- APAC stocks traded mixed following the similar performance stateside where price action was choppy amid soft data and as participants looked ahead to the latest key US jobs report.

- Amazon (AMZN) shares slipped 4.1% after-market as Q1 net sales guidance fell notably short of analysts' expectations.

- RBI cut the Repurchase Rate by 25bps to 6.25%, as expected, via a unanimous vote and unanimously decided to maintain a neutral policy stance; Mexican Interest Rate 9.5% vs. Exp. 9.5% (Prev. 10.0%) with the decision made by split vote (4-1).

- Russia's Kremlin said Russia and the US have not yet begun to discuss a possible Trump-Putin meeting and there have been no initial contacts about whether such a meeting is needed or where and how it might take place if it is, according to IFAX.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.4% after the cash market closed with gains of 1.6% on Thursday.

- Looking ahead, highlights include ECB Staff Revision of Natural Interest Rate, German Industrial Output, US NFP, Payrolls Benchmark Revision, Canadian Jobs, UoM Survey, Speakers including ECB’s de Guindos, Fed's Bowman & Kugler.

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks and bonds were choppy ahead of Friday's key NFP report and the major indices finished mixed gains in the Nasdaq and S&P 500, while the DJIA and Russell 2000 closed in the red.

- Nonetheless, sectors were predominantly higher as Financials, Staples and Tech outperformed, while Energy and Health Care were the laggards.

- SPX +0.36% at 6,084, NDX +0.54% at 21,774, DJI -0.28% at 44,748, RUT -0.39% at 2,307.

- Click here for a detailed summary.

TARIFFS/TRADE

- US Treasury Secretary Bessent said they could see a small one-time price adjustment with tariffs and commented that he sees China eating some tariffs.

- Hong Kong Post continues to suspend postal service for items containing goods to the US and has started communication with USPS to clarify matters including the US imposing tariffs.

- Canada’s Energy and Natural Resources Minister said the US has not set out clear objectives to resolve tariff issues.

NOTABLE HEADLINES

- Fed's Goolsbee (2025 voter) said it seems the job market is settling at full employment and the effect of tariffs on inflation may be hard to discern, while the first-order effect of tariffs on prices may be less important than possible impact on expectations. Goolsbee also stated that he feels the neutral rate is well below current Fed policy, but it is appropriate to slow the pace of cuts to find a stopping point.

- Fed's Logan (2026 voter) said choices in 2025 boil down to resuming rate cuts soon or holding rates steady for quite some time, while she added that near-2% inflation with the labour market holding steady would not necessarily allow the Fed to cut rates soon. Logan also stated that a rise in inflation would signal monetary policy has more to do and cooling labour market or demand could be evidence it's time to cut rates. Furthermore, she said estimates of the real neutral rate in the US vary widely, but most have moved up substantially since the pandemic and it will always be important to take broad financial conditions into account when setting monetary policy.

- Fed's Waller (voter) said a stablecoin is like a synthetic dollar and if it makes payments faster and cheaper, he is all for it but noted they need regulation for stablecoins and "the faster the better". Waller said will make the dollar even more of a reserve currency, while he responded the Fed would not run such a thing when asked about a possible Bitcoin strategic reserve and he does not see a case for retail CBDC in the US.

- White House outlined its tax priorities in a meeting with House GOP leaders on Thursday, while the list includes campaign promises like ending taxes on tips and Social Security benefits, according to a White House official cited by Axios.

- White House is reportedly preparing an order to cut thousands of federal health workers and an executive order could come as soon as next week if the Trump administration goes ahead with plans, according to WSJ.

- US President Trump signed an executive memo ordering a review of funding to all NGOs that rely on federal dollars, while it was also reported that the Trump administration is to keep just 294 USAID staff out of over 10,000 globally, according to sources cited by Reuters. In relevant news, the Trump administration is being sued by government workers over slashing of international aid agency USAID.

- US Treasury Secretary Bessent said he met with Fed Chair Powell and had a very constructive discussion. Bessent also commented that there is a lot of misinformation about DOGE and the Treasury, while he added that DOGE has "absolutely not" had the power to change the system. Furthermore, he said they want the dollar to be strong and a strong dollar policy is completely intact under Trump, as well as noted that the US is never going to default on its debt and he wants to get data on bondholder thoughts on the debt limit.

- US House Speaker Johnson said they were working to finish the final details of the reconciliation bill and could wrap up the deal by Thursday night.

NOTABLE EARNINGS

- Amazon (AMZN) Q4 2024 (USD): Adj. EPS 1.86 (exp. 1.49), Revenue 187.8bln (exp. 187.3bln), sees Q1 net sales 151.0bln-155.5bln (exp. 158.64bln); Co. shares fell 4.1% after-market.

- Microchip Technology (MCHP) Q3 2025 (USD): Adj. EPS 0.20 (exp. 0.28), Revenue 1.03bln (exp. 1.06bln); Co. shares fell 6.9% after-market.

APAC TRADE

EQUITIES

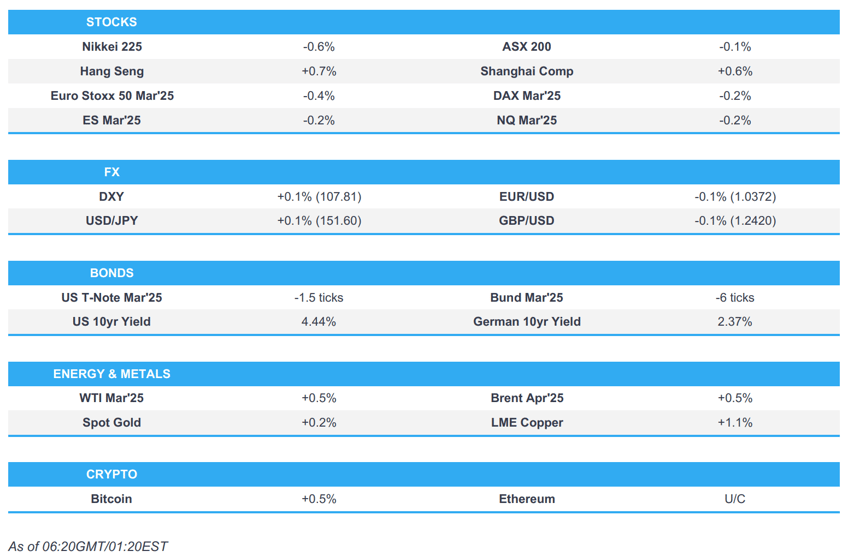

- APAC stocks traded mixed following the similar performance stateside where price action was choppy amid soft data and as participants looked ahead to the latest key US jobs report.

- ASX 200 struggled for direction as strength in tech and consumer staples offset the losses in energy and healthcare.

- Nikkei 225 was pressured by recent currency strength and mild upside in yields but with losses cushioned by stronger-than-expected Household Spending data which showed a surprise M/M growth and the fastest Y/Y pace of increase since August 2022.

- Hang Seng and Shanghai Comp were on the front foot despite the absence of any major fresh catalysts with participants potentially taking solace from the lack of trade war escalation, while the gains in Hong Kong were led by advances in tech and auto names.

- US equity futures traded little changed as all focus turned to the looming US jobs data, with price action also not helped by recent disappointing earnings updates including Amazon's weak guidance.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.4% after the cash market closed with gains of 1.6% on Thursday.

FX

- DXY traded little changed following yesterday's inconclusive performance and soft data releases with participants lacking conviction ahead of the looming Non-Farm Payrolls report.

- EUR/USD remained constricted after stalling just shy of the 1.0400 handle and following recent dovish ECB rhetoric.

- GBP/USD took a breather with the pair above 1.2400 after clawing back the losses from the BoE's 'dovish' rate cut.

- USD/JPY saw two-way price action in which it initially extended on recent declines after stronger-than-expected Household Spending data from Japan but then rebounded off support around the 151.00 level.

- Antipodeans eked slight gains amid the lack of fresh catalysts and the ultimately mixed risk appetite, while the PBoC continued to set a much firmer-than-expected yuan reference rate.

- PBoC set USD/CNY mid-point at 7.1699 vs exp. 7.2780 (prev. 7.1691).

- Mexican Interest Rate 9.5% vs. Exp. 9.5% (Prev. 10.0%) with the decision made by split vote (4-1) in which Heath dissented and voted for a 25bps cut, while Governor Rodriguez said they will consider 50bp cuts at the next meetings.

- BoC Governor Macklem said they are facing new uncertainty with a shift in policy direction in the US and President Trump's threats of new tariffs are already affecting business and household confidence, particularly in Canada and Mexico. Furthermore, Macklem said the world looks increasingly shock-prone and the longer the uncertainty persists, the more it will weigh on economic activity in their countries.

FIXED INCOME

- 10yr UST futures lacked demand after recent indecisiveness, soft data and as the key US jobs report looms.

- Bund futures were uneventful above the 133.00 level with German trade data and industrial production scheduled later.

- 10yr JGB futures declined amid the slight upside in Japanese yields and better-than-expected household spending data.

COMMODITIES

- Crude futures attempted to pick themselves up from the prior day's trough after prices were dragged lower by comments from US President Trump who stated they will drive the price of oil down and everything else would follow, while he also said they are making good progress to stop the Russia-Ukraine war.

- Spot gold remained afloat and marginally extended on yesterday's intraday rebound, while Citi expects gold prices to stay elevated this year and potentially reach the USD 3,000/oz level.

- Copper futures edged mild gains amid the positive risk sentiment seen in its largest buyer.

CRYPTO

- Bitcoin gradually advanced overnight after breaching back through the USD 97,000 level.

NOTABLE ASIA-PAC HEADLINES

- RBI cut the Repurchase Rate by 25bps to 6.25%, as expected, via a unanimous vote and unanimously decided to maintain a neutral policy stance, while the Standing Deposit Facility rate was adjusted to 6.0% and the Marginal Standing Facility Rate was set at 6.5%. RBI Governor Malhotra stated that CPI has mostly stayed aligned with the target, barring a few occasions, as well as noted that growth is expected to recover and growth-inflation dynamics will open up space to support growth. He also commented that food inflation pressures should see significant softening, barring supply shocks, and core inflation is expected to rise but remain moderate. The central bank lowered its FY25 real GDP growth forecast to 6.4% from 6.6% and sees FY26 real GDP growth at 6.7%, while it maintained FY25 CPI inflation view at 4.8% and sees FY26 CPI inflation at 4.2%. Furthermore, Malhotra said exchange rate policy has remained consistent, with intervention focused on smoothing excess volatility and the RBI does not target any exchange rate level or band.

- China mutual funds have reportedly been buying convertible bonds amid less supply with end-Q4 2024 fund holdings of convertible bonds reaching CNY 287.7bln, according to China Securities Journal.

DATA RECAP

- Japanese All Household Spending MM (Dec) 2.3% vs. Exp. -0.5% (Prev. 0.4%)

- Japanese All Household Spending YY (Dec) 2.7% vs. Exp. 0.2% (Prev. -0.4%)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu told Channel 14 that President Trump told him that Trump is in contact with a number of countries to implement his plan to displace Palestinians, according to Al Jazeera.

- Israel's army conducted a strike in Lebanese territory on two military sites that contained Hezbollah weapons.

- White House Press Secretary said President Trump has made it clear he will not be sending boots on the ground in Gaza.

OTHER

- Russia's Kremlin says Russia and the US have not yet begun to discuss a possible Trump-Putin meeting and there have been no initial contacts about whether such a meeting is needed or where and how it might take place if it is, according to IFAX.

- Taiwan announced that it detected six Chinese balloons near the island, while it also detected nine Chinese military aircraft, six warships and two official ships in the prior 24 hours.