By Peter Tchir of Academy Securities

Baby Pool Closed for “Maintenance”

Anyone who ever got that notice from a town or community pool knows exactly what happened. It feels like some of that has gone on in our markets of late, ensuring that this is an “adult swim.” For those who have had their vacations disrupted or are about to experience that as market volatility continues, we feel your pain!

The Nasdaq 100 has had some wild swings, and the S&P 500 broke a long string of trading days without dropping 2%. Stocks ended the week strong on Friday and we got to continue to examine de-grossing, rotations, and de-risking. Last weekend we delved into these subjects in Know When to Fold ‘Em and we refined our views on Thursday morning in A Lot Going On.

Here we are, once again attempting to navigate through what is likely going to be another “interesting” week to say the least. But, before diving into the week ahead, we saw lots of evidence of rotation/de-grossing:

The Nasdaq 100 was down 2.6% while the Russell 2000 gained 3.5%.

The S&P 500 was down 0.8% while the equal weight version was up 0.8%.

Energy, which we like as our favorite hedge against geopolitical risk, was mixed (XLE was down a smidge, while OIH was up 1.6%).

The 2s vs 10s spread on the Treasury side of things got as low as -14 and ended the week less inverted than when it started. For now, we will put this on the rotation/de-grossing side of the ledger and expect it to continue.

Questions remain about how much de-risking has occurred?

Sure, QQQ has had some outflows of late, but it actually had inflows last week, while IWM (Russell 2000 ETF) had another week of strong inflows – which feels more like a rotation than de-risking.

When I look at the “frothier” end of things, I see little evidence of de-risking. TQQQ (a triple leveraged Nasdaq 100 ETF) had inflows, and SQQQ (3x inverse Nasdaq 100) had outflows. That looks like risk is being added. Similarly, NVDL (1.5x NVDA) had inflows. NVDS (-1.5x NVDA) had outflows, but it is tiny. I truly don’t understand the need for single stock ETFs (call me old fashioned), but those flows give some sense of the underlying tone out there. While I don’t understand why they exist, NVDL at $4.2 billion of AUM with an expense ratio of 1.15% is on a roughly $50,000,000 annual fee run-rate, which is pretty darn impressive for the creators!

What really "seals the deal" for me on my view that we are not done de-risking (but likely will be) is the view of the Fed.

We’ve gone from being “out there” for saying that the Fed should cut in July, to being a more or less consensus view that the Fed should be cutting, but won’t cut until September.

According to Bloomberg’s WIRP function, based on futures contracts, the market is now pricing in 1.13 cuts at the September meeting and 3.4 cuts by the end of the January meeting. We’ve been in the camp that the Fed is late to the easing cycle, the real rates are too high, the economy is slowing, and inflation pressures have abated, but the market may be getting ahead of itself again. The current pricing is just a bit more aggressive than our view (from having been more conservative), which leads us to wonder if the Fed isn’t already priced in? Or, and this is becoming our base case, the Fed will have to ease at this pace or faster, only because economic conditions won’t support anything resembling tight monetary policy.

With a lack of fear (even VIX has scaled back), some aggressive fund flows, and conviction that the Fed is going to announce the start of rate cuts driving this market, there still seems to be far more downside risk than upside risk.

Maybe the weakest hands have played out their de-grossing strategy and the rotation that remains (which still makes sense to us) will happen in an “overall rising” market. The data could support that.

We have four reasons to expect that we have not seen the summer lows yet:

1. The Fed is fully priced in.

2. The jobs data this week will be extremely disappointing. But not so disappointing that the Fed can pivot to “full-on dovish” given the Fed’s fears of an inflation resurgence. The pendulum swinging from no landing, to soft landing, to a possible bumpy landing could be the catalyst for more downside risk, especially since the Fed will likely feel the need to be restrained for the coming months.

3. Earning and AI. There is no longer an automatic 5% pop in your stock price just for saying “AI” on your earnings call (I’m being facetious, but….). What is the cost of AI? The price to implement AI has soared. How good is the AI you are getting? The best analogy, that I have heard on many fronts, is that the “large language models” are like reading a really good newspaper or magazine. The articles on subjects that you know little about make a lot of sense. However, you find a lot of issues with the articles about your area of expertise. Yes, LLMs are only one part of AI. Even in that subset, there are different ones, and some have very specific training to overcome that rather generic analogy of reading articles. Will today’s models (or more accurately, the perception of what the cost benefit analysis will yield in a couple years) be able to justify today’s current valuations? Given positioning and some of what we have seen in some recent earnings, that might prove difficult and be a catalyst for de-risking.

4. Politics and Geopolitical Risks.

Political first. There is a real risk that as both parties start campaigning on their policies, the market will get nervous about where we are headed on the deficit and inflation. How we get the bigger deficit and inflation risks posed by each parties’ policies will be different, but I think the risks are similar and currently not being priced in. This is why we expect to see less inversion and even “normal” yield curves as term premium gets put back into the market.

Geopolitical. On Thursday we published a SITREP as Chinese AND Russian Bombers were Intercepted Off the Alaskan Coast. While intercepting bombers is “normal,” this was the first time (that we are aware of) that planes from these two countries took off from the same base and operated together near North America.

This comes on the heels of our monthly Around the World piece, published on Wednesday. It is longer than usual, as there is so much going on. The Geopolitical Intelligence Group provides an updated assessment on the War in Gaza and the risk of escalation with Hezbollah. Next, it addresses what might change and what is likely to remain the same following Iran’s election of a reformist president. Next, it identifies how Russia is enhancing its partnerships to support its war in Ukraine and some problems that are coming up in discussions about what any sort of peace might look like. Finally, we address the Increased Tensions with China in the South China Sea! While for most people, Taiwan is the main area of concern, but there is also an increased concern about China’s intentions regarding some “disputed” reefs with the Philippines. “Disputed” is in quotes, as the international courts have ruled in favor of the Philippines, so away from China’s view, there is little to dispute.

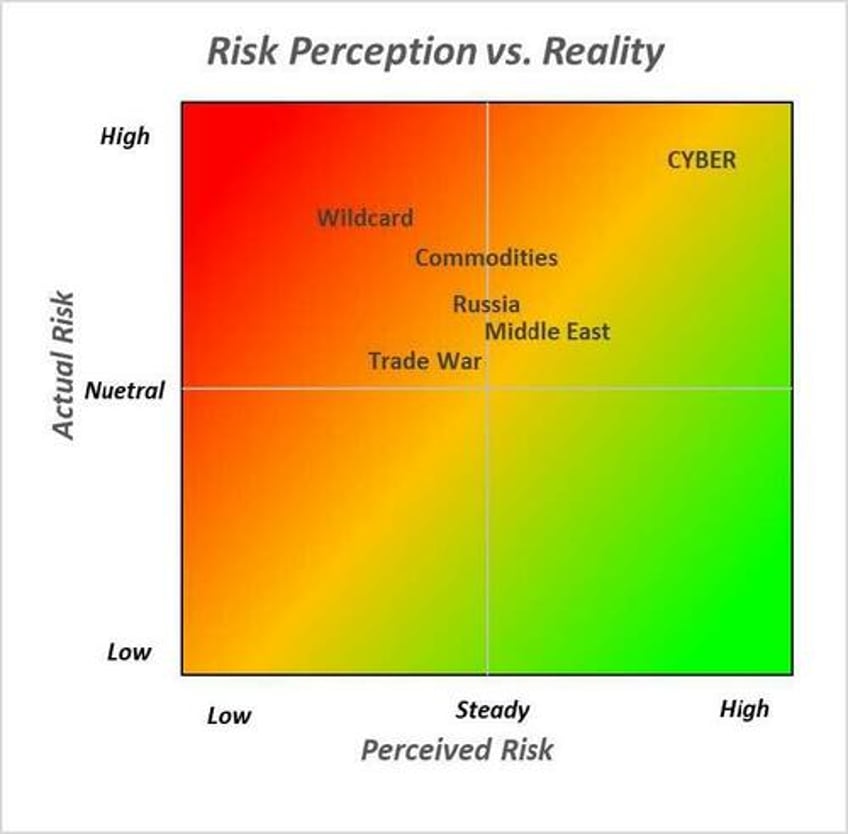

This seems like a good time to update our Geopolitical Risk vs Perception Heatmap, last published in June.

While the events of July 19th were not CYBER related, we have inched up the risk of a real cyber threat.

We’ve reduced the risk of a trade war as it seems that China is content to wait until after the election to respond to our most recent round of tariffs against them. While the real risk is reduced, the perception of risk has declined almost as fast, leaving this as a potential problem for markets.

While nothing has specifically happened with Russia, current signals, messages, and chatter warrant increasing the risk of some activity on their part, which helps support commodities.

Far and away is the risk of some “wildcard” event. The potential opportunities for a geopolitical event somewhere around the globe seem to be on the rise. We currently have a President who is not running for re-election, parties that seem as happy to attack and divide to win as they are to win on policies alone, and an entire media industry geared towards elections at the expense of reporting on the rest of the world. Maybe Russian and Chinese planes flying together near Alaska is all that we will get? Or maybe that is a snippet of our enemies/adversaries/competitors (take your pick) trying to analyze how much they can get away with?

Bottom Line

The Fed is not enough to “end the risk of de-risking.” The rotation trades should continue to work (though the move has already been quite extreme), but look for it to occur in a falling market. Look for some form of “not so good” landing to make its way back into the lexicon in the coming weeks.

Energy remains a favorite sector.

For banks (both KRE and KBE have been doing very well) the risk is that we get data indicating stretched consumers and unrealized problems in some segments of commercial real estate (such as office space in some specific cities). That could put some pressure on banks. The outlook is good, unless the data starts coming in worse than our already mildly bearish view, which isn’t our base case, but it seems more likely than surprising to the upside.

Credit. If we are correct and equities face more pressure, it will translate into some pressure on spreads, but nothing to be too concerned about as equities are far more about valuations in certain areas and positioning rather than overall economic concerns that would directly affect the creditworthiness of most borrowers. However, it would be helpful if the calendar slowed, giving everyone a little time to tuck away the recent issues. Finally, if we get a scenario that puts banks under any pressure (not our view, but something to think about for the first time in a while), that would impact credit spreads more materially.

The worst might be behind us in risk assets, but the view here is that we have more trouble to come and August, often a “trend-following month,” will follow the trend of choppiness and losses for stocks.

Good luck and for those of you who swim as poorly as I do, put on the water wings, because the adult swim is likely going to continue!