In a week when everyone is allegedly scrambling for the "safety" of bonds with stocks crashing at the fastest rate since the covid collapse, one would think that demand for the week's first coupon auction wouldbe off the charts. One would be wrong. Moments ago the Treasury sold $58 billion in 3Y paper in a tailing, subpar auction.

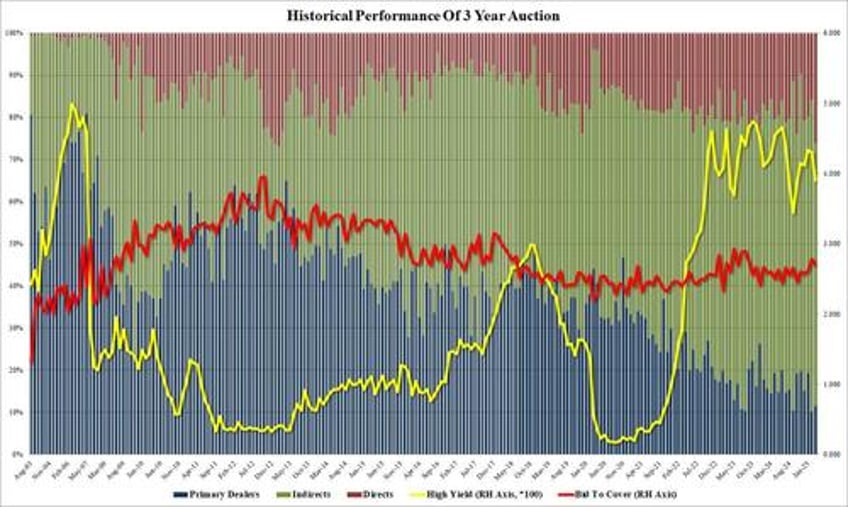

The auction priced at a high yield of 3.908% , down sharply from 4.300% in February and the lowest since October; it tailed the When Issued 3.902% by 0.6bps, the 5th tail in the past 6 auctions.

The bid to cover was 2.70, down from 2.79 but above the 2.62 recent average.

The internals were soggier with Indirects sliding from 74.0% to 62.5%, the lowest since January and below the 67.5 recent average. And with Directs awarded a whopping 26%, which was the second highest on record and only February 2013 saw higher Directs, Dealers were left holding just 11.5%, above last month's near record low 10.2% but well below the recent average of 15.7%.

Overall, this was a subpar auction and while not terrible one would expect a far stronger showing at a time when everyone is - reportedly - piling into Bills and the short-end of the curve as protection from the ongoing collapse in risk. Which then begs the question: what is everyone doing with all that excess cash they just got from nuking their deep underwater momentum stonks...