Parsing through a Goldman note on the online dating sector, particularly focusing on Match Group (MTCH), Bumble (BMBL), and Grindr (GRND), the industry remains on a healthy upward growth trajectory. However, mature online dating markets are slowing, while emerging regions (Asia ex-China) drive new user adoption. While Hinge outperforms Tinder, Bumble is restructuring its growth strategy, and Grindr continues penetrating the LGBTQ+ community.

Goldman analysts Eric Sheridan and Julia Fein-Ashley provided clients with the key takeaways of what's currently happening across the online dating industry:

We continue to forecast the directly addressable online dating user TAM to grow at a 4% CAGR from 2024-2029;

Expect Asia ex-China to contribute to a large portion of new dating users and slower growth from more mature markets (i.e. UCAN [United States and Canada]/Europe growing at a 1% CAGR from 2024-2029); &

Forecast Hinge to increase penetration in the addressable user market, driven partially by continued focus on the international opportunity (and scaling in new international regions/markets).

Sheridan leveraged third-party data and industry sources that found the latest trends:

Industry: UCAN user preferences continue to shift towards intentional dating and community/friendship oriented apps (a theme of industry narrowing at the application layer);

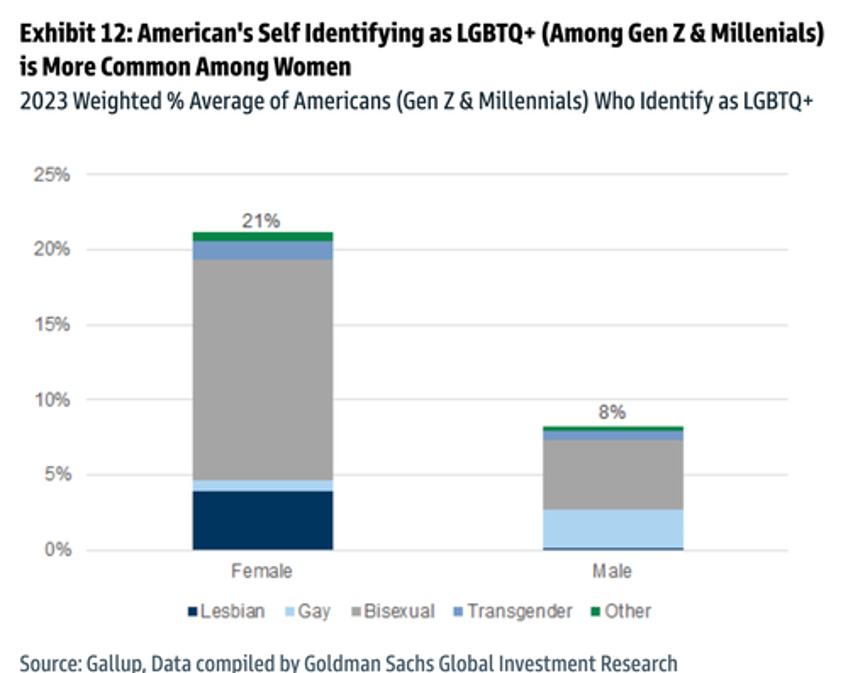

GRND: the LGBTQ+ userbase size at Tinder/Hinge remains less scaled than Grindr &

BMBL: commentary around Bumble's decision to discontinue/sunset the Fruitz app.

Instead of analyzing the entire note, we highlight two interesting trends.

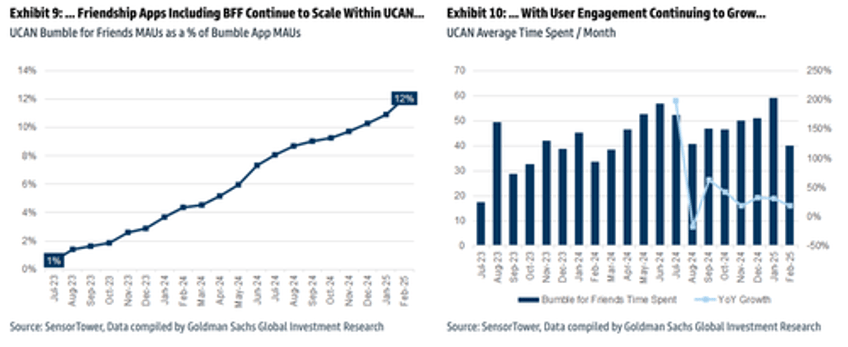

The first is Bumble for Friends. This app helps users build platonic relationships rather than romantic connections and has seen rapid growth over the last 18 months.

More from the analysts:

Bumble for Friends (BFF) has continued to scale over the past 18 months, both in MAUs (now in double digits as a % of Bumble App MAUs in UCAN) and engagement (Exhibit 10). We view this as an area of increasing focus at Bumble, with mgmt. noting their increased focus on the friendship/community opportunity and shift in focus away from other apps (i.e. discontinuing Fruitz and Official apps

While BFF tends to have less of an impact on the number of total paying users, we view the app as providing a low-pressure alternative to dating apps and an additional acquisition channel specifically targeting younger (Gen Z) users.

The second is this...

"This, paired with LGBTQ+ identification being more common among American women (Exhibit 12) highlights that addressable user penetration rates at Grindr are likely higher than Tinder/Hinge (even when factoring in differences among addressable LGBTQ+ population)," the analysts noted.

1 in 5 Gen Z & millennial women!

It's not a surprise after 15 years of woke propaganda jammed down the throats of all generations.

When you peel back the rainbow shell of the woke and well-funded Pride Month conglomerate, you find something deeply insidious. Their profits come at a steep cost: the well-being of vulnerable children.

— Gays Against Groomers (@againstgrmrs) June 29, 2024

These corporations aren't allies, they're opportunists. They've discovered… pic.twitter.com/Lnl3Y2Euot

To sum up, younger generations increasingly rely on friendship apps rather than engaging in real-world exchanges at bars, restaurants, churches, and other public areas, making eye contact, and simply saying "hello"—a tradition that has existed for thousands of years. Additionally, 15 years of woke has led to 1 in 5 women identifying as LGBTQ+ (maybe we're missing a few letters and numbers).