By Jane Foley, Senior FX Strategist at Rabobank

In a televised address last night, President Biden laid out the case for US taxpayers to continue supporting both Israel and Ukraine. He stressed that the success of both partners was vital for the US’s national security. Referencing Putin’s war with Ukraine and the Hamas attack on Israel, he warned that when dictators and terrorists do not pay a price for their aggression and terror, that more chaos, death and destruction is created so that the costs to America and the world keep rising.

According to the US Pentagon, yesterday a US Navy warship operating in the Red Sea shot down three land-cruise missiles fired by Houthi rebels in Yemen which could “potentially” have been headed towards Israel, though there appeared to be some uncertainty about this. US bases in Iraq and in Syria were also repeatedly targeted by drone attacks. This morning, reports are indicating that there has been a rocket attack on US and coalition forces at a diplomatic support centre near Baghdad International Airport. Initial assessments indicate that one rocket was intercepted while another hit an empty storage facility. Additionally, frequent exchanges of fire have been reported along the Lebanese border with Israel between armed militants in Lebanon and the Israeli army which have prompted fears of a larger confrontation. It is widely assumed that a ground offensive by Israel into Gaza remains imminent, though there is no clear consensus as to what is planned after this operation is complete.

Fear of an escalation in the crisis has been reflected in asset prices. Oil prices again pushed higher with Brent crude moving to within a whisker of the USD93.50 level this morning. Gold prices are higher and stock markets are down across the board with futures also in the red. A little comfort was drawn from comments from Fed Chair Powell yesterday in his address to the Economic Club of New York. These promoted the view that rates are likely to remain on hold at the Fed’s next policy meeting on November 1. He highlighted that the committee “is proceeding carefully” and reinforced the data dependency of policy decisions. That said, the door to further rate hikes was not closed. The Fed Chair referenced the strength of demand in the US economy and that of the labour market, but he also spoke about the lags and lack of precision involved in monetary policy.

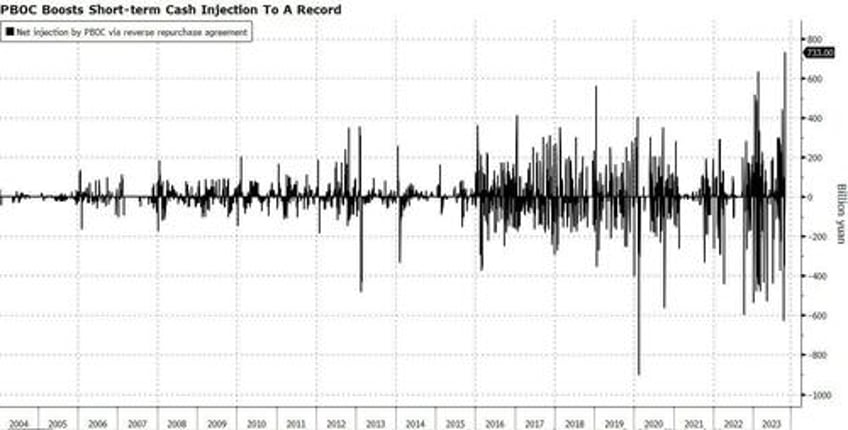

In China, the PBOC offered a record sum of cash to lenders via a short-term liquidity tool aimed at reversing an increase of funding costs. This should help to boost loans and also potentially demand for government bond issues.

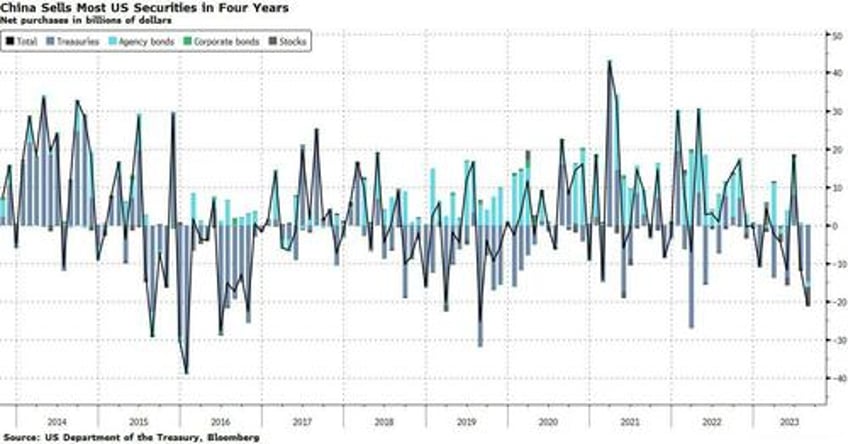

While the positive growth implications is, in theory, a positive factor for the outlook for Chinese stocks, the CSI 300 has remained on its downtrend this morning reflecting the continuation of fragile sentiment and market demands for further policy support. Bloomberg has reported that overseas investors are on track for a third straight month of selling stocks in Shanghai and Shenzen, with the CSI poised for its worst week in the year. At the same time the FT is reporting that Chinese investors dumped the most US stocks and bonds in four years in August, according to data from the US Treasury. This is likely linked with efforts by Beijing to support the value of the renminbi. USD/CNY has gained 5.73% in the year to date on the back of widening interest rate differentials.

10 year treasury yields are positioned a little below yesterday’s high this morning as the market continues to speculate about the timing of a breach of the 5% level. Some volatility was injected into the market yesterday afternoon as Chair Powell spoke. US economic data releases yesterday brought an improvement in the Philly Fed business outlook, though this was still softer than market expectations. That said, the index is well above the 3-year low registered in April. The moderately softer than expected reading for US initial jobless claims brought it to a 9 -month low, though continuing claims rose to a 3-month high.