Such Thing as a Carbon-Free Lunch

Imagining a hypothetical all-EV world requires acknowledging the unavoidable fact of a rats’ nest of assumptions, guesses, and ambiguities regarding emissions. Much of the necessary data may never be collectible in any normal regulatory fashion, given the technical uncertainties and the variety and opacity of geographic factors, as well as the proprietary nature of many of the processes. Those uncertainties could lead to havoc if U.S. and European regulators enshrine “green disclosures” in legally binding ways, and it all will be subject to manipulation, if not fraud.

If implemented, ICE bans will lead to a massive misallocation of capital in the world’s $4 trillion personal mobility industry. It will also lead to draconian constraints on freedoms and unprecedented impediments to affordable and convenient driving. And it will have little to no impact on global CO2 emissions. In fact, the bans and EV mandates are more likely to cause a net increase in emissions.

Mish Comments

The report by Mark P. Mills is complete with over 200 footnote citations and 14 charts of which I only discussed a few.

Mills presents an excellent starting point for understanding why the Biden push for EVs and especially Biden’s timeline cannot and will not happen. More importantly, it’s not even the right goal.

Also, Biden envisions production of EVs and minerals in the US while his Green administration is hell bent on blocking every mine for environmental reasons.

The ridiculously-named Inflation Reduction Act (IRA) allocates $7.5 billion for infrastructure when a trillion dollars may be insufficient. This does not include the massive underinvest in mines, mostly powered by diesel or coal, and largely controlled by China.

Solid State Batteries and the Kiss of Death for Gas Powered Cars, Hype or Reality?

Regarding alleged battery breakthroughs, please consider Solid State Batteries and the Kiss of Death for Gas Powered Cars, Hype or Reality?

Numerous articles cite an alleged breakthrough by Toyota that will be the kiss of death for the gasoline engine. Some of us are skeptical.

Please note that Toyota is so convinced of its solid state technology that it continuing research in hybrids, fuel cells, plug-in hybrids, regular batteries, and semi-solid state batteries.

Mills stated To meaningfully reduce primary mineral demands would require a nearly 10-fold leap in underlying electrochemistry efficiency. Such gains aren’t even theoretically feasible. Many processes are already operating near physics limits.

Ford to Layoff at Least 1,000 Workers, EV Startup Lordstown Motors Dies

We have hype over batteries, production, and goals that are not remotely possible.

Meanwhile, Ford to Layoff at Least 1,000 Workers, EV Startup Lordstown Motors Dies

EV Irony of the Day

Biden and the EPA have conspired to force companies to produce more EVs, but they cannot force anyone to buy them.

Please ponder the EV Irony, Despite Huge Incentives, Supply of EVs on Dealer Lots Soars to 92 Days

Hello car manufacturers, what are you going to do with all that inventory?

By the way, According to Florida’s Department of Emergency Management (DEM), nearly 6.8 million Floridians evacuated their homes in the lead up to Hurricane Irma, “beating 2005’s Houston-area Hurricane Rita exit by millions.”

Everyone will get 300 miles then their cars will all die.

* * *