In a recent discussion on TheRealInvestmentShow, Bob Farrell and his 10 investment rules were discussed, which elicited several email questions asking, “Who is Bob Farrell, and where are these rules?”. I often forget how old I have become, and the investing legends of my youth are no longer there and are lost to the sands of time. While I have written several articles discussing the investing legend’s famous rules, which have served us well. the last time I had a deep discussion of Bob’s rules was in 2016; much has happened since then. From tax cuts and tariffs to trade wars, or the Fed cutting rates and instituting a massive QE program following COVID-19, to rate hikes to combat inflation. The question worth exploring is whether Bob’s rules still hold today. That is the subject of this week’s discussion.

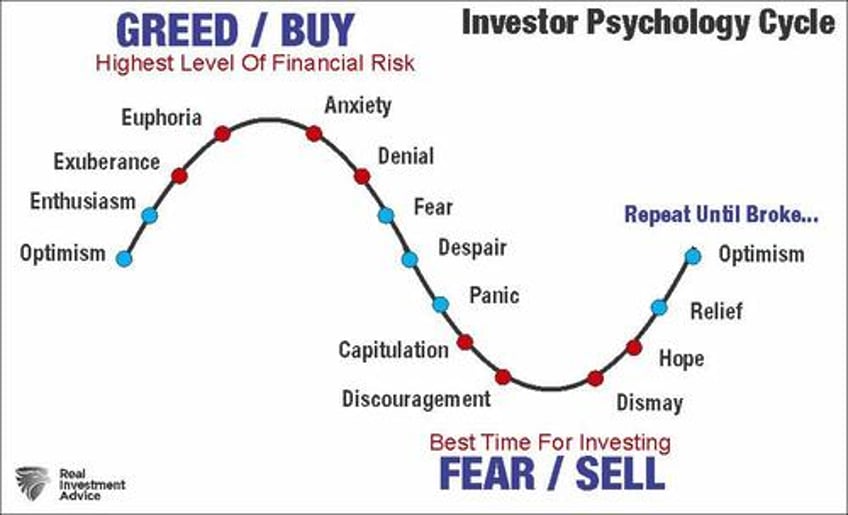

Why are Bob’s rules so important? The answer is simple: The downfall of all investors is ultimately “greed” and “fear.” Investors repeatedly fail to sell when markets are near peaks, nor do they buy market bottoms. However, this does not just apply to individuals but also to many advisors, which is why many promote “buy and hold” investment strategies because they either can’t, don’t want to, or don’t know how to manage portfolio risk.

While buy-and-hold strategies work well during trending bull markets, they can be devasting during larger corrections and bear markets. This is why Bob Farrell’s rules are so important for navigating markets over the long term. Such is particularly the case today, with expectations elevated, valuations high, and sentiment extremely bullish.

Who is Bob Farrell?

Bob was a Wall Street veteran with over 50 years of experience crafting his investing rules. Farrell obtained his master’s degree from Columbia Business School and started as a technical analyst at Merrill Lynch in 1957. Even though Farrell studied fundamental analysis under Graham and Dodd, he turned to technical analysis after realizing there was more to stock prices than balance sheets and income statements. Farrell became a pioneer in sentiment studies and market psychology. His ten rules on investing stem from personal experience with dull markets, bull markets, bear markets, crashes, and bubbles. In short, Farrell saw it all and lived to tell about it.

With that said, let’s dive into Bob Farrell’s famous rules.

1) Markets tend to return to the mean (average price) over time.

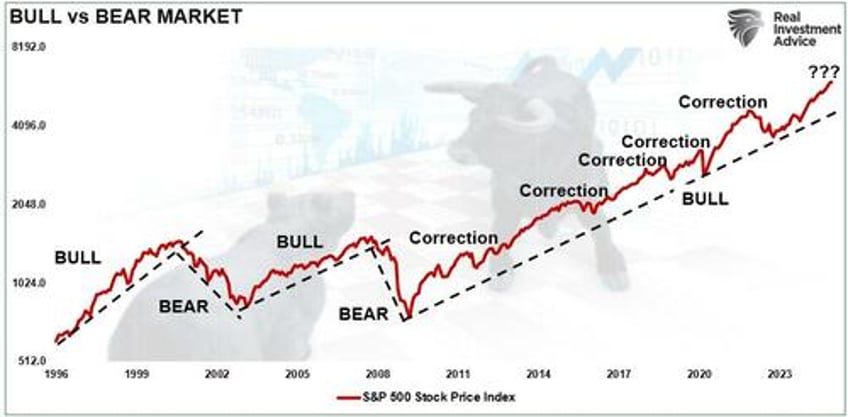

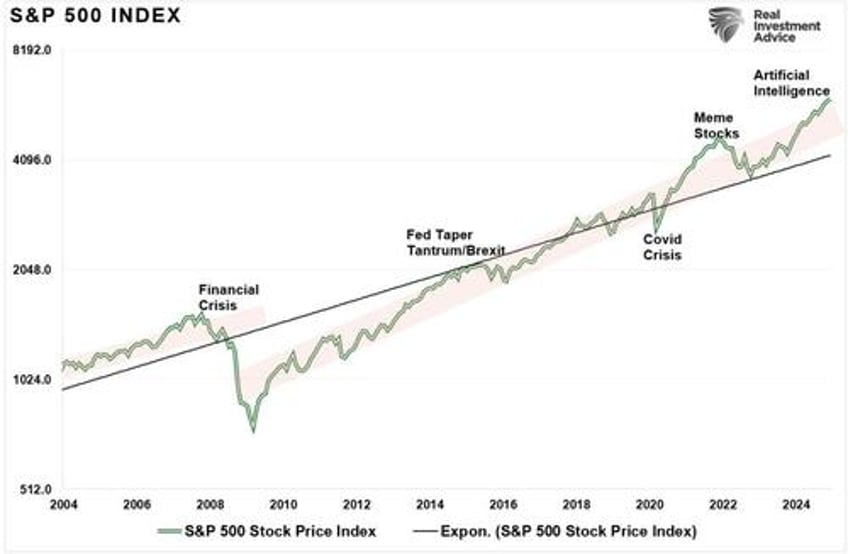

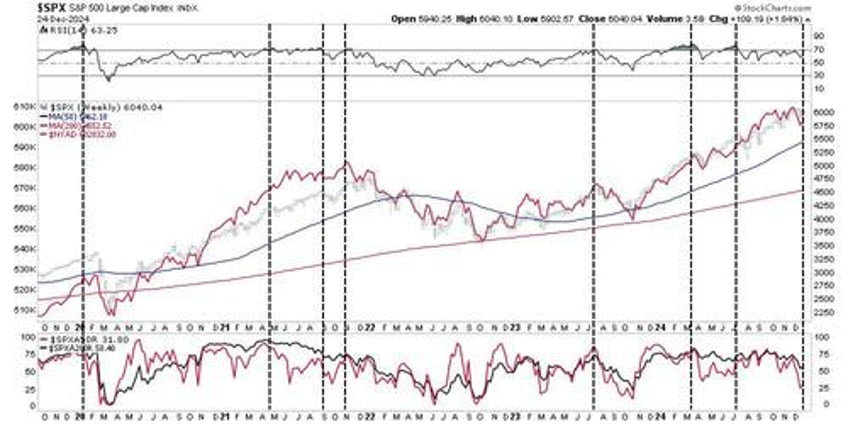

Like a rubber band stretched too far – it must be relaxed to be stretched again. The same is true for stock prices anchored to their moving averages. Trends that get overextended in one direction or another always return to their long-term average. Even during a strong uptrend or downtrend, prices often return (revert) to a long-term moving average or trend. The chart below shows the S&P 500 versus its bullish and bearish trends. Even during strongly trending bull markets, markets revert regularly to their underlying trend. The difference between a BULL market and a BEAR market is when the previous existing trend is reversed.

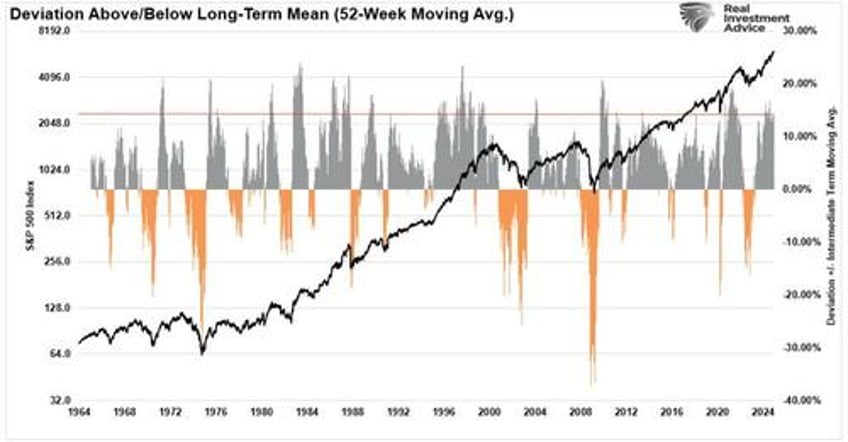

The next chart shows the percentage deviation of the market’s current price from the 52-week moving average. During bullish trending markets, there are regular reversions to the mean, which create buying opportunities. However, what is often not stated is that investors should have taken profits from portfolios as deviations from the mean reached historic extremes. Conversely, in bearish trending markets, such reversions from extreme deviations should be used to sell stocks, raise cash, and reduce portfolio risk rather than “panic sell” at market bottoms. The current deviation of the long-term mean is at levels that suggest investors may be best served in becoming more risk-averse in portfolio allocations.

2) Excesses in one direction will lead to an opposite excess in the other direction.

Markets that overshoot on the upside will also overshoot on the downside, like a pendulum. The further it swings to one side, the further it rebounds to the other side. Such is the extension of Rule #1 as it applies to longer-term market cycles (cyclical markets).

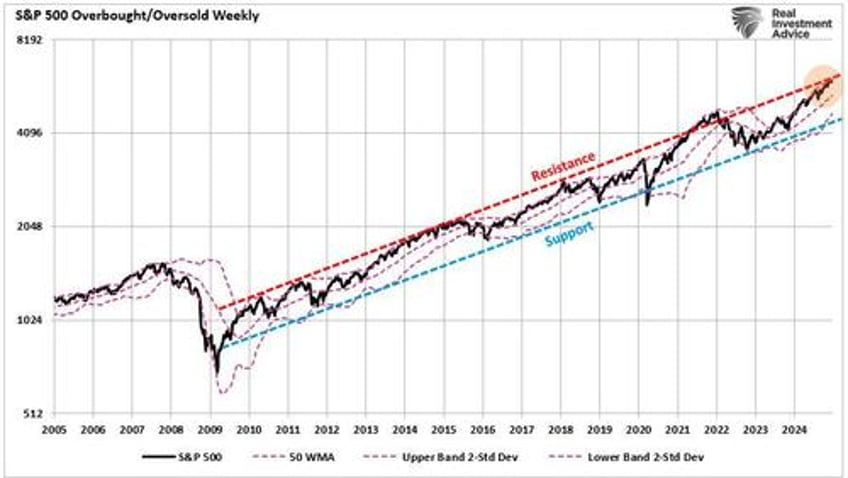

While the chart above shows how prices behave on a short-term basis, longer-term markets also respond to Newton’s 3rd law of motion: “For every action, there is an equal and opposite reaction.” The first chart below shows that cyclical markets reach extremes when they are more than two standard deviations above or below the 50-week moving average. Notice that these excesses ARE NEVER worked off by just going sideways.

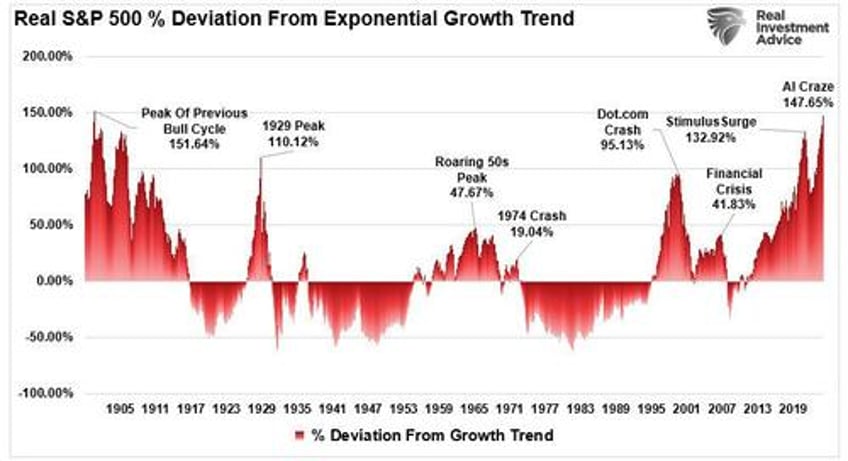

The second chart shows the S&P 500’s price deviations from its long-term exponential growth trend adjusted for inflation. Notice that when prices have historically reached extremes, the price reversion is just as extreme. It should be somewhat logical that the current deviation from the long-term mean will eventually revert.

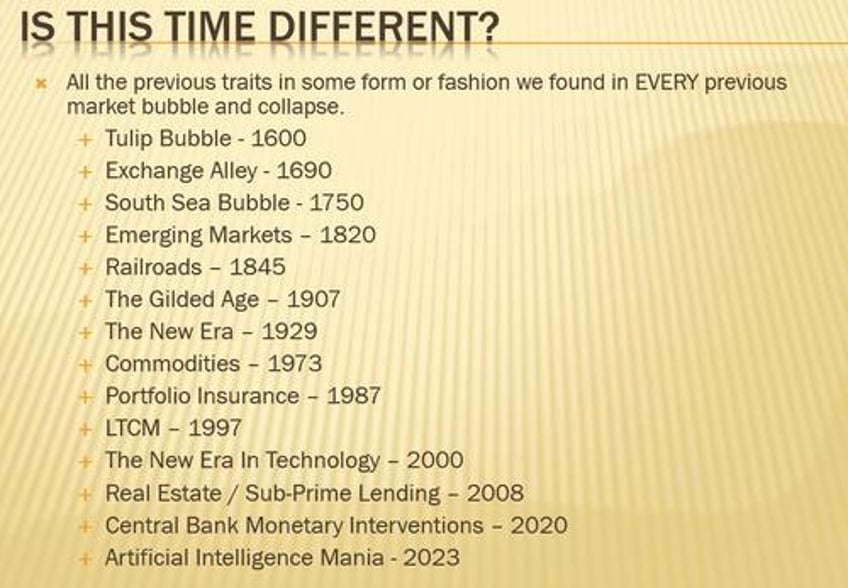

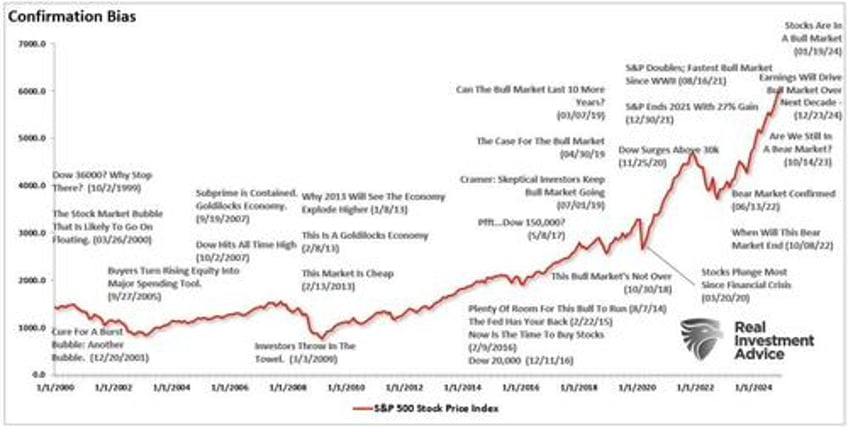

3) There are no new eras – excesses are never permanent.

There will always be some “new thing” that elicits speculative interest. These “new things” throughout history, like the “Siren’s Song,” has led many investors to their demise. In fact, over the last 500 years, we have seen speculative bubbles involving everything from Tulip Bulbs to Railways, Real Estate to Technology, Emerging Markets (5 times) to Automobiles and Commodities. It always starts the same and ends with the utterings of “This time it is different.”

[The chart below is from my March 2008 seminar discussing that the next recessionary bear market was about to occur. I have updated it for the current events.]

As legendary investor Jesse Livermore once stated:

“A lesson I learned early is that there is nothing new on Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

4) Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways

Excesses, such as what we see in the market now, can go much further than logic dictates. However, as stated above, these excesses are never worked off simply by trading sideways. Corrections are always just as brutal as the advances were exhilarating. The chart below shows when the markets broke out of their directional trends—the corrections came soon after that.

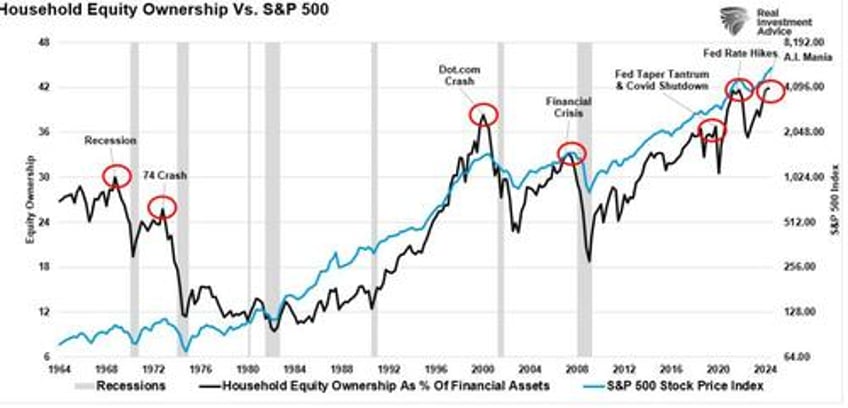

5) The public buys the most at the top and the least at the bottom.

The average individual investor is bullish at market tops and bearish at market bottoms. Such is due to investors’ emotional biases of “greed” when markets are rising and “fear” when markets fall. Logic would dictate that the best time to invest is after a massive sell-off; unfortunately, this is the opposite of what investors do.

6) Fear and greed are stronger than long-term resolve.

As stated in Rule #5, emotions cloud your decisions and affect your long-term plan.

“Gains make us exuberant; they enhance well-being and promote optimism,” says Santa Clara University finance professor Meir Statman. His studies of investor behavior show that “Losses bring sadness, disgust, fear, regret. Fear increases the sense of risk and some react by shunning stocks.”

The bullish sentiment index shows that “greed” is again beginning to reach levels where markets have generally reached intermediate-term peaks.

In the words of Warren Buffett:

“Buy when people are fearful and sell when they are greedy.”

Currently, those “people” are getting extremely greedy.

7) Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.

Breadth is important. A rally on narrow breadth indicates limited participation, and the chances of failure are above average. The market cannot continue to rally with just a few large-caps (generals) leading the way. Small and mid-caps (troops) must also be on board to give the rally credibility. A rally that “lifts all boats” indicates far-reaching strength and increases the chances of further gains.

The chart above shows the NYSE Advance-Decline Line and the number of S&P 500 companies trading above their 50—and 200-day moving averages. When the market is overbought, and the breadth deteriorates, this usually precedes a short-term correction or period of consolidation. While such does not necessarily mean a more significant market crash is imminent, there is no way to distinguish between consolidations and corrections until after.

8) Bear markets have three stages – sharp down, reflexive rebound, and a drawn-out fundamental downtrend

Bear markets often start with a sharp and swift decline. After this decline, an oversold bounce retraces a portion of that decline. The longer-term decline continues at a slower and more grinding pace as the fundamentals deteriorate. Dow Theory suggests that bear markets have three phases with two down legs and a reflexive rebound.

The chart above shows the stages of the last two primary cyclical bear markets. There were plenty of opportunities to sell into counter-trend rallies during the decline and reduce risk exposure. Unfortunately, the media and Wall Street told investors to “hold on” until they finally sold out at the bottom.

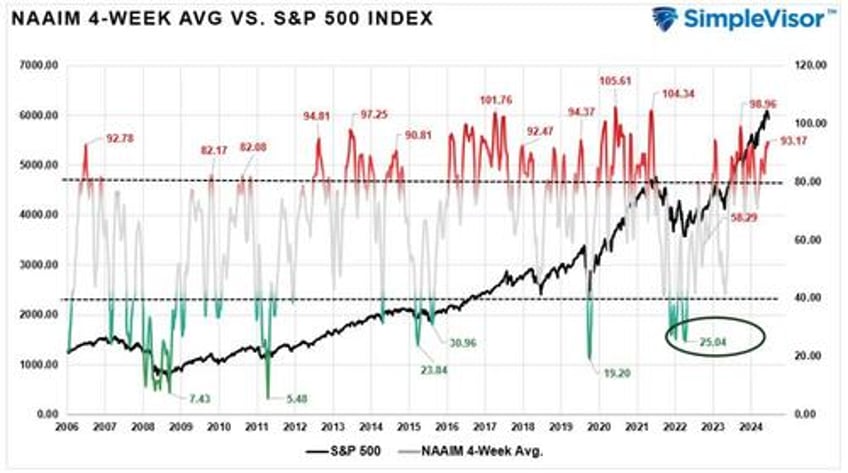

9) When all the experts and forecasts agree, something else will happen.

This rule fits within Bob Farrell’s contrarian nature. As Sam Stovall, the investment strategist for Standard & Poor’s, once stated:

“If everybody’s optimistic, who is left to buy? If everybody’s pessimistic, who’s left to sell?”

As a contrarian investor, along with several of the points already made within Farrell’s rule set, excesses are built by everyone on the same side of the trade. Ultimately, when the shift in sentiment occurs – the reversion is exacerbated by the stampede going in the opposite direction.

Being a contrarian can be quite difficult at times as bullishness abounds. However, it is also the secret to limiting losses and achieving long-term investment success. As Howard Marks once stated:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, since momentum invariably makes pro-cyclical actions look correct for a while. (That’s why it’s essential to remember that ‘being too far ahead of your time is indistinguishable from being wrong.’)

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

10) Bull markets are more fun than bear markets

As stated above in Rule #5 – investors are primarily driven by emotions. As the overall markets rise, up to 90% of any individual stock’s price movement is dictated by the market’s general direction. Such is the derivation of the saying, “a rising tide lifts all boats.”

Psychologically, as the markets rise, investors begin to believe they are “smart” because their portfolios increase. In reality, their portfolios are primarily driven by “luck” rather than “intelligence.”

Investors behave much the same way as individuals who are addicted to gambling. When they win, they believe their success is based on their skill. However, when they begin to lose, they keep gambling, thinking the next “hand” will be the one that gets them back on track. Eventually – they leave the table broke.

Bull markets are indeed more fun than bear markets. They elicit euphoria and feelings of psychological superiority. However, bear markets bring fear, panic, and depression.

What is interesting is that no matter how many times we continually repeat these “cycles” – as emotional human beings, we constantly “hope” that somehow this “time will be different.” Unfortunately, it never is, and this time, it won’t be either. The only questions are: when will the next bear market begin, and will you be prepared for it?

Conclusions

Like all rules on Wall Street, Bob Farrell’s rules are not meant to have hard and fast rules. There are always exceptions to every rule, and while history never repeats precisely, it often “rhymes” very closely.

Nevertheless, these rules will benefit investors by helping them to look beyond the emotions and the headlines. Awareness of sentiment can prevent selling near the bottom and buying near the top, which often goes against our instincts.

Regardless of how often I discuss these issues, quote successful investors, or warn of the dangers – the response from individuals and investment professionals is always the same.

“I am a long term, fundamental value, investor. So these rules don’t really apply to me.”

No, you’re not. Yes, they do.

Individuals are long-term investors only as long as the markets are rising. Despite endless warnings, repeated suggestions, and outright recommendations, getting investors to sell, take profits, and manage your portfolio risks is nearly a lost cause as long as the markets are rising. Unfortunately, when the fear, desperation, or panic stages are reached, it is far too late to act, and I can only say I warned you.

* * *

For more in-depth analysis and actionable investment strategies, visit RealInvestmentAdvice.com. Stay ahead of the markets with expert insights tailored to help you achieve your financial goals.