A class action lawsuit has been filed against H&R Block, Facebook (now known as Meta), and Google, accusing the companies of scheming to illicitly install trackers on H&R Block’s website used scan and transmit sensitive tax data, which was allegedly used for targeted advertising and refining Facebook’s AI algorithms. As one attorney explained, “It’s like your income tax guy handing your pay stubs and tax returns over to a marketing firm.”

The lawsuit, filed in the Northern District of California, alleges that the three companies engaged in a “joint scheme” to exploit H&R Block’s tax return preparation services, potentially impacting anyone who has used these services in recent years. The legal action claims that this conduct amounts to a “pattern of racketeering activity,” a serious charge typically reserved for organized crime, under the Racketeer Influenced and Corrupt Organizations Act (RICO).

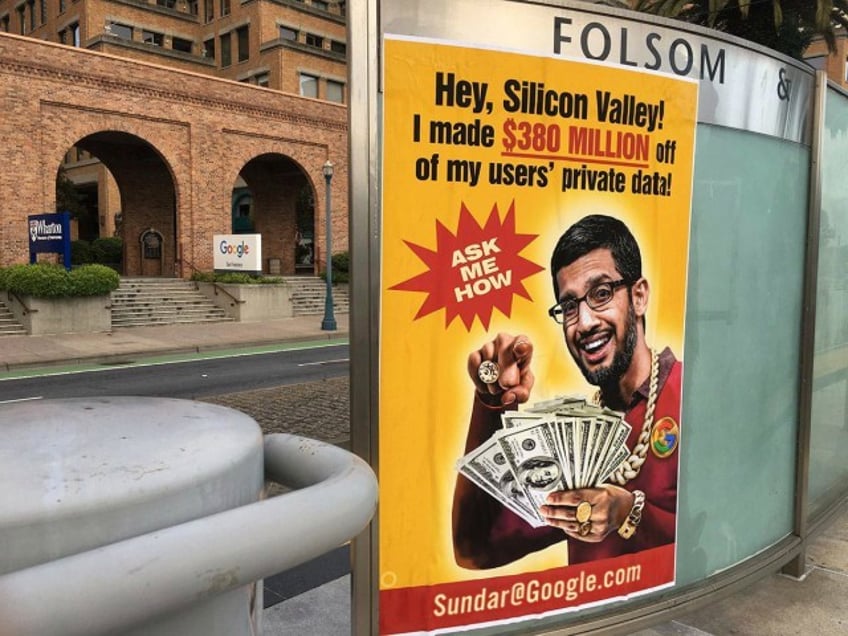

Sabo mocks Google CEO Sundar Pichai (unsavoryagents.com)

an H&R Block office (Photo by Tim Boyle/Getty Images)

The legal action follows a revealing Congressional report released earlier this year, detailing how multiple tax preparation firms, including H&R Block, have “recklessly” shared the sensitive tax data of tens of millions of Americans without implementing proper safeguards. The report highlighted the use of tracking “pixels” on these firms’ websites, referred to as “spy cams” in the lawsuit, which would allegedly scan tax documents and expose a variety of personal tax information, including a filer’s name, filing status, federal taxes owed, address, and number of dependents.

Brent Wisner, one of the attorneys for the plaintiffs, stated, “H&R Block, Google, and Meta ignored data privacy laws, and passed information about people’s financial lives around like candy.” He emphasized the gravity of the situation, comparing it to posting sensitive financial information on social media platforms, “It’s like your income tax guy handing your pay stubs and tax returns over to a marketing firm.”

The lead plaintiff, California resident Justin Hunt, claims he was unaware his personal tax data was being “fraudulently intercepted” when he used H&R Block’s software to file his taxes between 2013 and 2018. He asserts that had he known about the partnership with the tech companies, he would not have used the service. The lawsuit seeks full refunds for Hunt and all US taxpayers who used H&R Block’s services since the alleged tracking began, as well as punitive damages for the supposedly illegal conduct of the three companies.

The lawsuit alleges that H&R Block has been using Facebook’s Pixel tracking service since at least 2015, collecting information from taxpayers who visited sites with the pixel on it. This information would be stored until they logged on to Facebook or Instagram, at which point Facebook would receive a “dossier” of personal data. Google, on the other hand, allegedly interacted with the tax data through H&R Block’s use of Google Analytics, a tool used by an estimated 70 percent of the top 100,000 websites.

H&R Block has explicitly declined to comment on the lawsuit. However, a spokesperson for Google emphasized the responsibility of site owners in controlling the information they collect and informing their users of its usage, stating, “We have strict policies and technical features that prohibit Google Analytics customers from collecting data that could be used to identify an individual.”

The case is Hunt v. Meta Platforms, Inc. et al, No. 3:2023-cv-04953 in the United States District Court for the Northern District of California.

Lucas Nolan is a reporter for Breitbart News covering issues of free speech and online censorship.