The Adani saga has taken its latest turn, and FT's Dan McCrum, famous for helping unveil the fraud at Wirecard, is having his say.

The now-controversial Adani Group, labeled "the largest con in corporate history" at the beginning of this year by short seller Hindenburg Research, "appears to have imported billions of dollars of coal at prices well above market value", according to a brand new report by FT, authored in part by McCrum.

The new FT report, published Thursday morning, says that data shows Adani "has been inflating fuel costs and led to millions of Indian consumers and businesses overpaying for electricity".

FT says that Adani has been using offshore intermediaries in Taiwan, Dubai and Singapore to import $5 billion worth of coal at prices that were "at times more than double" the market price. A Taiwanese entrepreneur, recently identified by the Financial Times as a significant concealed stakeholder in Adani firms, owns one of these companies.

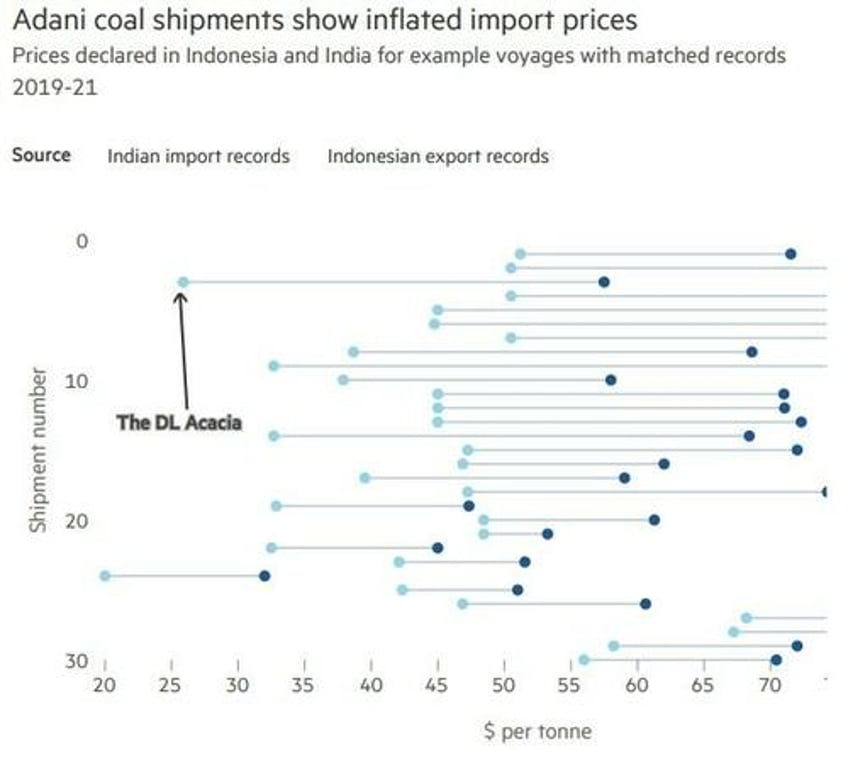

FT further scrutinized 30 coal shipments from Indonesia to India by an Adani enterprise between 2019 and 2021. In every instance, the recorded import prices substantially exceeded the listed export values. Over the course of these shipments, an inexplicable surge of over $70 million in total value was observed.

The initial accusation of inflating fuel expenses dates back seven years to an investigation conducted by the Directorate of Revenue Intelligence (DRI), an economic crime-fighting unit under the Ministry of Finance. In a 2016 notification, the DRI listed five Adani firms and another five supplied by the group among 40 importers implicated in a probe for supposedly "artificially inflating" the cost of Indonesian coal.

This alleged scheme aimed to divert funds overseas and overbill electricity providers. The DRI notification indicated that the comparison between export and import records revealed an extreme overvaluation ranging from 50% to 100%.

Furthermore, the DRI notice pointed out that while coal was shipped directly from Indonesia to India, the invoices from suppliers took a circuitous route through one or more intermediary invoicing agents located in a third country. This was done solely to add complexity, a tactic characteristic of trade-based money laundering, and to artificially boost the coal's landed cost in India, the FT report noted.

Financial Times reported that three intermediary firms—Hi Lingos in Taipei, Taurus Commodities General Trading in Dubai, and Pan Asia Tradelink in Singapore—appear to have received significant payments from the Adani group for coal supplies. According to Indian import records from July 2021 onwards, Adani disbursed a total of $4.8 billion to these companies for coal acquired at considerably higher prices than market rates.

Financial Times uncovered data on 2,000 coal shipments, amounting to 73 million tonnes, declared as Indian imports by Adani companies between September 2021 and July 2023, as recorded in the Export Genius database. The principal importer in these transactions was Adani Enterprises.

During this period, for the 42 million tonnes of coal sourced from its own operations, Adani declared an average cost of $130 per tonne. However, for the 31 million tonnes obtained through these three middlemen, the average declared price per tonne soared to $155—a 20% markup translating to almost $800 million in added costs.

Hi Lingos, operating from a residential location in Taipei, was cited as the supplier for 12.9 million tonnes of coal across 428 shipments from Australia and Indonesia. Adani expended approximately $2 billion for these supplies. This company is owned by Chang Chung-Ling (photo below from FT), a Taiwanese entrepreneur who has been previously flagged by both Hindenburg Research and Financial Times as a person of interest. Hindenburg identified him in their original report as a "director of multiple Adani entities".

The emergence of this piece may explain why Adani went on the offensive against award winning journalist McCrum days ago, as was pointed out on X by Hindenburg Research CEO Nathan Anderson.

Adani called the article a "renewed attempt" by the paper to "rehash old and baseless allegations to tarnish the name and standing" of the company. In response to Thursday's FT report, Adani Group denied any wrongdoing and said the story is based on an “old, baseless allegation”, and is “a clever recycling and selective misrepresentation of publicly available facts and information”.

"Adani is attacking journalist Dan McCrum at the Financial Times (FT) over an upcoming article," Anderson wrote earlier this week after Adani's press release. "The last company that tried that was Wirecard, later found to be the largest fraud in German history."

Major new FT investigation into Adani shows trade-based money laundering involving $5b in imports since 2021 alone.

— Hindenburg Research (@HindenburgRes) October 12, 2023

Report reveals ongoing dummy invoicing & overseas entities used to inflate coal prices, passing costs on to customers.https://t.co/T1gHylxRfp

The news follows short seller Hindenburg Research's scathing report at the beginning of this year that accused Adani of "brazen stock manipulation and accounting fraud."

Hindenburg's report initially led to a $50 billion selloff in Adani's corporate empire, but most of the enterprises' entities have steadied over the course of the year. Adani, in response, called Hindenburg's short report "bogus" and threatened legal action.