iRobot's shares crashed by as much as 40% in early cash trading in New York after the maker of robotic household vacuums issued a going concern warning for the next 12 months following a dismal fourth-quarter earnings report.

Let's begin with four quarter earnings.

Irobot reported wider-than-expected losses and revenue that missed the average estimates tracked by Bloomberg Consensus.

Snapshot of fourth-quarter earnings courtesy of Bloomberg:

Revenue $172.0 million, estimate $181 million (Bloomberg Consensus) (2 estimates)

Adjusted loss per share $2.06, estimate loss/shr $1.73 (2 estimates)

Loss per share $2.52 * Average gross selling price $365

Gross margin 9.5%

R&D expenses $16.5 million, estimate $19.5 million (2 estimates)

Selling and marketing expenses $39.9 million, estimate $44.8 million (2 estimates)

Adjusted gross margin 12.8%, estimate 20.7% (2 estimates)

Adjusted operating loss $44.8 million, estimate loss $37.4 million (2 estimates)

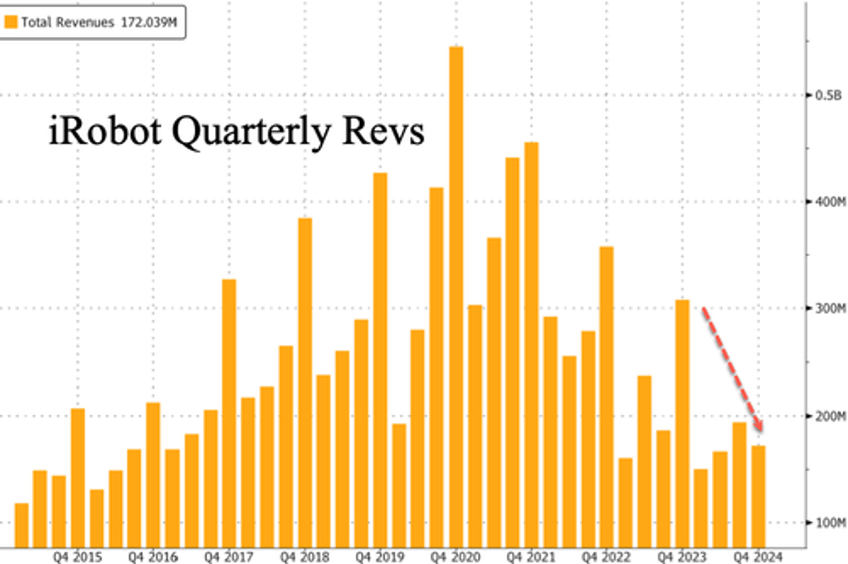

IRobot reported a 44% revenue drop in the fourth quarter from a year earlier...

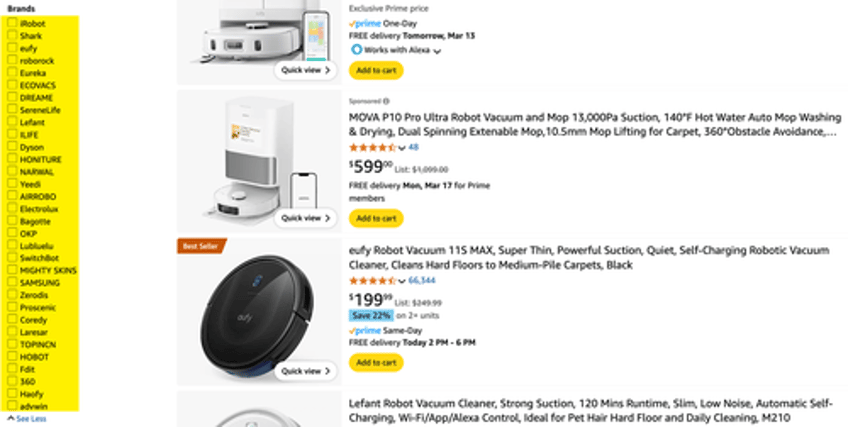

Chinese producers have flooded the US market with cheaper versions of robotic household vacuums, pressuring iRobot sales in recent years. Irobot sales peaked in 4Q20 during the early days of the pandemic.

Bloomberg noted that iRobot canceled its fourth-quarter and full-year 2024 results conference call and webcast earlier.

Gary Cohen, iRobot CEO, wrote in a statement:

iRobot has defined the robotic floorcare category for more than 30 years, and we remain committed to growing and evolving our business across smart home categories amidst a dynamic operating landscape. As we move ahead, we will continue to take decisive action to reclaim our position as the industry leader and build on iRobot's strong foundation centered around our globally recognized, iconic brand, Roomba.

iRobot has been undergoing a restructuring plan since 2024, significantly reducing its headcount by more than 50%, along with supply chain and R&D changes.

The robot company was once Amazon's $1 billion buyout target, but that deal fell through after clashing with European Union regulators.

What spoked the market was the company's going concern...

As will be noted in iRobot's Annual Report on Form 10-K for the year ended December 28, 2024 (10-K), there can be no assurance that the new product launches will be successful due to potential factors, including, but not limited to consumer demand, competition, macroeconomic conditions, and tariff policies. Given these uncertainties and the implication they may have on the Company's financials, there is substantial doubt about the Company's ability to continue as a going concern for a period of at least 12 months from the date of the issuance of its consolidated 2024 financial statements. Additional information will be included in the 10-K that is filed with the SEC.

Another one bites the dust—or will Amazon make another offer at a significantly lower price?