Ahead of tomorrow's "most important data point in history" payrolls print, this morning we get the ADP employment report and jobless claims (and ISM Services) as an aperitif to tease the day traders and test the reaction functions of the algos.

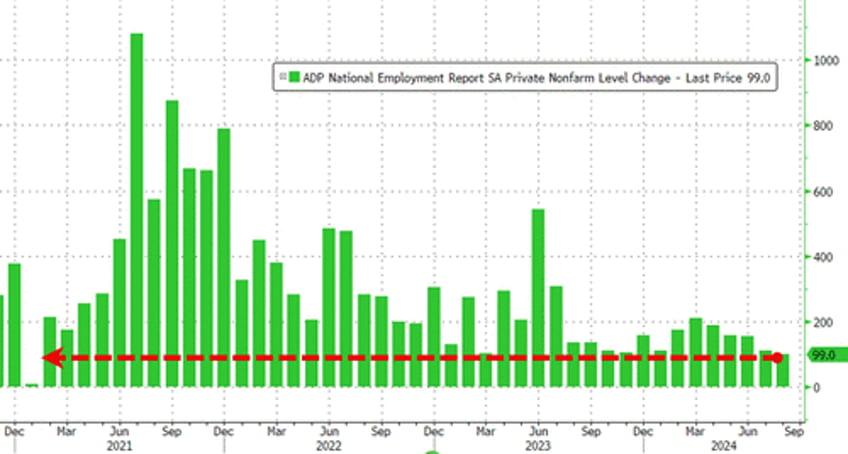

Against expectations of adding 145k jobs (a slight improvement over July's 122k), ADP's Employment report printed a dismal +99k for August - the weakest print since January 2021 (and July's +122k was revised down to +111k)...

Source: Bloomberg

That is also the fifth straight monthly decline in the ADP employment report's jobs additions.

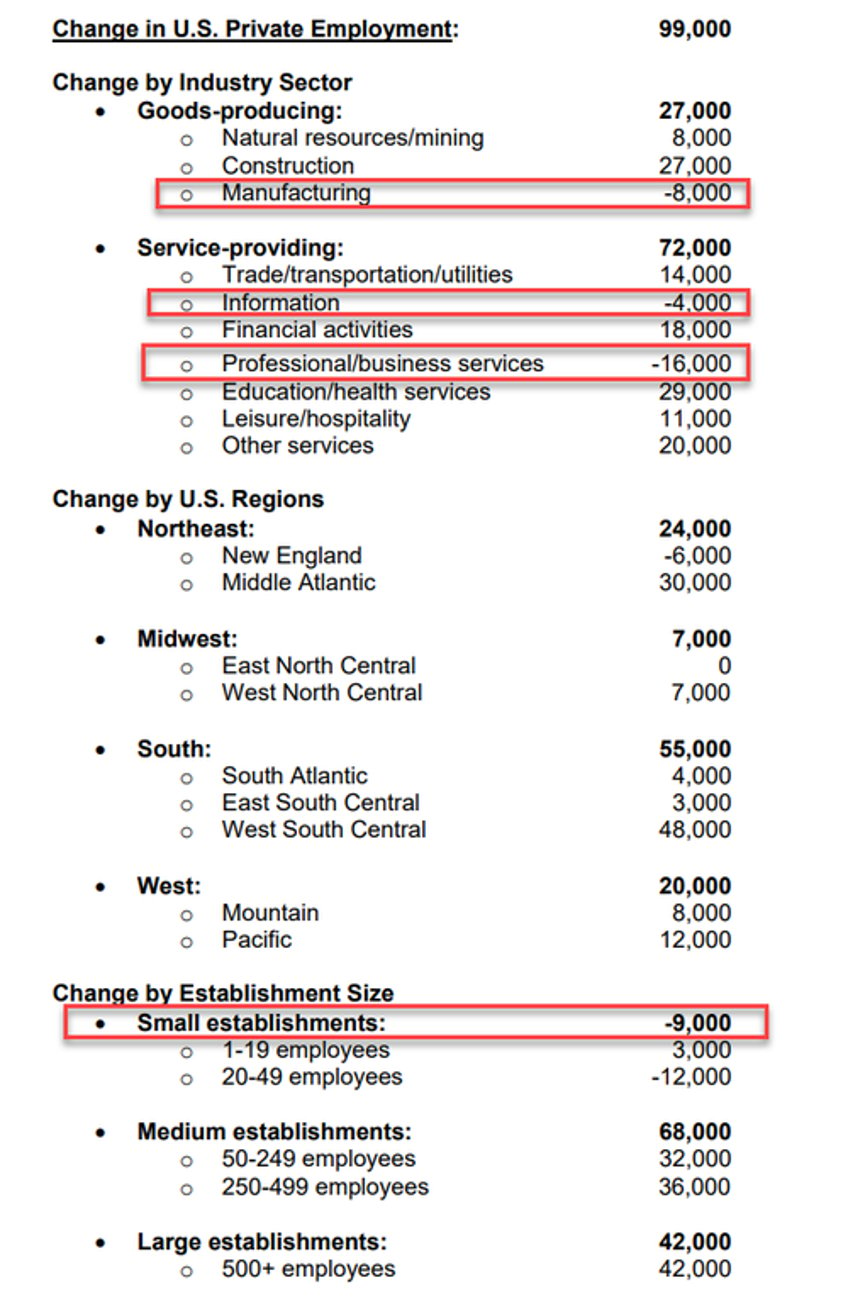

The highest-paying jobs segments including Manufacturing and Professional Services saw the largest job declines...

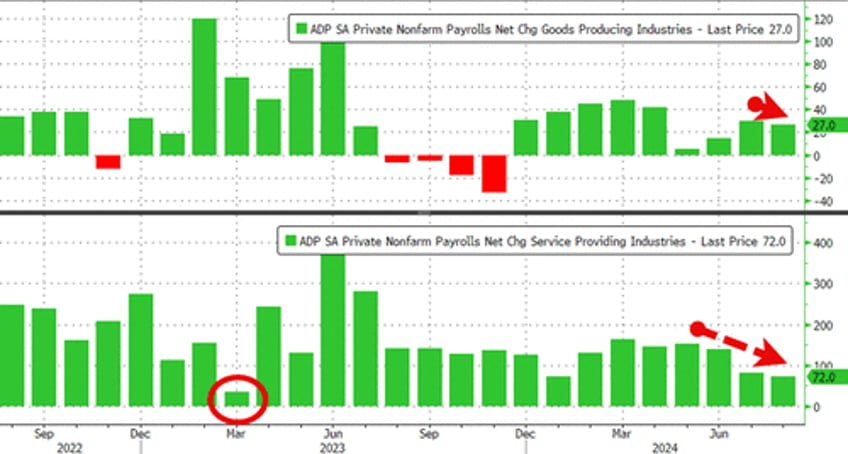

This was the weakest Services job growth since March 2023 as Manufacturing job growth also slowed...

“The job market's downward drift brought us to slower-than-normal hiring after two years of outsized growth,” said Nela Richardson, chief economist, ADP.

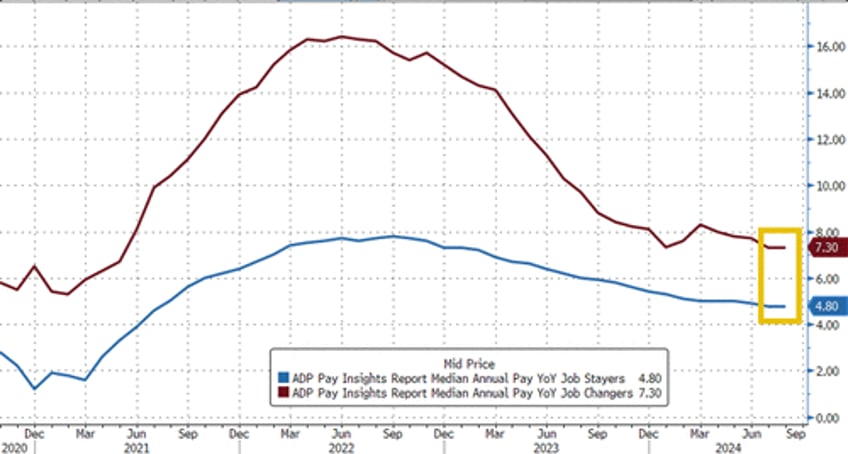

“The next indicator to watch is wage growth, which is stabilizing after a dramatic post-pandemic slowdown.”

Source: Bloomberg

Finally, as a reminder, ADP has underestimated the official BLS data for 10 of the last 12 months...

Source: Bloomberg

So jobs growth weak (great news for the doves) but wage growth has stopped is disinflatinary trend (not a great picture).

Stagflation anyone?