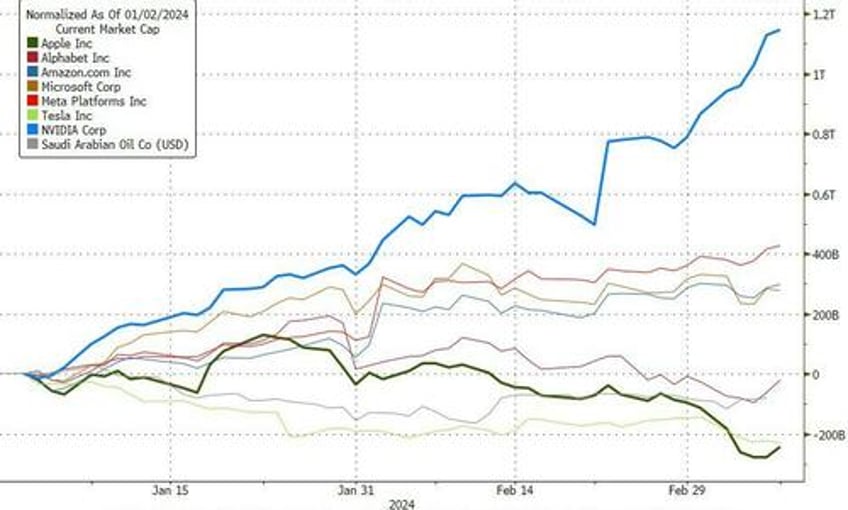

Nvidia, which controls about 80% of the high-end AI chip market, has surged over 80% since the start of the year amid exponentially-growing euphoria around AI. The literal explosion in NVDA has added a stunning $1 trillion in market cap this year alone.

NVDA is rapidly converging on AAPL's fading market cap (having overtaken Aramco this week)...

The surge in 'price' has prompted some to suggest a stock split is imminent:

“Probably in the next year or so, I expect the stock to split and that would be able to get some small retail investors into the stock where they think it’s out of reach right now,” said Ken Mahoney, president and chief executive officer of Mahoney Asset Management.

The company last announced a four-for-one stock split in May 2021, when it was trading at about $600 per share. Today, the stock is nearing the $1,000 level, extending last year’s 240% surge.

As Bloomberg reports, the reasoning Nvidia gave at the time of the 2021 split was “to make stock ownership more accessible to investors and employees,” according to a press release.

Of course, stock-splits are nothing more than a cosmetic move generally enacted to attract smaller investors.

But it seems 'smaller investors' have been anything but shy about piling into this now-giant tech stock.

The stock was on course for its 7th straight daily gain - the longest streak since November - until crypto starte to doive today and smashed the giant AI company's stock lower...

It seems the 0-DTE gamma-squeezers just abandoned ship...

But...

Remember: today (friday) is 0DTE day for single stocks (indexes are every day).

— zerohedge (@zerohedge) March 8, 2024

So any minute now we will see the 0DTE BTFD hordes

As Goldman Sachs trader, Rich Privorotsky, noted earlier, if you could attempt to bottle the current sentiment of the market toward AI in one chart it would probably look something like the one below:

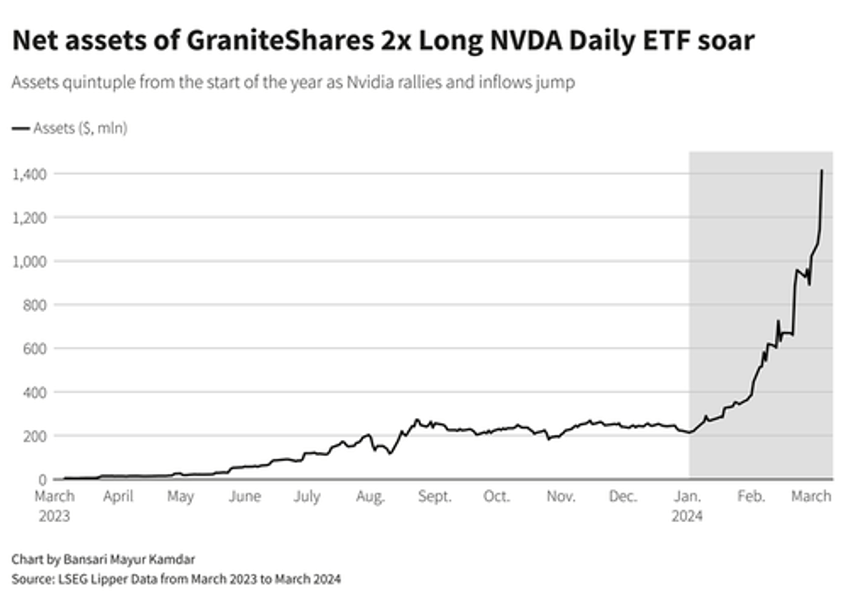

"Investors have piled into Nvidia-focused exchange-traded funds (ETFs) this year on the frenzy around AI, with inflows into a bullish fund that tracks the shares of the chip designer hitting an all-time high on Wednesday.

Net daily inflows into the GraniteShares 2x Long NVDA Daily ETF NVDL.O hit a record of $197 million, according to LSEG Lipper data.

The assets managed by the ETF have grown to $1.41 billion from $213.75 million at the start of the year." - RTRS

As Reuters reports, net monthly inflows into leveraged ETFs tracking Nvidia such as the GraniteShares 2x Long NVDA ETF, the Direxion Daily NVDA Bull 1.5X Shares ETF and the T-Rex 2X Long Nvidia Daily Target ETF hit a record in February.

The GraniteShares ETF has already crossed its net monthly flow record within the first six days of the month.

Assets of the three Nvidia-linked ETFs jumped between five and 11 times since the start of 2024, while their prices are up between 143% and 218% year-to-date, outperforming other ETFs.

"Nvidia has been the hottest stock in 2024 and many investors are eager to seek out higher returns in exchange for added risk," said Todd Rosenbluth, chief ETF strategist at VettaFi.

"We expect to see continued demand for single stock leveraged ETFs as a new wave of must-own companies emerge."

Well, of course, until the whole house of cards collapses Todd.

Which leaves us asking: if the world and their pet rabbit is literally all-in - selling VIX with leverage, selling calls, buying puts, and 2x levered inverse VIX ETNs, buying 2x-levered NVDA ETFs - who the fuck is left to buy?