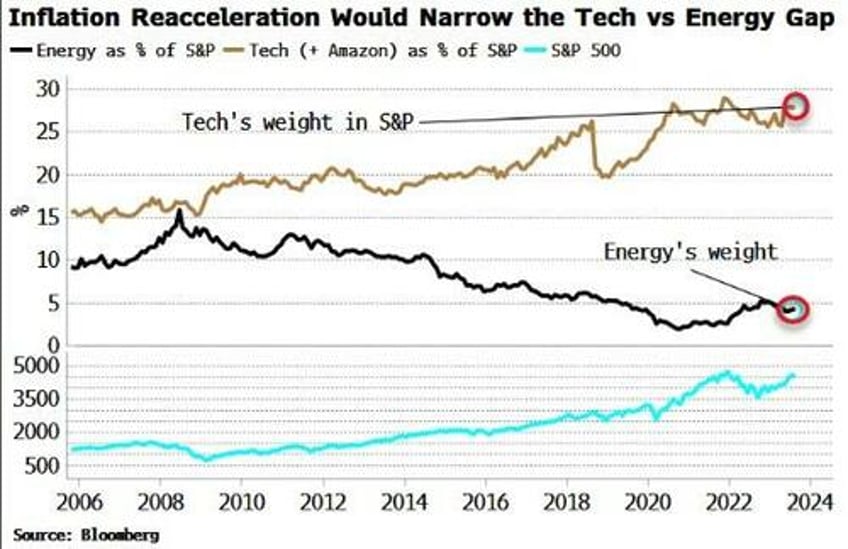

Continued outperformance of the tech sector depends on the shelter component of US CPI falling further.

Even then, inflation in the US is soon poised to be supported by a nascent recovery in China, denting high-duration tech stocks and boosting the low-duration energy sector.

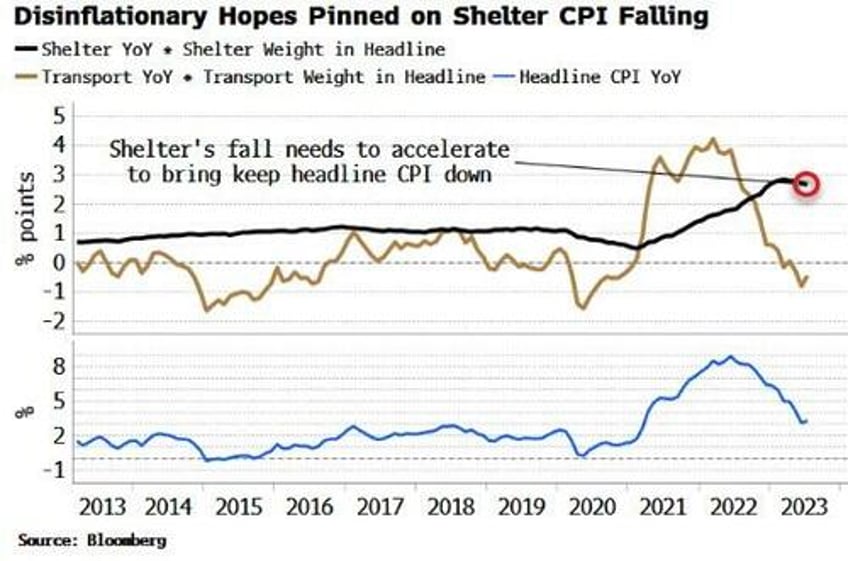

The market is bracing for the latest US CPI data. One of the most important components to watch will be shelter CPI – over one third of the CPI basket – as the continued trend of falling headline inflation that’s expected is dependent on the decline in shelter inflation persisting.

The biggest component of shelter is owners’ equivalent rent, a value the BLS imputes for what the rent would be for a home occupied by its owners. Thus a good lead for shelter CPI is the rental vacancy rate. This has been rising, signaling lower rents in the coming months.

So far, so good, but some caution is required. An explosion in rental prices was not what caused inflation to balloon in the first place. While part of it, the overriding cause was a deluge of demand meeting a shortfall in supply in the pandemic. A fall in rental prices is therefore unlikely to take us back to low and stable inflation.

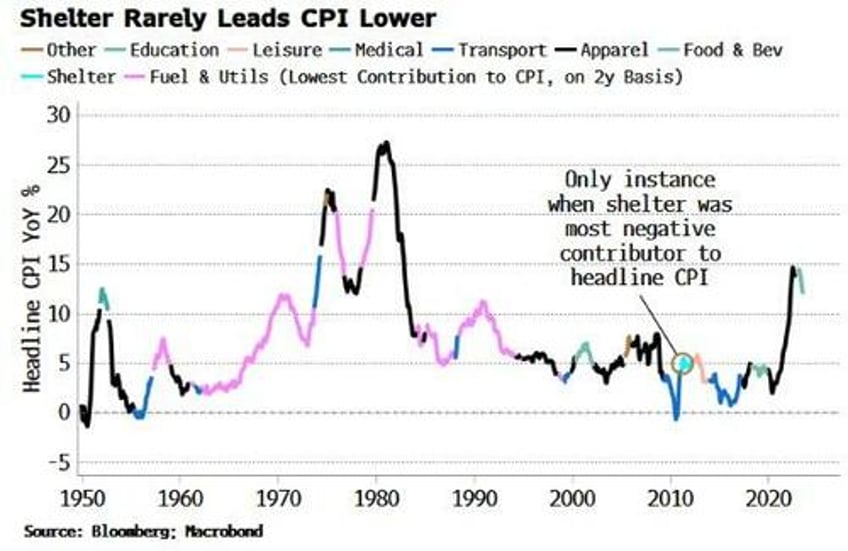

In the interim, other inflationary forces have been unleashed. Even though supply-chain pressures have eased (although the NY Fed’s Supply Chain Pressure Index has begun to rise again), companies are now out of synch, constantly playing catch-up with other companies raising prices – one of inflation’s hysteresis effects. Moreover, China’s PPI, which leads US CPI by about six months, has started to rise.

Standing back, we can look at which inflation components tend to drive inflation lower. The chart below shows, using color-coding, which US CPI component has the most negative impact on the headline index on a two-year basis. Despite shelter’s large weight in the basket, it is very rarely the biggest driver of falling inflation.

Markets are still assuming inflation will trend back to 2.5-3% in the next 6-12 months. Higher-duration tech sectors continue to outperform, while lower duration-sectors such as energy and utilities languish at the bottom of the pack.

Tech (+ Amazon’s) weight in the S&P is still near its high at almost 30%, while energy’s is only 4%. An unexpected return of inflation would likely see an outsized rotation within the market towards more inflation-resilient stocks, narrowing this historically wide gap.