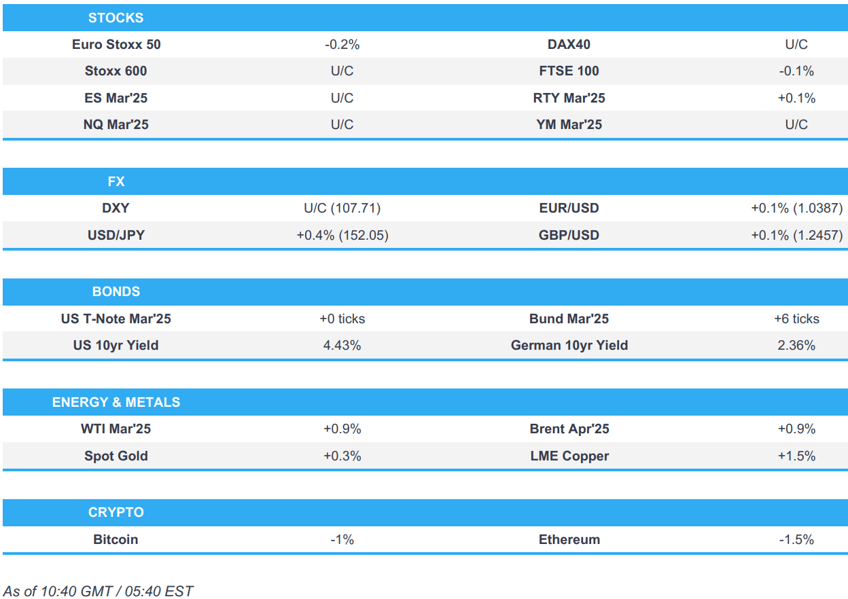

- Stocks and bonds trade tentatively ahead of US NFP and ECB Natural Interest Rate.

- AMZN -2.6% pre-market after it beat expectations but issued weak Q1 guidance.

- USD mixed vs. peers ahead of NFP, GBP is attempting to recoup lost ground, havens narrowly lag.

- Upward bias in industrial commodities while precious metals await US jobs.

- Looking ahead, ECB Staff Revision of Natural Interest Rate, US NFP, Payrolls Benchmark Revision, Canadian Jobs, UoM Survey, Speakers including Fed's Bowman & Kugler.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (Stoxx 600 +0.1%) are mixed, with trade tentative ahead of the all-important US NFP report. European traders will also be cognizant of the ECB Staff Revision of the Natural Interest Rate.

- European sectors are mixed, and aside from the top/bottom performers, the breadth of the market is fairly narrow. Construction and Materials tops the pile, lifted by post-earning strength in Vinci; Consumer Products is weighed on by losses in L’Oreal (-4%) after posting weak LFL Sales in Q4 and highlighting poor Chinese demand.

- US equity futures are mixed, and ultimately trading on either side of the unchanged mark, as traders remain focused of the US NFP later today, alongside Payrolls Benchmark Revisions.

- China Auto Industry Body CPCA says Tesla (TSLA) sold 63,238 China-made vehicles in January (prev. 93,766 M/M; 71,447 Y/Y)

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

EARNINGS SUMMARY

- Amazon.com (AMZN) -2.7%: Q4 beat, Q1 guide weak; AWS missed forecasts. Plans 105bln in FY25 capex.

- Microchip Technology (MCHP) -6.5%: Q3 miss, evaluating all aspects of business.

FX

- DXY is a touch softer with the USD mixed vs peers (firmer vs. havens, weaker vs. cyclicals). Today is of course NFP day with headline payrolls expected to slow to 170k from 256k and the unemployment rate hold steady at 4.1%. Note, today will also see the BLS publish its annual benchmark revisions.

- EUR/USD is steady vs. the USD in the run-up to today's publication of the ECB's neutral rate. Ahead of which, ECB Chief Economist Lane has suggested that it is best not to focus too much on the neutral rate. EUR/USD is currently capped by the 1.04 mark and within yesterday's 1.0352-1.0405 range.

- JPY is a touch softer vs. the USD as havens lag cyclicals. Overnight, USD/JPY saw two-way price action in which it initially extended on recent declines after stronger-than-expected Household Spending data from Japan but then rebounded off support around the 151.00 level. Since then, the pair has made its way up to a 151.89 peak.

- GBP is attempting to recoup some of Thursday's BoE-induced losses, which were triggered by a "dovish cut" from the MPC as uber-hawk surprised markets with a vote for a 50bps cut. Cable is currently tucked within yesterday's 1.2359-1.2509 range.

- Antipodeans are both incrementally firmer vs. the USD in what has been a strong showing this week for both currencies after a shaky performance on Monday.

- PBoC set USD/CNY mid-point at 7.1699 vs exp. 7.2780 (prev. 7.1691).

- BoC Governor Macklem said they are facing new uncertainty with a shift in policy direction in the US and President Trump's threats of new tariffs are already affecting business and household confidence, particularly in Canada and Mexico. Furthermore, Macklem said the world looks increasingly shock-prone and the longer the uncertainty persists, the more it will weigh on economic activity in their countries.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are flat and are awaiting today's US NFP report, as well as the benchmark payroll revisions. Firstly, the pace of payroll additions is expected to ease towards recent averages with consensus looking for 170k; though, hurricane, wildfire, cold weather and industrial factors could all impact and weigh on the headline. Into the release, USTs hold in a particularly narrow 109-13+ to 109-20 band with yields mixed and the curve itself a touch flatter.

- Bunds are contained; German export data was better than expected but sparked little move at the time. Bunds find themselves at the top-end of 133.29-49 band which is entirely within Thursday’s 133.13-61 parameters. No reaction to commentary from ECB’s Lane or de Guindos this morning, who both spoke on inflation. Traders are awaiting the ECB Natural Interest Rate release, due at 12:00GMT / 07:00 ET. Ahead of the release it is worth revisiting remarks from recent officials on where they think the Neutral Rate is, to surmise: Lagarde 1.75-2.25%; Schnabel 2.0-3.0%; Rehn 2.2-2.8%, Villeroy & Stournaras around 2.0% and Centeno >2.0%.

- Gilts are contained with specifics light post-BoE and as the fixed complex is focussed on upcoming events from the ECB and US BLS. As such, Gilts are pivoting the unchanged mark in a 93.06-93.49 band.

- Click for a detailed summary

COMMODITIES

- Crude futures overnight attempted to pick themselves up from the prior day's trough. Newsflow was light this morning but Iran delivered some punchy rhetoric in which Leader Khamenei said talks with the US are neither smart, wise, nor honourable, according to IRNA. Brent Apr resides in a USD 74.26-75.12/bbl parameter.

- Spot gold remains afloat but within Thursday's ranges as the yellow metal bides times ahead of the US Jobs reports. China's Financial Regulator will allow insurance funds to purchase gold as part of a pilot project - modest upticks in prices were seen around this time. Spot gold resides in a current USD 2,855.98-2,870.73/oz parameter.

- Copper futures overnight edged mild gains amid the positive risk sentiment seen in its largest buyer, with traders now looking ahead to the US jobs report. 3M LME copper resides in a USD 9,295.97-9,433.00/t range.

- China gold reserves end-Jan USD 206.53bln (vs end-Dec USD 191.34bln); Gold reserves 73.65mln toz (prev. 73.29mln toz).

- China's Financial Regulator will allow insurance funds to purchase gold as part of pilot project

- Click for a detailed summary

NOTABLE DATA RECAP

- German Trade Balance, EUR, SA (Dec) 20.7B vs. Exp. 17.0B (Prev. 19.7B); Exports MM 2.9% vs. Exp. -0.6% (Prev. 2.1%); Imports MM 2.1% vs. Exp. 1.8% (Prev. -3.3%)

- German Industrial Output MM (Dec) -2.4% vs. Exp. -0.6% (Prev. 1.5%)

- French Trade Balance, EUR, SA (Dec) -3.905B (Prev. -7.085B, Rev. -6.340B)

- UK Halifax House Prices MM (Jan) 0.7% vs. Exp. 0.2% (Prev. -0.2%)

- UK BBA Mortgage Rate (Jan) 7.49% (Prev. 7.5%)

NOTABLE EUROPEAN HEADLINES

- ECB's Lane says services inflation in January was softer-than-expected; 2% inflation target should be achieved "fairly soon".

- ECB's de Guindos says inflation is beginning to converge to 2% in spring, services inflation remains top price concern, need prudent approach to monetary policy.

NOTABLE US HEADLINES

- Punchbowl says US house republicans are torn over the level of spending cuts, House GOP initially proposed USD 500bln to USD 1tln, conservative hardliners are pushing for at least USD 2.5tln.

- US President Trump has reportedly placed VP Vance and NSA Waltz in charge of overseeing a potential sale of TikTok, via Punchbowl citing sources.

- BofA Institute (w/e Feb 1st) Total Card Spending +0.9% Y/Y (prev. 2.2%) average in Dec; spending in South seems to have recovered from snowstorms driven decline

- Fed's Logan (2026 voter) said choices in 2025 boil down to resuming rate cuts soon or holding rates steady for quite some time, while she added that near-2% inflation with the labour market holding steady would not necessarily allow the Fed to cut rates soon. Logan also stated that a rise in inflation would signal monetary policy has more to do and cooling labour market or demand could be evidence it's time to cut rates. Furthermore, she said estimates of the real neutral rate in the US vary widely, but most have moved up substantially since the pandemic and it will always be important to take broad financial conditions into account when setting monetary policy.

- US President Trump signed an executive memo ordering a review of funding to all NGOs that rely on federal dollars, while it was also reported that the Trump administration is to keep just 294 USAID staff out of over 10,000 globally, according to sources cited by Reuters. In relevant news, the Trump administration is being sued by government workers over slashing of international aid agency USAID.

- US House Speaker Johnson said they were working to finish the final details of the reconciliation bill and could wrap up the deal by Thursday night.

GEOPOLITICS

- Russian Kremlin's Peskov says Russia is open to negotiations on Ukraine.

- IAEA Head Grossi says the number of attacks on Zaporizhia nuclear power plant in Ukraine has increased; adds the situation is tough, via Tass

- "Al-Arabiya sources: Hamas informed mediators that Israel did not abide by the agreed humanitarian protocol" and as such Hamas is "Delaying the names of hostages scheduled to be released tomorrow".

- Russia's Kremlin says Russia and the US have not yet begun to discuss a possible Trump-Putin meeting and there have been no initial contacts about whether such a meeting is needed or where and how it might take place if it is, according to IFAX.

- Israel's army conducted a strike in Lebanese territory on two military sites that contained Hezbollah weapons.

- Taiwan announced that it detected six Chinese balloons near the island, while it also detected nine Chinese military aircraft, six warships and two official ships in the prior 24 hours.

CRYPTO

- Bitcoin is a little weaker and trading just shy of USD 93k; Ethereum posts deeper losses and down to USD 2.7k

APAC TRADE

- APAC stocks traded mixed following the similar performance stateside where price action was choppy amid soft data and as participants looked ahead to the latest key US jobs report.

- ASX 200 struggled for direction as strength in tech and consumer staples offset the losses in energy and healthcare.

- Nikkei 225 was pressured by recent currency strength and mild upside in yields but with losses cushioned by stronger-than-expected Household Spending data which showed a surprise M/M growth and the fastest Y/Y pace of increase since August 2022.

- Hang Seng and Shanghai Comp were on the front foot despite the absence of any major fresh catalysts with participants potentially taking solace from the lack of trade war escalation, while the gains in Hong Kong were led by advances in tech and auto names.

NOTABLE ASIA-PAC HEADLINES

- Chinese Foreign Minister, in response to a media inquiry regarding reports that China is exploring a potential antitrust probe into Apple (AAPL) policies related to its app store policies and fees, says "he was not aware of the situation", via Global Times

- UMC (2303 TT) revenue +4.2% Y/Y to TWD 19.8bln.

- RBI cut the Repurchase Rate by 25bps to 6.25%, as expected, via a unanimous vote and unanimously decided to maintain a neutral policy stance, while the Standing Deposit Facility rate was adjusted to 6.0% and the Marginal Standing Facility Rate was set at 6.5%. RBI Governor Malhotra stated that CPI has mostly stayed aligned with the target, barring a few occasions, as well as noted that growth is expected to recover and growth-inflation dynamics will open up space to support growth. He also commented that food inflation pressures should see significant softening, barring supply shocks, and core inflation is expected to rise but remain moderate. The central bank lowered its FY25 real GDP growth forecast to 6.4% from 6.6% and sees FY26 real GDP growth at 6.7%, while it maintained FY25 CPI inflation view at 4.8% and sees FY26 CPI inflation at 4.2%. Furthermore, Malhotra said exchange rate policy has remained consistent, with intervention focused on smoothing excess volatility and the RBI does not target any exchange rate level or band.

- China mutual funds have reportedly been buying convertible bonds amid less supply with end-Q4 2024 fund holdings of convertible bonds reaching CNY 287.7bln, according to China Securities Journal.

DATA RECAP

- Japanese All Household Spending MM (Dec) 2.3% vs. Exp. -0.5% (Prev. 0.4%); YY (Dec) 2.7% vs. Exp. 0.2% (Prev. -0.4%)

- China gold reserves end-Jan USD 206.53bln (vs end-Dec USD 191.34bln); Gold reserves 73.65mln toz (prev. 73.29mln toz). Chinese FX Reserves (Monthly) (Jan) 3.209Trl vs. Exp. 3.2Trl (Prev. 3.202Trl)