Robinhood, the Menlo Park based company best known for popularizing commission-free trading — and the meme stock frenzy — entered the credit card space with its new Robinhood Gold Card.

The launch of a credit card comes less than a year after Robinhood’s $95MM cash acquisition of credit card company X1. We wrote a detailed piece on this last year; in summary, X1, the self-proclaimed “smartest credit card ever made” was a no-fee, rewards-based credit card offering a modern digital interface, innovative income-based underwriting, and user-friendly features such as easy subscription cancellations and single-use virtual cards. It was more “software app” than “card”.

The specifics of what Robinhood planned to do with the asset, particularly the benefits it would bring to the table, remained unknown. Based on the details that have been released so far, we think the excitement is justified. Some key highlights:

3% cashback on all transactions and 5% back on travel booked through their new travel portal.

While the 5% back on travel is competitive, the unlimited 3% cash back on all purchases sets a new market standard. Although some cards offer higher rewards in specific categories, these benefits are often restricted by category limits and annual caps on earnings.

Users will have the ability to add up to five family members of any age as additional cardholders with each one receiving their own card. The primary account holder can monitor each card's spending and impose spending limits.

This should be table stakes in today’s market, but adding a cardholder can be shockingly painful. Moreover, many issuers do not provide detailed spending breakdowns by user. This treats a family credit line as a software component, which we like.

Cardholders can create and delete virtual cards for one-time purchases.

Great feature to have and one that is still lacking for many consumer cards, although newer business cards have gotten on board. As we touched on with X1, this allows for subscription cancellations and added security.

As a Visa Signature card, users automatically get trip interruption protection, extended warranty protection, auto rental collision waiver, and more.

Although it falls short of Visa's top-tier offering, Visa Infinite, it still stands out as a premium option compared to other Visa categories like Visa Classic and Visa Gold.

Now, a few caveats.

Advertising this as a "no fee" card is misleading. To qualify, users subscribe to a Robinhood Gold account, which runs $5 per month or $50 per year.

The fee is minimal for the value you get. You cover your monthly cost so long as you spend $166 per month ($166*3%=$5).

The cash back has limitations as to how it can be redeemed — (1) purchases at select merchants directly through Robinhood’s shopping portal; (2) booking travel through the travel portal; or (3) redeeming as cash to be deposited in the Robinhood brokerage account, which is set up automatically

Users who want to spend their cash back outside of the Robinhood ecosystem will have to figure out how to transfer the cash out of the brokerage account to a checking or savings account. Clearly, the program is set up as a customer acquisition cost for their core brokerage activity, which is where revenue generation is mature. While on the surface this may seem like a money-losing endeavor, it is important to understand the economics behind credit cards. Here are the levers:

Interest Income: Revenue accrued from the interest paid by cardholders on any carried outstanding balances;

Interchange Fees: Often referred to as swipe fees, these are charged to merchants by card networks each time a card is used for a transaction.

Annual Fees: Fees charged to owners of certain premium cards to compensate for the added perks these cards have.

Other Fees: This category encompasses a range of charges, including late payment fees, balance transfer fees, cash advance fees, and others.

In order to be profitable, the revenue from these streams must cover the costs associated with reward programs and unrecoverable debts. When managed properly, credit cards are money-making machines. That said, it's crucial to recognize that the income generated is distributed among various stakeholders in the ecosystem. The issuer, also known as the issuing bank (e.g., Chase, Citi, Barclays) receives the largest share, generally getting the majority of interchange fees and interest income, as they are the entities extending the credit. The credit networks (e.g., Visa, Mastercard) receive a smaller portion of the interchange fee. However, as networks participate in a significantly higher number of transactions, this really adds up — with merchants paying MasterCard and Visa collectively over $100B in 2023.

For Robinhood, the exact economics from the program are more complicated. Robinhood is not issuing the card directly, instead relying on Coastal Community Bank as the issuer. However, unlike how such models typically work, it appears that Robinhood will still be underwriting the cards and agreeing to cover certain defaults. With that in mind, while the exact revenue share is not disclosed, the nature of the relationship likely means that the interchange fees and interest income will be split, in some manner, between the two entities.

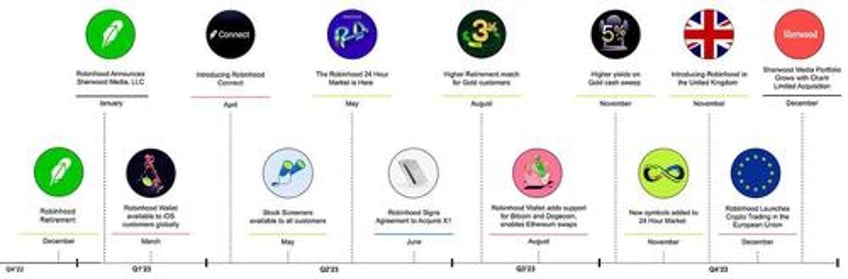

The credit card launch follows Robinhood’s continued push for growth, coming after products like 24-hour trading, IRA accounts, and expansion into the UK Market.

Robinhood is executing a “land and expand” strategy, acquiring customers and then cross-selling them on the Fintech bundle to grow ARPU. This has several benefits:

Increased Customer Value: Allows the company to extract the maximum value from each customer across several offerings

Customer Retention: Customers who have multiple products or services from a company are more integrated into its ecosystem, making them “stickier” and less likely to switch to a competitor.

Lower Acquisition Cost: Acquiring a new customer is expensive, involving marketing, sales efforts, and onboarding processes. In contrast, selling to an existing customer, who is already familiar with and trusts the institution, incurs much lower costs.

Enhanced Customer Insight: Having customers use multiple products allows the company to gather more data on them, and therefore create more effective marketing and risk management

Revenue Diversification: Trading revenues may be cyclical, while credit card revenues are more consistent, and likely more profitable when rates are high.

Robinhood needs to derive maximum value from each customer because their monthly active users (MAUs) have been falling since 2021. The company had over 20 million users in 2021, and shows around 10 million in 2023 — a 50% collapse.

That said, while overall MAUs are declining, Gold Members are increasing, adding 280K during 2023, and an additional 90K in the first 2 months of 2024. Recurring subscription revenue is the antidote to volatility and might be the most critical thing for Robinhood going forward. As discussed by the CFO, Jason Warnick, on the company’s 2023 Q4 earning webcast, aside from generating $85MM in annualized membership fee revenue, Gold Members adopt products at a higher rate and hold approximately 8x the assets, or $40,000, compared to average users.

The introduction of the credit card into this mix is a compelling proposition for subscribers. The link between the Gold Card and a Gold Membership will accelerate membership growth, leading to more revenue from memberships.

However, a critical challenge remains — Robinhood's ability to effectively cross-sell to these new members within its ecosystem. The allure of the credit card is likely to attract a demographic distinct from the existing Gold Members, which might complicate cross-selling efforts. Will the new credit card users bring $40,000 to the trading platform? Robinhood seems willing to pay 3% cash back for a while to test the hypothesis.