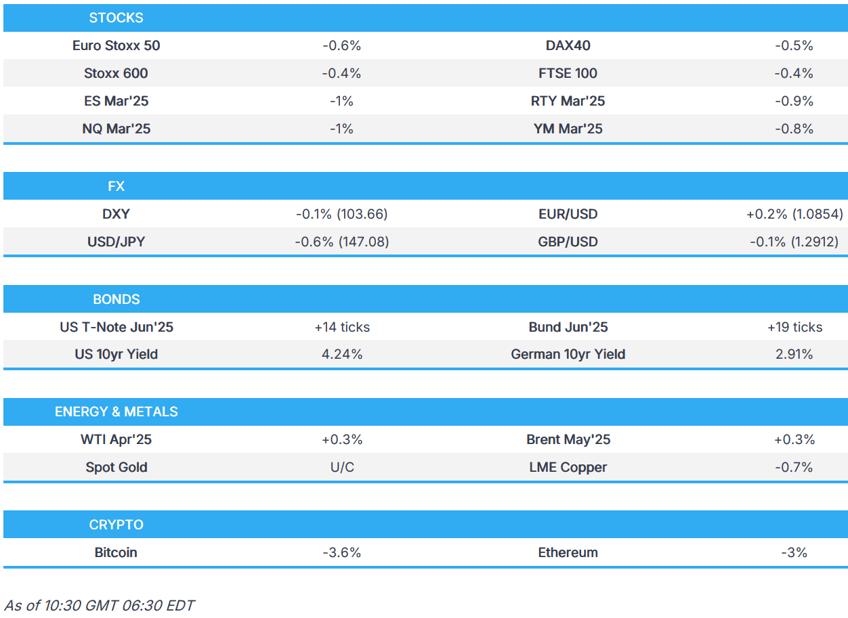

- European bourses opened higher but quickly succumbed to selling pressure as sentiment took a hit; US futures are in the red, NQ -1.2%.

- A choppy start to the week with USD failing to bounce back from last week's selling; JPY leads.

- Bonds are propped up by a deterioration in sentiment, offsetting initial Bund pressure on fiscal-related developments.

- Crude consolidates, precious metals are cushioned, and base metals are hit after Chinese CPI.

- US House Republicans unveiled a stopgap funding bill to keep the government funded through September 30th.

- Looking ahead, US Employment Trends, NY Fed SCE, Chinese M2 Money Supply. Earnings: Oracle, BioNTech.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US Commerce Secretary Lutnick said President Trump will not ease up on fentanyl-related tariffs and that tariffs will come off if fentanyl ends, while he noted steel and aluminium tariffs take effect on Wednesday and they will revisit fentanyl and reciprocal trade issues on April 2nd.

- Incoming Canadian PM Carney vowed to discover new trade partners and ensure borders, while they will keep tariffs on the US until Americans show them respect. Carney said they cannot let Trump succeed and will ensure that all proceeds from tariffs will be used to protect their workers.

- Canadian Finance Minister LeBlanc said Canada is ready for an immediate review of the USMCA trade agreement and there is still room for talks on steel and aluminium tariffs.

- China’s MOFCOM said it will impose tariffs on some imports from Canada in retaliation for Canadian tariffs on Chinese goods effective March 20th in which it will impose 100% tariffs on Canadian rapeseed oil imports and 25% on port and seafood imports, while it will impose additional tariffs on some other Canadian goods.

- South Korean Acting President Choi ordered to communicate actively with the US about tariff rates and will consult with the US about cooperation in shipbuilding and energy sectors, while they are to review non-tariff measures related to US reciprocal tariffs.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.5%) opened modestly in the green, but quickly succumbed to selling pressure soon after, to display a negative picture in Europe. As it stands, indices currently reside at the bottom end of the day's ranges.

- European sectors are mixed vs initially opening with a slight positive bias; Real Estate takes the top spot, as yields move lower, whilst Tech is swept away by the risk tone.

- US equity futures (ES -1% NQ -1% RTY -0.9%) are entirely in the red, with very modest underperformance in the NQ, giving back some of Friday's upside. Pressure in the complex could stem from commentary via Commerce Secretary Lutnick who said that President Trump will not ease up on fentanyl-related tariffs and that steel and aluminium tariffs will take effect on Wednesday.

- China sold 1.41mln (prev. 1.11mln) passenger cars in February, +26.1% Y/Y, via CPCA; Tesla (TSLA) exported 3.9k China-made vehicles (prev. 30.2k Y/Y).

- Ford (F) is set to inject EUR 4.4bln into its German subsidiary, according to the FT. Ford (F) confirms FT Reports that they will provide up to EUR 4.4bln in new financing for German subsidiary.

- Novo Nordisk (NOVOB DC) says Cagrisema demonstrates superior weight loss in adults with obesity or overweight and type 2 diabetes in the Redefine 2 trial; People treated with Cagrisema achieved a superior weight loss of 15.7% after 68 weeks. Shares dip -5% on this news.

- Analysts at HSBC downgrade US equities to Neutral.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY has been choppy thus far, initially topping the 104.00 mark as risk sentiment waned, but is now a little lower thus far; currently trading within a 103.55-104.03 range. The Fed is now in blackout, so focus this week will be on trade developments. Most recently, US President Trump said on Friday regarding Canada that he may do reciprocal tariffs as early as Friday or Monday, while he added the EU has been a terrible abuser on tariffs and India has agreed to cut tariffs way down. Focus ahead will be on US NY Fed SCE.

- EUR price action has been at the whim of a choppy Dollar; currently firmer and trading around 1.0870, in a 1.0806-1.0874 range. As mentioned above, commentary from President Trump who said the EU has been a terrible abuser on tariffs, will garner some attention. On the domestic front, Germany’s CDU/CSU and SPD said they have completed preliminary talks on forming a coalition government. The EU Sentix Index printed above expectations, but had limited impact on the Single-Currency. ECB's Nagel is set to speak this afternoon.

- JPY is one of the better performing G10 currencies today, largely a factor of narrowing yield differentials and as risk sentiment continues to deteriorate in European trade. Overnight, USD/JPY was relatively choppy given the uncertain risk sentiment in Tokyo in APAC trade. USD/JPY currently trading at the bottom end of the day's ranges (146.98-147.96), dipping below 147.00, with Friday's 146.93 thereafter.

- GBP is softer vs. the USD and at the bottom of the G10 leaderboard after a solid showing for Cable last week which saw the pair rally from a 1.2577 opening level last Monday to a YTD peak at 1.2944. UK-specific newsflow has been light and does not pick-up until Friday.

- Antipodeans are firmer today, with modest outperformance in the Kiwi but with upside capped amid downbeat sentiment and with Chinese inflation over the weekend printing below expectations.

- The NOK is stronger today, after the region printed hotter-than-expected inflation data; EUR/NOK fell from 11.7463 to 11.7150 before then paring around half of the move. Following the data, Nordea bank wrote that "Norges Bank need to think twice about cutting rates at all this year. The March cut is definitely off."

- PBoC set USD/CNY mid-point at 7.1733 vs exp. 7.2355 (Prev. 7.1705).

- Former Central Banker Mark Carney won the Liberal Party race to become the next Canadian PM, according to official results cited by Reuters.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs picked up at the reopening of trade, given the pressure in US equity futures and as the benchmark acknowledged the soft Chinese inflation data on the weekend. The risk-off tone has intensified further with USTs outperforming and at a 111-03 peak, resistance at 111-11+ and 111-15 from last week. Market focus is firmly on tariffs/trade with new measures set to come into play on metals on Wednesday and the prospect of reciprocal tariffs being implemented imminently. Furthermore, President Trump’s sights seem to have turned back to the EU, with him labelling the bloc as a terrible abuser. Finally, focus is also on fiscal matters as the Friday deadline to pass a funding bill to avoid a federal shutdown fast approaches. The House Republicans released their CR on the weekend and following this Punchbowl writes that it does not feel as if a shutdown will occur.

- Bunds opened lower following German political updates; reports indicate that coalition talks for the new Bundestag are progressing well. Elsewhere, for the bloc more broadly, EU Commission President von der Leyen said that “nothing” is off the table for security, including defence eurobonds. All of the above weighed on Bunds to a 127.21 low overnight, just above Friday’s 127.18 base and the contract low from last week at 126.64 below. However, fixed benchmarks generally have been lifting off worst through the European morning as the risk tone deteriorates. On incoming Chancellor Merz's spending plans, recent reporting via Handelsblatt has suggested that the approval of financial package becomes less likely every day, citing a Green party inside. Furthermore, Germany's AfD has filed an urgent appeal with the Constitutional Court against the session of the outgoing Bundestag on Thursday.

- Gilts are trading in tandem with the above as the risk tone soured throughout the European morning. Gapped higher by 22 ticks at the open and has since risen almost the same amount again to a 92.49 peak. A high which surpasses the 92.41 top from last Wednesday but has stopped just shy of Friday’s 92.63 best.

- Click for a detailed summary

COMMODITIES

- Crude is incrementally firmer, in what has been a choppy but fairly lacklustre European morning for the complex thus far, but also in a continuation of the price action seen overnight. In early European trade, oil prices picked up a touch, but gains were soon capped as sentiment waned in Europe. Brent'May sits in a USD 69.84-70.57/bbl range. On the geopolitical front, new Russia/US talks are reportedly not scheduled for this week, according to TASS. And in the Middle East, Al Jazeera reported that Smotrich said that "in light of the lack of progress in negotiations, we will return to fighting in Gaza".

- Spot gold is a little firmer, with a slight bounce in recent trade as the Dollar comes off best levels. Currently trading in a USD 2,896.83-2,918.32/oz range.

- Base metals are mostly lower, given the weak Chinese inflation data and flimsy risk tone. 3M LME Copper currently trading in USD 9,510.35-9,640.6/t range vs the prior close at USD 9,584.63.

- Iraq set the April Basrah medium crude official selling price to Asia at plus USD 2.15/bbl vs Oman/Dubai and the OSP to Europe at minus USD 1.50/bbl vs Dated Brent, while it set the OSP to North and South America at minus USD 0.65/bbl vs ASCI, according to SOMO.

- US is in exploratory talks with Congo about a potential minerals deal, according to FT.

- Click for a detailed summary

NOTABLE DATA RECAP

- German Imports MM SA (Jan) 1.2% vs. Exp. 0.8% (Prev. 2.1%); Trade Balance, EUR, SA (Jan) 16.0B vs. Exp. 20.6B (Prev. 20.7B); Exports MM SA (Jan) -2.5% vs. Exp. 0.5% (Prev. 2.9%); Industrial Output MM (Jan) 2.0% vs. Exp. 1.5% (Prev. -2.4%)

- Norwegian Core Inflation YY (Feb) 3.4% vs. Exp. 2.9% (Prev. 2.8%); Producer Price Index YY (Feb) 23.3% (Prev. 18.1%); Core Inflation MM (Feb) 1.0% (Prev. 0.1%); Consumer Price Index MM (Feb) 1.4% (Prev. 0.2%)

- EU Sentix Index (Mar) -2.9 vs. Exp. -8.4 (Prev. -12.7)

NOTABLE EUROPEAN HEADLINES

- Germany's Green party insider says approval of financial package becomes less likely every day, according to Handelsblatt. "Willingness to help the black-red debt package for defence and infrastructure to gain a two-thirds majority in the Bundestag is apparently declining."

- Leaders of Germany’s CDU/CSU and SPD said they have completed preliminary talks on forming a coalition government.

- Germany's AfD has filed an urgent appeal with the Constitutional Court against the session of the outgoing Bundestag on Thursday, via Reuters citing a court spokesperson.

- S&P affirmed Norway at 'AAA'; Outlook Stable.

- ECB's Kazimir says inflation risks remain tilted to the upside; must remain open minded on whether we cut rates or pause. Geopolitical and trade tensions add another layer of unpredictability. Looking for undeniable confirmation that disinflation will stay; tariffs historically slow growth and boost inflation.

- Germany's VDMA says Jan orders -2% Y/Y (domestic -6%, foreign unchanged); Nov-Jan orders -2% Y/Y (domestic 10%, foreign +1%).

NOTABLE US HEADLINES

- Punchbowl writes, ahead of the Friday deadline for a funding bill to pass to avoid a US shutdown, "It doesn’t feel like a shutdown is going to happen, although there’s still a chance because, well, this is Congress."

- Fed’s Daly (2027 voter) suggested that economic research shows uncertainty is a source of demand restraint and noted there are plenty of signs that the economy is solid but the market is giving mixed signals which is the reason monetary policy should be careful and deliberate, while she added that the Fed has rates in a good place.

- US President Trump said he will pick the Federal Reserve Vice Chairman for Bank Supervision fairly soon It was also reported that Trump declined to predict whether the US could face a recession amid stock market concerns about his tariff actions on Mexico, Canada and China over fentanyl, while he said tariffs on Mexico and Canada could go up, according to Reuters citing an interview with Fox News.

- US House Republicans unveiled a stopgap funding bill that would keep the government funded through September 30th. It was later reported that President Trump said the House and Senate have put together a very good funding bill and he urges Republicans to vote for it in the week ahead.

- Jefferies Analyst Simon has trimmed his US GDP forecast from 2.9% to 2.4%; still expects 3 fed cuts in 2025.

GEOPOLITICS

MIDDLE EAST

- Hamas says it dealt with mediator efforts with flexibility, now awaiting the result of talks with Israel. Talks focussed on ending the war, Israel's withdrawal from Gaza and reconstruction.

- "Israel Broadcasting Corporation on Smotrich: In light of the lack of progress in negotiations, we will return to fighting in Gaza and the new chief of staff has a more effective combat plan than his predecessor", according to Al Jazeera

- Israel’s Energy Minister ordered the stoppage of electricity transmission to Gaza, according to Israeli broadcaster Kan.

- Hamas said there are positive indicators over negotiations for the second phase of the Gaza ceasefire deal, while it noted its delegation met Egypt’s spy chief in Cairo to discuss the Gaza ceasefire and it urged commitment to all the Gaza ceasefire deal’s articles and the immediate start of talks for the second phase. It was separately reported that a Hamas official said the group is open to releasing American-Israeli hostage Edan Alexander as part of talks to end the Gaza war, according to Al-Aqsa TV.

- US hostage envoy Boehler said meetings with Hamas leaders in recent days were very helpful and that something could come together within weeks on Gaza and hostages, while he thinks all prisoners could get out not just Americans.

- France, Germany, Italy and Britain said they welcome the Arab plan for Gaza reconstruction which they said shows a realistic path to reconstruction of Gaza and are committed to working with the Arab initiative.

- US State Department has not renewed a waiver for Iraq to buy Iranian electricity and noted the decision ensures the US does not allow Iran any degree of economic relief. It was separately reported that the Iraqi PM’s Foreign Affairs advisor Alaaldin said non-renewal of US sanctions waiver for Iraq to purchase Iranian energy presents temporary operational challenges, while Iraq is committed to its strategic goal of achieving energy self-sufficiency.

- Iran Supreme Leader Khamenei said Tehran will not negotiate under pressure from a bullying country and will never accept demands to curb its missile program. It was separately reported that the White House reiterated that Iran's nuclear concern can be dealt with by making a deal or militarily, while it hopes the Iranian regime puts its people and best interests ahead of terror.

- Iran’s mission to the UN said talks on the potential militarisation of Iran’s nuclear program may be considered and Iran will not discuss the dismantlement of its nuclear program.

- Joint naval drills between Iran, Russia and China will begin on Monday in the Chabahar region of Iran.

- US and Russia ask UN Security Council to meet on Monday regarding escalating Syria violence It was separately reported that UN rights chief Volcker Turk said the killing of civilians in coastal areas in northwest Syria must cease immediately.

- UK Foreign Secretary Lammy said reports that a large number of civilians have been killed in coastal areas in Syria in ongoing violence are horrific and authorities in Damascus must ensure the protection of all Syrians and set out a clear path to justice.

- Syrian leader Sharaa said Syria is confronting attempts to drag it into a civil war and that remnants of the former regime have no choice but to surrender immediately, while he added that Syria will not allow any external or local forces to drag it into chaos or civil war.

RUSSIA-UKRAINE

- New Russia/US talks are reportedly not scheduled for this week, according to TASS.

- US President Trump said Ukraine will sign the minerals deal but needs to show more willingness for peace, while Trump also stated they are looking at a lot of things with respect to tariffs on Russia and will make a lot of progress this week, while he is expecting good results coming out of Saudi on Ukraine and stated they have just about lifted the intelligence pause on Ukraine.

- Russian Defence Ministry said it has taken one village in Russia’s Kursk region and another in Ukraine’s Sumy region, while Russia also said it has taken the village of Kostyantynopil in eastern Ukraine’s Donetsk region. Furthermore, it was later reported that Russian forces recaptured three more settlements in the Kursk region.

OTHER

- North Korea's Foreign Ministry said US and South Korean military exercises are a dangerous provocative act, according to KCNA. It was separately reported that North Korea unveiled a nuclear-powered submarine under construction for the first time which appears capable of carrying 10 missiles, according to Nikkei.

CRYPTO

- Bitcoin is on the backfoot and trades around USD 82k whilst Ethereum moves towards the USD 2k mark.

APAC TRADE

- APAC stocks began the week mixed amid tariff-related concerns and as participants digested the softer-than-expected Chinese inflation data from over the weekend.

- ASX 200 eked mild gains with outperformance seen in energy, resources and materials but with the upside capped by weakness in defensives and the economic concerns related to Australia's largest trading partner.

- Nikkei 225 gradually shrugged off the initial indecisiveness and clawed back early losses to reclaim the 37,000 status as participants digested data releases including the slower-than-forecast growth in Labour Cash Earnings.

- Hang Seng and Shanghai Comp retreated amid deflationary headwinds after CPI data slipped into negative territory for the first time in over a year, while tariff concerns lingered as China's retaliatory tariffs against the US's March 4th additional tariffs took effect today.

NOTABLE ASIA-PAC HEADLINES

- Deputy to China's National People's Congress (NPC) says China's "around 5%" GDP target for 2025 is certainly challenging and by no means an easy feat, via Global Times. Tian said one of China's biggest challenges is insufficient domestic demand but believes the government's plans, such as increasing the budget deficit to support higher government spending, issuing ultra-long special treasury bonds, and improving investment efficiency will help address the issues.

- China’s Housing Minister said market confidence has been enhanced and the property market shows positive changes, while they will step up lending for ‘White list’ property projects and promote the purchase of existing housing stocks. China will give more autonomy to local governments in purchasing housing stocks for affordable housing and part of China’s local government special bonds will be used for purchasing land and housing stocks.

- China’s Human Resources Minister said they face an arduous task to stabilise and expand employment in 2025 and the external environment for employment could become more complex and severe but added that the employment situation is generally stable. Furthermore, China will step up resources and funding to support employment and will prepare to roll out new policies to support employment.

- South Korean prosecutors decided not to appeal President Yoon’s release.

- Acer (2353 TW) Feb Revenue TWD 17.07bln.

- Key Japanese government panel members called for vigilance to risks of rising inflation hurting the economy.