By Michael Msika, Bloomberg Markets Live reporter and strategist

Soaring bond yields, a conflict in the Middle East and a tricky earnings season to navigate have cemented market strategists’ view that a year-end rally in European stocks isn’t on the cards.

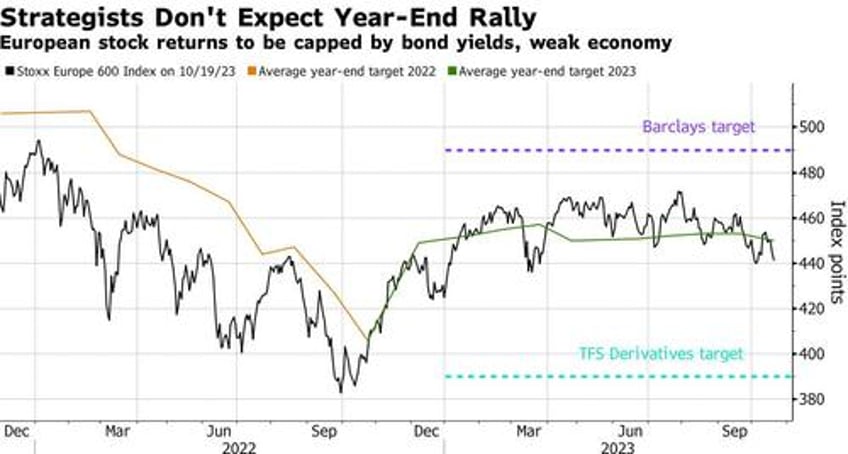

The Stoxx Europe 600 index is expected to end the year at 450 points, according to the average of 16 strategists in a Bloomberg survey — just 1% above Wednesday’s close. Britain’s FTSE 100 is forecast to end 2023 pretty much where it is now, while the Euro Stoxx 50 and Germany’s DAX are seen rising by less than 3%.

With the global economy expected to slow, and with so many moving parts in the market, the average target hasn’t changed much from predictions made a month ago. Among those surveyed, the two most bearish firms — Bank of America and TFS — raised their targets by as much as 5%, while four firms cut their forecasts by a similar magnitude.

"With the relative valuation of equities to bonds at levels not seen since the great financial crisis, and earnings momentum in negative territory, we expect European equities to remain under pressure from any further increase in bond yields,” says Societe Generale head of European equity strategy Roland Kaloyan. He reiterated his Stoxx 600 year-end target of 440 points, but expects further downside in the first half of 2024 as the economy weakens.

For many strategists, stocks will be in a holding pattern while bond yields remain high, and the earnings season just kicking off has the potential to disappoint.

“The European macro backdrop has been weakening for some time and the third quarter was no exception,” says UBS strategist Gerry Fowler. He says results may show company margins are starting to contract as the economy stalls. “More sectors are not only reporting very weak new orders but also more recently, weakening backlogs of work too. This is a sign of imminent profit warnings.”

At the same time, the recent spike in bond yields is unlikely to reverse quickly, implying valuations are now slightly expensive in Europe. “Valuations can’t bail out weaker earnings until we are closer to ECB/Fed rate cuts in the middle of 2024,” Fowler says.

This round of forecasts comes after almost three months of declines for European stocks. The market has been paring its year-to-date gain amid a steep bond selloff that sent US benchmark Treasury yields to the highest level since July 2007, causing cracks for equities. Economic data has also been a headwind, with contracting PMIs in Europe and disappointing numbers out of China.

The latest risk that strategists are considering is war in the Middle East. While it isn’t seen as a significant threat to markets by most, it is an additional risk in the event of a major escalation.

“The geopolitical risk premium is unlikely to go away quickly,” say Barclays strategists led by Emmanuel Cau. He recommended that investors look at hedges like increasing allocation to energy, and reiterated a 490 target for the Stoxx 600. That’s the highest in the survey and implies a 10% rally into year end.

On the buy-side, investors are still bearish in the near term. The Bank of America fund manager survey in October showed that 55% see downside for European equities over the next few months because of high interest rates and falling earnings in the region. Still, more than half expect some upside over the next year.

BofA strategists are also cautious on the trajectory of earnings in the region. They see nearly 15% downside for the Stoxx 600 12-month forward EPS by the third quarter of next year, with strategists led by Sebastian Raedler saying that weakening global growth momentum and fading inflation support are growing headwinds. Their 410 target for the Stoxx 600 implies about 8% downside.