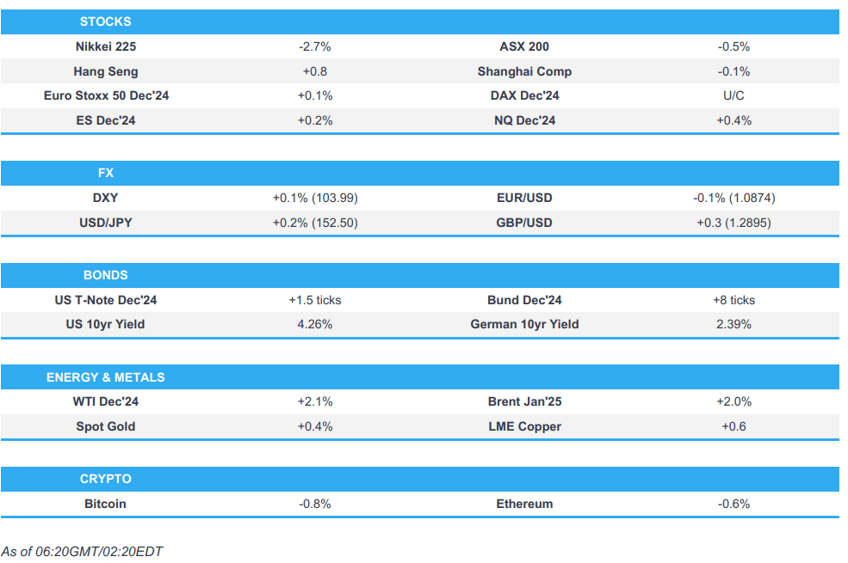

- APAC action mixed as Amazon and Apple diverge, China outperforms on further encouraging PMI data

- DXY little changed around 104.00, USD/JPY found support at 152.00

- Fixed benchmarks contained after recent marked Gilt-led pressure, awaiting US data

- Crude underpinned on reports that Iran is preparing a major retaliatory strike from Iraq within days.

- Looking ahead, highlights include US NFP, ISM Manufacturing PMI, Earnings from ExxonMobil, Chevron, Ares Management, Dominion Energy, Charter Communications, Imperial Oil, LyondellBasell, Cardinal Health & Cboe Global Markets

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were pressured with the Nasdaq 100 leading the declines seen across the major indices as the tech sector suffered heavy losses owing to weakness in mega-cap names including Microsoft (MSFT)(-6%) and Meta (META)(-4.1%) post-earnings. Furthermore, participants digested a slew of mixed data releases, while attention was also on geopolitics after a report that Israeli intelligence suggested Iran is preparing to attack Israel from Iraqi territory in the coming days.

- SPX -1.86% at 5,705, NDX -2.44% at 19,890, DJIA -0.90% at 41,763, RUT -1.63% at 2,197.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Harris campaign official rejected Trump's claims of election fraud in Pennsylvania and said the system is working as it should to identify a small number of problems.

- Apple Inc (AAPL) Q4 2024 (USD): Adj. EPS 1.64 (exp. 1.58), Revenue 94.93bln (exp. 94.58bln), Products revenue 69.96bln (exp. 69.15bln), iPhone revenue 46.22bln (exp. 45.04bln), Mac revenue: 7.74bln (exp. 7.74bln), iPad revenue: 6.95bln (exp. 7.07bln), Wearables, home, and accessories revenue: 9.04bln (exp. 9.17bln), Service revenue: 24.97bln (exp. 25.27bln), Greater China revenue fell 0.3% Y/Y to 15.03bln (exp. 15.8bln), Co. expects Q1 rev. growth at low to mid-single digits.. -1.8% after-hours

- Amazon.com Inc (AMZN) Q3 2024 (USD): EPS 1.43 (exp. 1.14), Revenue 158.9bln (exp. 157.2bln). +5.6% after hours

- Intel Corp (INTC) Q3 2024 (USD): Adj. EPS -0.46 (exp. -0.02), Revenue 13.3bln (exp. 13.02bln).

APAC TRADE

EQUITIES

- APAC stocks traded mixed following the tech-heavy losses stateside and heightened geopolitical concerns, while Chinese markets outperformed after further encouraging manufacturing PMI data.

- ASX 200 declined with nearly all industries subdued aside from the commodity-related sectors.

- Nikkei 225 slumped at the open after recent currency strength and the hawkish tone from BoJ Governor Ueda.

- Hang Seng and Shanghai Comp were underpinned after the Chinese Caixin Manufacturing PMI followed suit to yesterday's official release with a surprise return to expansion territory, while the attention was also on recent earnings reports.

- US equity futures found some respite from recent selling but with the recovery limited after tailwinds from Amazon's strong results were countered by Apple's disappointing China sales, while participants now look ahead to the NFP report.

- European equity futures are indicative of a marginally positive cash open with the Euro Stoxx 50 future +0.1% after the cash market closed lower by 1.2% on Thursday.

FX

- DXY traded little changed beneath the 104.00 level after giving up ground yesterday to a stronger yen and euro, while the latest US data releases were mixed and the attention now turns to the incoming key US jobs data.

- EUR/USD took a breather and remained at the 1.0800 handle after recently strengthening for a fourth consecutive day.

- GBP/USD languished around the 1.2900 level after slipping from resistance at 1.3000 in the fallout from the UK Budget.

- USD/JPY found support at 152.00 after suffering in the aftermath of the BoJ policy decision and Governor Ueda's press conference where he downplayed concerns over financial stability risks acting as an impediment to further policy tightening.

- Antipodeans lacked conviction amid the mixed risk tone and with no tier-1 data from either side of the Tasman.

- PBoC set USD/CNY mid-point at 7.1135 vs exp. 7.1122 (prev. 7.1250).

FIXED INCOME

- 10yr UST futures traded sideways after yesterday's choppy mood and as markets braced for the looming US jobs data.

- Bund futures were uneventful with price action contained beneath the 132.00 level following the recent sell-off.

- 10yr JGB futures remained lacklustre following yesterday's BoJ meeting and Ueda's hawkish tone at the press conference.

COMMODITIES

- Crude futures remained underpinned with WTI above USD 70/bbl owing to the geopolitical risk premium following reports that Iran is preparing a major retaliatory strike from Iraq within days.

- Spot gold regained some composure after it recently pulled back from its all-time highs.

- Copper futures were lifted amid the surprise expansion in Chinese Caixin Manufacturing PMI data.

CRYPTO

- Bitcoin was subdued and retreated back beneath the USD 70,000 level.

NOTABLE ASIA-PAC HEADLINES

- China National People's Congress Standing Committee proposed a law amendment for further refining government debt supervision, while it added the provision state council and above county-level governments should report on debt management progress.

- IMF expects Asia's economy to expand by 4.6% in 2024 and 4.4% in 2025 but noted risks to Asia's economic outlook are tilted to the downside and that an acute risk for Asia is an escalation in tit-for-tat retaliatory tariffs between major trading partners. Furthermore, it stated that persistent downward price pressures from China can hurt countries with similar export structures and provoke trade tensions, as well as noted that China's property sector problems have not been addressed comprehensively, leading to plummeting consumer confidence.

DATA RECAP

- Chinese Caixin Manufacturing PMI (Oct) 50.3 vs. Exp. 49.7 (Prev. 49.3)

- Australian PPI QQ (Q3) 0.9% (Prev. 1.0%)

- Australian PPI YY (Q3) 3.9% (Prev. 4.8%)

GEOPOLITICS

MIDDLE EAST

- Iran is reportedly preparing a major retaliatory strike from Iraq within days, according to Axios. In relevant news, Al Arabiya noted the IRGC chief said the response to Israel will be unexpected, while Al Jazeera reported there are no indications that Iran is preparing to attack Israel.

- Iran’s supreme leader Khamenei instructed the Supreme National Security Council on Monday to prepare for attacking Israel, according to NYT citing three Iranian officials familiar with the war planning. Khamenei was said to have made the decision after he reviewed a detailed report from senior military commanders on the extent of damage to Iran’s missile production capabilities and air defence systems around Tehran, critical energy infrastructure and a main port in the south.

- Israel conducted strikes on Beirut suburbs for the first time in days, while a Lebanese news agency reported that dozens of buildings in the southern suburbs of Beirut were flattened by Israeli raids, according to Sky News Arabia.

- Islamic Resistance in Iraq said it attacked with marches a vital target in the south of the occupied territories several times since dawn today, according to Al Jazeera.

- US Secretary of State Blinken said there is 'good progress' towards a ceasefire in Lebanon.

- US Defence Secretary Austin spoke to Israeli Defence Minister Gallant and reaffirmed the US remains fully prepared to defend US personnel and partners across the region against threats from Iran, according to the Pentagon.

- US State Department issued a response to Israel's cabinet decision on extending indemnification for correspondent banking between Israel and West Bank in which it stated the short-term extension creates another looming crisis by November 30th and called for Israel to swiftly extend indemnification for essential banking relationships for at least a year.

- Egypt denied what was reported by media outlets about Alexandria port receiving the MV Kathrin vessel carrying military supplies for Israel, according to Al Qahera News TV citing a high-level source.

OTHER

- US Secretary of State Blinken condemned North Korea’s ballistic missile launch in the strongest terms and said as many as 8k North Korean troops are deployed in the Kursk region.