The artificial intelligence boom that revitalized US tech stocks in 2023 is now facing scrutiny as investors question the sustainability of AI-driven market gains.

Business Insider reports that the landscape of U.S. technology stocks has undergone a dramatic shift since 2022, when falling demand following pandemic-era expansions led to a significant downturn. However, 2023 saw a remarkable reversal, fueled by enthusiasm for artificial intelligence. This resurgence propelled the S&P 500 index to a 40 percent gain and the tech-focused Nasdaq to an impressive 60 percent increase since the beginning of 2023.

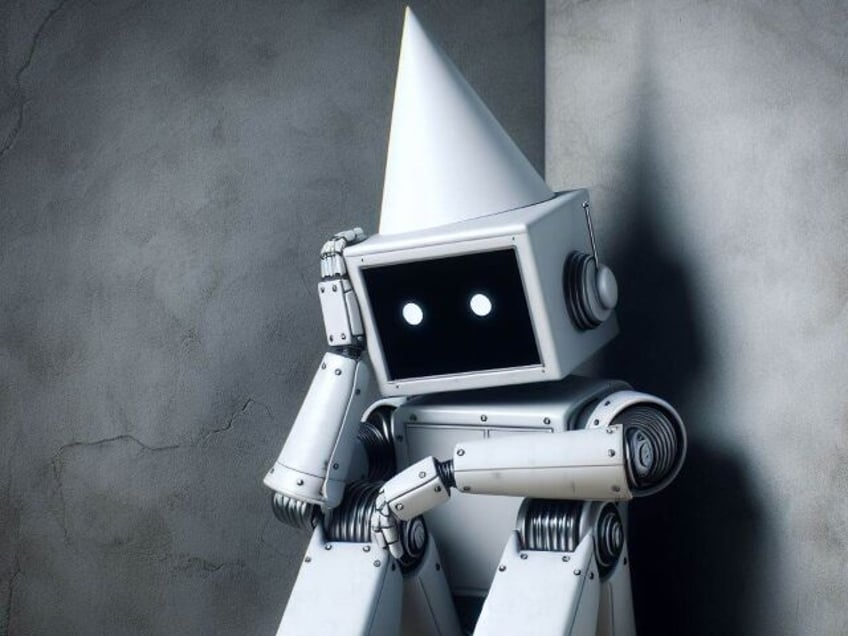

Despite these gains, recent market activity suggests growing investor impatience and skepticism. US stocks have experienced a sell-off, prompting questions about whether excessive capital is being directed towards AI initiatives. Michael Strobaek, global CIO at Swiss private bank Lombard Odier, highlighted this concern in a recent report, stating that major stock markets have been driven by “investor optimism that we think borders on complacency.”

Strobaek further noted that AI enthusiasm has “supercharged” certain US equities, driving key indices to new highs. However, this performance is heavily concentrated in a few mega-cap names, potentially amplifying the impact of any significant decline in Big Tech stocks.

This concentration effect was evident on Wednesday when all major US indices closed lower. The Nasdaq Composite experienced its worst trading day since October 2022, falling over three percent. Bloomberg reported that the Nasdaq 100 index lost $1 trillion in value. Notable declines included AI chip leader Nvidia, which closed nearly seven percent lower, and Alphabet, Google’s parent company, which fell five percent after reporting mixed second-quarter earnings.

Alphabet’s earnings call highlighted investor focus on AI initiatives and their revenue-generating potential. However, Google executives provided limited information on these topics, leaving many questions unanswered.

As other Big Tech companies prepare to report their quarterly earnings, attention is turning to their AI investments and the potential for near-term returns. Jim Reid, a research strategist at Deutsche Bank, raised a crucial question: “How much are companies willing to spend to outpace one another in the AI race?” The cost of developing advanced AI models is substantial, with some estimates suggesting it could reach billions of dollars over the next few years.

The current market dynamics have led some analysts to draw comparisons between AI enthusiasm and previous market bubbles. Lombard Odier’s Strobaek warned of a growing risk of market reversal, suggesting that funds may rotate to other stocks and sectors if tech experiences a downturn.

Despite these concerns, major tech companies appear committed to substantial AI investments. Google’s AI chief announced plans to invest more than $100 billion in AI technology development over time. During Alphabet’s earnings call, CEO Sundar Pichai emphasized the company’s perspective on AI investment, stating, “When we go through a curve like this, the risk of underinvesting is dramatically greater than the risk of over-investing for us here, even in scenarios where if it turns out that we are over-investing.”

Read more at Business Insider here.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship.