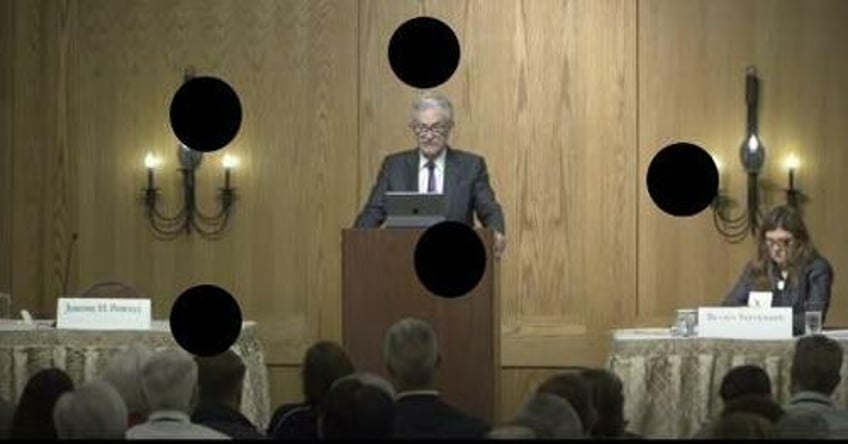

Federal Reserve Chairman Jerome Powell delivered his annual speech at Jackson Hole on Friday. Peter Schiff broke the speech down in his podcast and said the speech itself was full of holes.

It wasn’t so much what he said, but what he left out.

Very early in the speech, stocks started to sell off, along with gold as the dollar rose when Powell said the Fed still has a very long way to go to get price inflation back to 2%. Peter called that one of the biggest understatements of the year — maybe of the century.

It’s not that they have a long way to go. They have an impossible distance to travel. In fact, the route is so far between where we are and where the Fed thinks it’s going to get that it’s basically a mission impossible. There’s no way that the Fed is going to complete this journey.”

LLE1Y06id1M

Powell made some other hawkish statements, reiterating that the central bank is going to remain resolute in the inflation fight. He also emphasized that 2% is the target and that the Fed won’t move the goalposts and accept a higher rate.

While the markets initially sold off on the speech, they recovered later in the day.

The markets just totally shrugged it off, which is what the market has been doing. Yes, we’ve had a decent correction off the highs, but the market has basically held up very well in relation to the carnage in the bond market.”

Peter said he expects the bond market carnage to continue and Powell’s Jackson Hole speech reinforces the momentum to the downside that we’re seeing in bonds.

Peter said the most interesting part of the speech wasn’t what Powell said, but what he left out.

The whole point of raising interest rates is to slow down aggregate demand. Raising rates makes borrowing more expensive and theoretically slows down consumption. But Powell never addresses the elephant in the living room — aggregate demand isn’t going down.

It doesn’t matter that the Fed has raised interest rates. It’s done nothing. And one of the main reasons it’s done nothing is because at the same time the Fed is pursuing a higher monetary policy of quantitative tightening and interest rate hikes, the US federal government is pursuing the opposite policy. The US government is now running one of the most expansive, stimulative fiscal policies in our nation’s history.”

Peter noted the massive budget deficits. With two months left to go, the deficit for fiscal 2023 already stood at $1.61 trillion. Based on the deficit, you would think the US economy is in the midst of a deep recession. In fact, the 2023 deficit will be higher than any deficit the Obama administration ran during the Great Recession.

Meanwhile, the Atlanta Fed recently upped its Q3 GDP estimate to 5.9%.

According to the Federal Reserve, the economy is booming and Powell is talking about how they’re reducing aggregate demand with their rate hikes. They haven’t reduced anything. But the point I’m making is we’ve got this growing economy, yet despite this growing economy we are running budget deficits that are close to $2 trillion per year. Now, if we’re running deficits of $2 trillion a year when the economy is good — when it’s growing, supposedly, what’s going to happen during the next recession?”

The bottom line is we already have a massive stimulative fiscal policy that is working at cross-purposes with the Fed.

How can the Fed not mention this? How can the Fed not say, ‘Look, we’ve got a problem here. We’re trying to fight inflation but the government is undermining our efforts. We’re trying to reduce aggregate demand by raising rates, and the reason it hasn’t worked, one of the reasons, is because the government is doing the opposite. The government is undermining everything we’re trying to achieve with its stimulative fiscal policy.'”

In just 72 days, the Biden administration added over $700 billion to the national debt.

A few years ago, that was more red ink than we built up in an entire year. … The budget deficits are going up. We’re stimulating more and more. That is going to undermine everything the Fed has done, and nothing that the Fed has done is going to work in the face of this fiscal policy that is so stimulative.”

The Fed is also fighting against the lag effect of more than a decade of easy money.

All the money that the Fed has been creating through QE1, QE2, QE3, QE4, those effects are still being pushed out in the economy. Yes, the Fed is backing off now, but that’s not going to do anything about all the inflation that’s still in the pipeline and what the government is doing now that is ultimately going to cause the Fed to reverse course.”

Peter raises the key question.

How is it that Powell can give this speech with all the world looking at him talking about inflation and ignoring this problem? What Powell should be doing is warning about these big deficits and saying, ‘Congress needs to help out here. I can’t do this all by myself.'”

Last year, Fed economists even admitted the central bank can’t rein in price inflation with monetary policy alone. But Peter said Powell is too big of a wimp to call out the Biden administration.

You can’t ignore fiscal policy when you’re running monetary policy. You can’t say, ‘Hey, there’s a separation here and I don’t want to interfere with what Congress is doing.’ No! He’s got to interfere. In fact, he’s paid to interfere. The idea that there is an independent Fed — it’s supposed to be independent from Congress, not the other way around. It’s not that the Fed is not supposed to point out when Congress is doing something wrong or the president. No, that is the job of the Fed chairman. If Congress is running these big deficits, and it’s creating a problem for inflation, if it’s creating a problem for the Fed and the public, the Fed chairman is supposed to call them out. The Fed chairman is supposed to say, ‘Hey, you’ve got to cut spending. You’ve got to bring down these deficits.”

Peter goes on to parse out some of the economic data, revealing the failure of the Fed’s inflation fight.