Verizon Communications announced a $20 billion deal to acquire rival telecommunications operator Frontier Communications Parent Inc., the US's largest pure-play fiber internet provider. The announcement follows a Wednesday report from The Wall Street Journal suggesting that Verizon was nearing a deal, sparking a 38% surge in Frontier's shares in New York.

Verizon said Frontier investors will receive $38.50 per share in cash, representing a 43.7% premium to Frontier's 90-day volume-weighted average share price on Tuesday, the last pure trading day before media reports leaked a potential acquisition of Frontier.

The Verizon and Frontier Boards of Directors have unanimously approved the transaction. Subject to approval by Frontier shareholders and regulatory approvals, the deal is expected to close in about 18 months.

"This strategic acquisition of the largest pure-play fiber internet provider in the US will significantly expand Verizon's fiber footprint across the nation, accelerating the company's delivery of premium mobility and broadband services to current and new customers. It will also expand Verizon's intelligent edge network for digital innovations like AI and IoT," Verizon wrote in a press release.

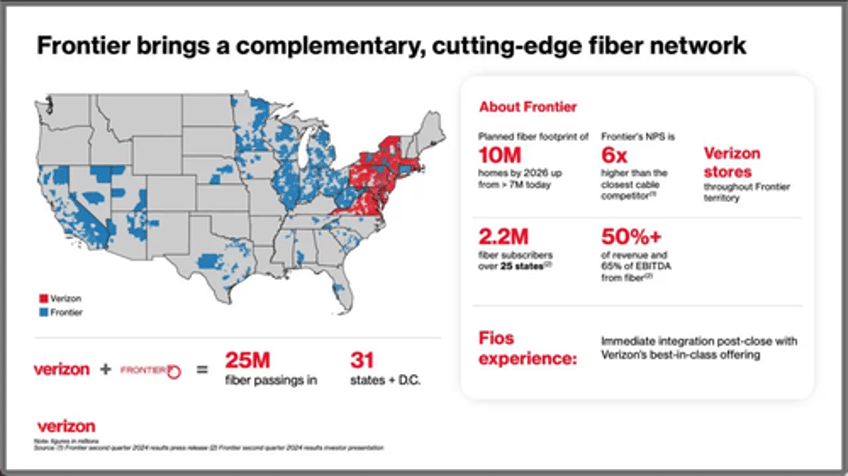

Frontier's 2.2 million fiber subscribers across 25 states will join Verizon's 7.4 million Fios connections in 9 states and Washington, DC. In addition to Frontier's 7.2 million fiber locations, the company is rapidly expanding its fiber footprint with an additional 2.8 million fiber locations by the end of 2026.

On Wednesday afternoon, WSJ initially broke the story about Verizon and Frontier. Shares of Frontier jumped as much as 38% to the mid-point of the $38 handle. This AM, shares are down 9% to the low $35 handle.

WSJ noted, "Faced with slowing wireless revenue growth and an expensive dividend, Verizon has invested in expanding its home-internet footprint. But new fiber-optic construction is expensive and time-consuming, making existing broadband providers attractive takeover targets."

What a rollercoaster ride for Frontier investors—from Chapter 11 bankruptcy in April 2020 to today's Verizon deal. What appears evident here is that fiber network infrastructure will be critical to powering the artificial intelligence boom and proliferation of data centers.