American Airlines Group slashed its third-quarter earnings forecast, just two months after raising it. The surge in air travel post-pandemic is waning as fall approaches, with travelers becoming more cautious amid mounting economic headwinds. Spirit Airlines also warned Wednesday about an emerging slump in air travel.

Bloomberg data shows American Air's cut in adjusted earnings per share guidance for the third quarter missed the guidance average estimate for Wall Street analysts.

Here's a snapshot of the Third Quarter Forecast (provided by Bloomberg):

- Sees adjusted EPS 20c to 30c, saw 85c to 95c, estimate 65c (Bloomberg Consensus)

Sees capacity about +6% to +7%, saw about +5% to +7%

Sees total revenue per available seat mile -5.5% to -6.5%, saw about -4.5% to -6.5%

Sees CASM ex-fuel +4% to +5%, saw about +4% to +6%

Sees adjusted operating margin about 4% to 5%, saw about 8% to 10%

As we noted on X, American Air hiked guidance only two months ago!

Remember: always hike guidance just to cut it 2 months later pic.twitter.com/plfh7zz9xE

— zerohedge (@zerohedge) September 13, 2023

Shares of American Air dropped as much as 4% on the news. Its peers, including Delta, United, Southwest, JetBlue, Spirit, Frontier, and others, also fell on the news.

The S&P500 Airlines index never recovered from pre-Covid levels.

Bloomberg's Lisa Abramowicz pointed out: "American Air cuts their earnings outlook. So does Spirit. Corporate expenses are increasing, consumer prices aren't keeping up."

American Air cuts their earnings outlook. So does Spirit. Corporate expenses are increasing, consumer prices aren't keeping up.

— Lisa Abramowicz (@lisaabramowicz1) September 13, 2023

Here's more from Bloomberg on Spirit's travel demand warning:

Spirit Airlines' warning that it is seeing steep discounting for flights booked in the pre-Thanksgiving fall period is weighing on shares of bigger U.S. carriers. Shares of American Airlines, United Airlines and Delta Air Lines all fell by about 1% in premarket trading after the warning from Spirit, which also said it will fly less in the 3Q than previously anticipated. Investors are watching for signs that the post-pandemic travel boom is petering out after a summer packed with transcontinental vacations. Hotels and airlines have largely said leisure demand is returning to more typical seasonal trends, but that demand is broadly holding up.

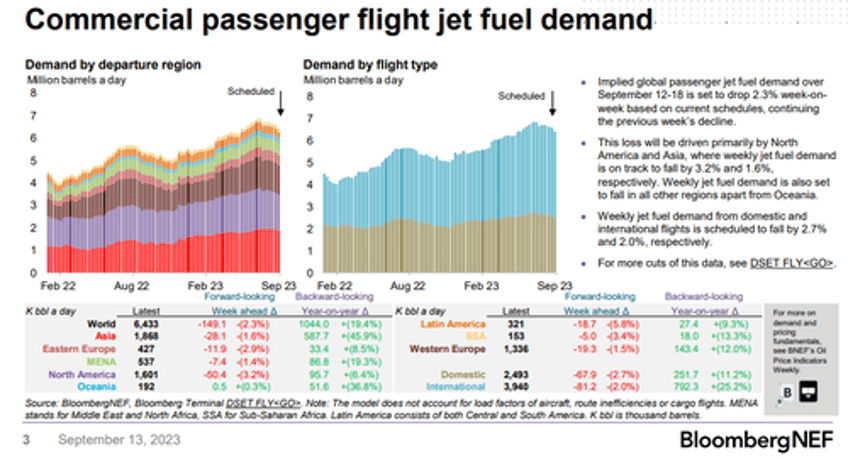

There appears to be a cooling in global commercial passenger flights as jet fuel demand sinks from the summer peak.

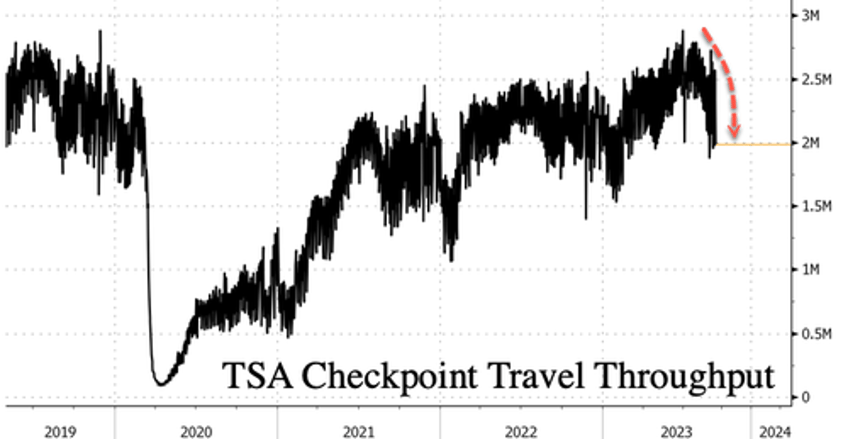

TSA Security Checkpoint numbers are also sliding.

Maybe this is more evidence the consumer is cracking...