A 6-sigma beat of expectations in non-farm payrolls has sparked chaos across asset classes this morning.

As Academy Securities' Peter Tchir commented: "What a “Weird” Report"

The headline number is shockingly good!

336k jobs created, PLUS 119k of upward revisions! Wow!

But things get a little weird from there:

Average hourly earnings stayed at 0.2% (2.4% annualized) and even the annual level came in lower than expectations at 4.2%. Given the strength of the job market (according to the Establishment data) and the barrage of “strike” headlines, that seems somewhat surprising.

Average hours worked remained unchanged at a moderate 34.4 (would expect that to have been stronger last month and this month, given the alleged jobs that were created in the Establishment Survey).

The unemployment rate stayed at 3.8%, as the Household survey showed decline in full-time jobs for the 3rd month in a row. Total jobs were positive for the Household survey, but driven by an increase in part-time jobs (which doesn’t seem overly consistent with a blow out jobs report).

Survey response rates seem to continue to decline (according to the BLS, for the June surveys only 41.7% of potential respondents, responded on the Current Employment Statistics Survey. Which is way better than the 31.9% response rate for JOLTS. When less than 50% of the ticket holders show up for an event, how good is the event? (or in this case, the data?)

Maybe the hiring is that good, but it didn’t show up ADP, which I suspect, increasingly, ADP has better data than the BLS as it is more dependent on actual, ADP data, than mediocre response rates to surveys.

The instant reaction was hawkish and rate-change expectations have shifted notably higher...

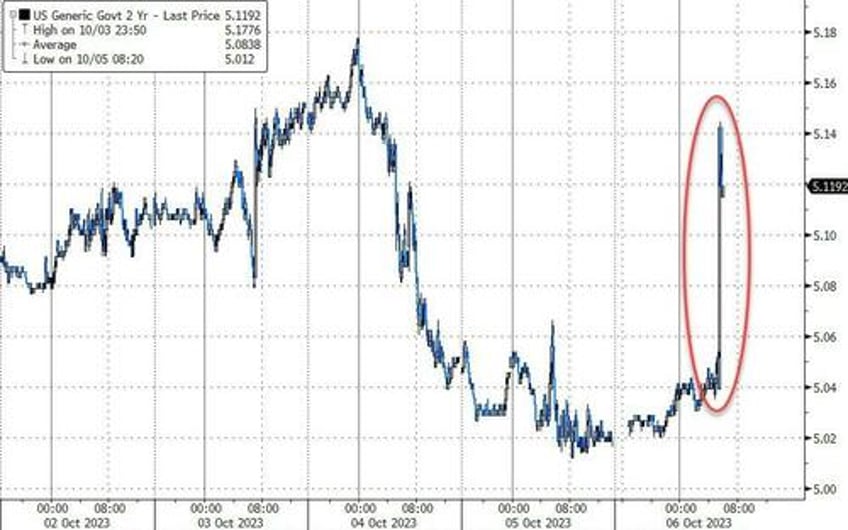

And treasury yields are surging - up around 10-15bps across the entire curve...

2Y bounced off close to 5.00%...

Equity futures immediately puked lower, led by Nasdaq...

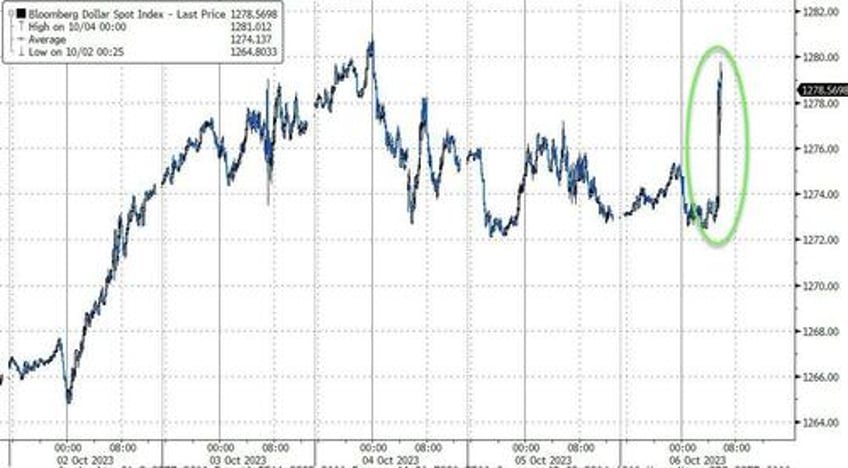

The dollar is spiking...

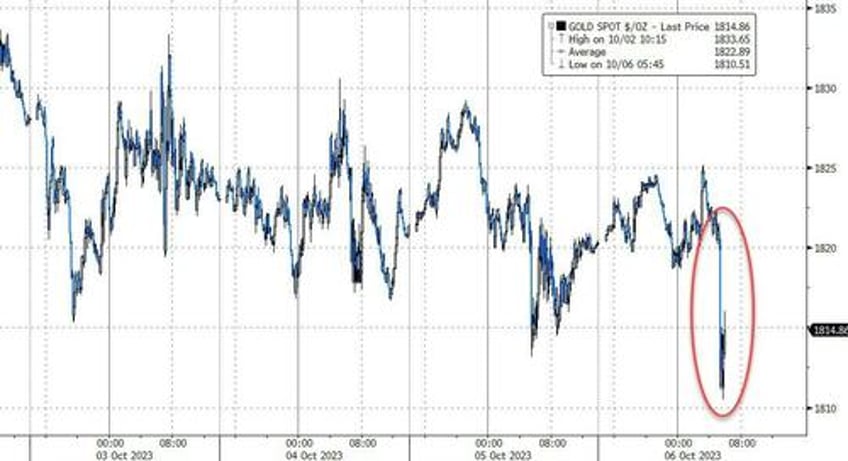

...and gold is dumping again...

Will all this kneejerk action hold? Academy Securities' Peter Tchir is doubtful:

"Difficult to fight the algos which are going to drive yields higher based on the headline number, but expect, as the day goes on, for many in the markets to question the veracity of this report and for the early losses in bonds and stocks to be dramatically reduced, if not finish the day and the week in the green! "

Nothing would surprise us less.