The rise of generative AI applications like ChatGPT, Midjourney or Bard already leads to increased demand in the world's data center network due to its sometimes hefty requirements for the underlying large language models.

This computing demand will only increase in the upcoming years, necessitating the building of new data centers and expanding the capacities of existing ones.

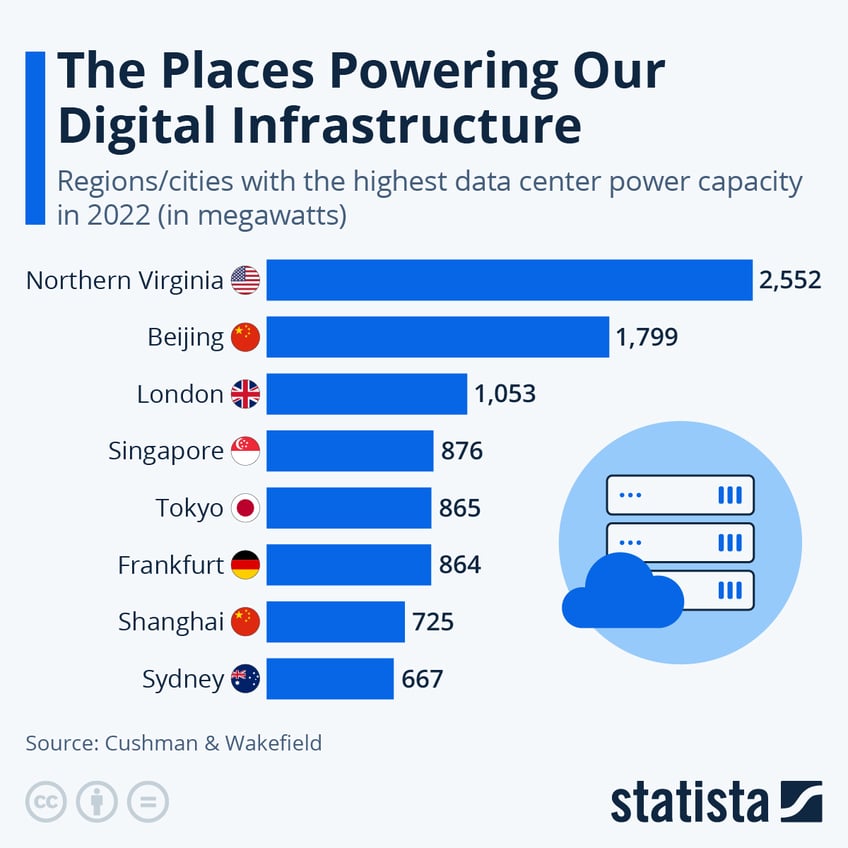

As Statista's Florian Zandt shows in the following chart, based on 2022 data collected by commercial real estate company Cushman & Wakefield, the race between the global superpowers China and the United States also extends to data centers.

You will find more infographics at Statista

The highest concentration of data center power capacity in the world can be found in Northern Virginia, particularly the counties of Loudoun and Prince William.

According to an interview with the vice chairman of real estate service provider CBRE, Rob Faktorow, with radio broadcaster WTOP in 2022, the main reasons are tax incentives, superior connectivity and infrastructure well suited to the resource needs of big server farms.

“It is true Northern Virginia is the data center capital of the world, the largest market in the world, by three times,” said Faktorow.

“It encompasses almost 50% of the data centers in the United States.”

We couldn't help but notice that both those Northern Virginia counties border The CIA's 'Langley' HQ in Fairfax County...

Coming in second is Beijing with a capacity of 1,800 megawatts, followed by London (1,000 megawatts) and Singapore (876 megawatts).

While the Greater Tokyo area only ranks fifth for current capacity, the island nation is on an accelerationist path in terms of future projects, especially compared to its competitors in the Asia-Pacific region. According to Cushman & Wakefield, Beijing's capacity will likely increase by around 300 megawatts in the next three to five years, owed partly to investors shifting funds due to rising U.S.-China tensions. The traditionally Western-aligned Japan might see its data power capacity double to almost 2,000 megawatts in the same period, in part due to pledges by big players like TSMC and Nvidia to build chip fabrication plants and establish a network of, as Nvidia CEO Jensen Huang put it, "AI factories" across the country.

Another relevant aspect in evaluating the growth potential of data centers in a specific region is their vacancy rate.

As CBRE notes, capacity vacancy in Singapore stood at less than one percent in Q1 of 2023. Northern Virginia had a vacancy rate of about two percent, and Tokyo stood at 11.2 percent.