After another rollercoaster of a week, we are now in the home stretch... but first we have to survive a massive $2.4 trillion option expiration on Friday, which will lead to dealer gamma collapsing by 90% and "unclench" gamma, potentially resulting in a burst in volatility which until this moment was trapped by strong positive dealer gamma.

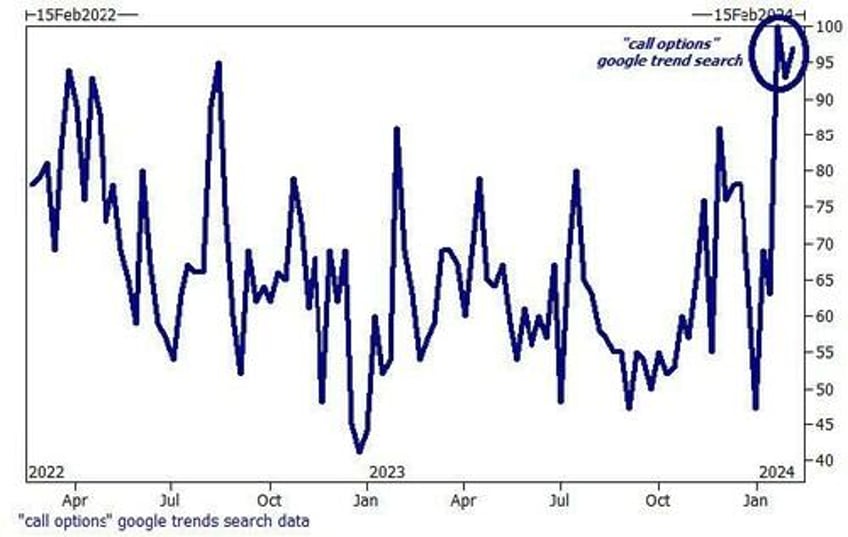

According to Goldman, there is over $2.4 trillion of notional in options exposure that will expire on Friday, including $510 billion notional of single stock options. Not surprisingly, index options volumes continue to grow, driven by 0DTE/short-dated options. Meanwhile, single stock options volumes have rebounded to an 18-month-high fueled by significant growth in call options volumes. In fact, as noted earlier, Google searches for "call options" just hit a 2 year high which, as Goldman puts it, "one would think it's not professional asset managers looking this up" (one would hope).