As Non-Farm Payroll hit the tape, the report initially looked strong, adding 275,000 jobs!

But that is where the “goodness” ends.

Downward revisions for the past 2 months were 167k! Making some (like me) wonder why we bother? Remember when last month seemed too strong? It was! Instead of 353k, we only got 229k (and why would we believe that next month, it won’t be revised down further?).

Then, unemployment ticked higher to 3.9%. Still a low level of unemployment, but that increase occurred while the labor participation rate stayed the same (at the somewhat low level of 62.5%). Which means, yes, you guessed it, the Household Survey showed job losses of 184k (bringing the 2-month total to over 200,000 jobs lost). Once again, on a brief glance, it looks like there were part-time jobs created, making the already weak report, even weaker.

Hourly earnings dropped (a good thing for bonds and inflation, a bad thing for workers).

The main thing I looked at earlier in the week with JOLTS was the “Quit” rate which came in at 2.1%, which was the lower than almost any point from 2016 to the end of 2019. Not impressive as it tells us that workers don’t think it is easy to find another job (and JOLTS is a month behind NFP in reporting). The “Hire” rate in JOLTS was at 3.6%, which is also at the lower end of the range in the years prior to COVID.

At best, this is a “normal” job market from historical standards. In reality, it is slightly below “normal” and heading the wrong direction (for the economy, if not monetary policy).

All of this would be less concerning if payment delinquencies on a wide variety of debt weren’t increasing (they are) and credit card debt wasn’t back above trend (it is), etc.

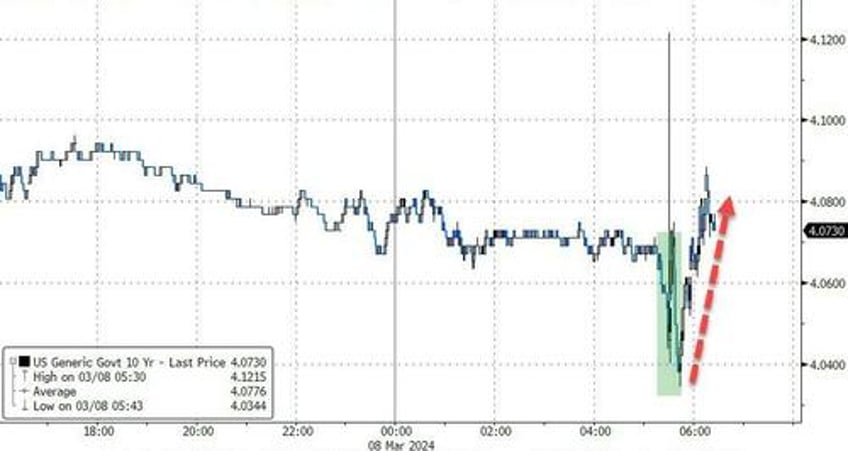

The initial reaction for bonds is lower yields. That seems reasonable, given the data, but I think after the State of the Union, as the “real” campaigning begins, we will realize that no one in D.C. cares about the deficit (how they grow it will vary, but it is going to keep growing) which will limit how much bonds can rally.

On the equity side, the initial reaction might be to rally as this data helps the Fed, but I think it is weak enough, that along with some recent earnings misses, pressure will be to the downside (I had to check 4 times to be sure, but the Nasdaq 100 closed lower on Thursday than it had last Friday – I had to check so often, because the headlines had me convinced it has been a great week, but it hasn’t).

So what initially looked like “good” news is actually mediocre, at best. How the markets treat that news remains to be seen, but I’m expecting a mediocre response, regardless of the fact that today’s data will help the Fed lean towards cuts.