Moments ago the Treasury completed the first of Monday's two coupon auctions (the scheduled is truncated due to this week's economic data barrage), and it was a solid sale of 2Y paper.

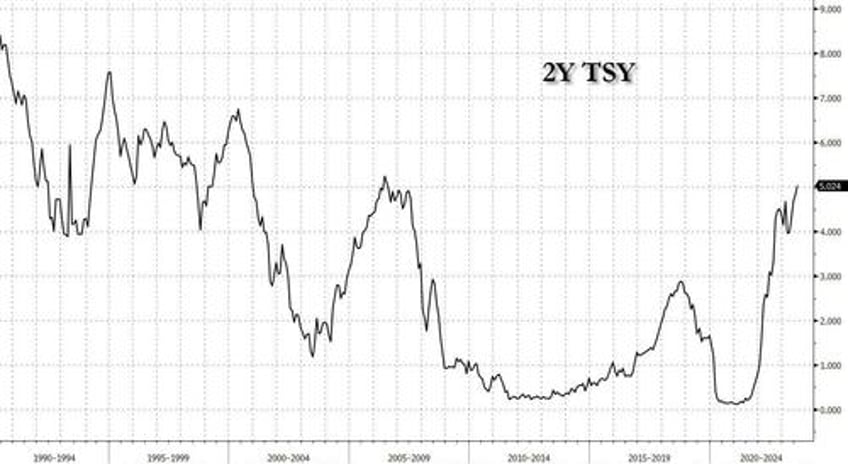

The sale of $45 billion in 2Y paper stopped at a high yield of 5.024%, the first auction pricing north of 5% since July 2006. The yield, which was just over 20bps compared to last month's 4.823%, stopped through the 5.028% When Issued, the 3rd stop through in the past 4 auctions.

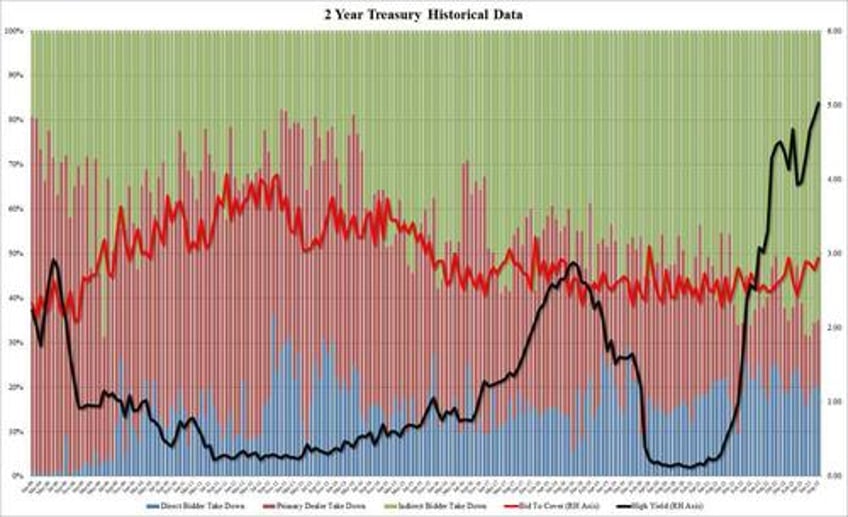

The bid to cover was an impressive 2.943, the highest since April 2020 excluding January's 2.944, and well above the recent average 2.71.

The internals were also solid, with Indirects taking down 65.01%, down from 65.45%, but also above the six-auction average of 63.03%. And with Directs awarded 20.0%, Dealers took down 14.98%, the highest since May.

Overall, this was a strong, if hardly stellar 2Y auction, and one which boosted bond market sentiment helping 10Y yields slide below 4.21% and approaching session lows of 4.20%.