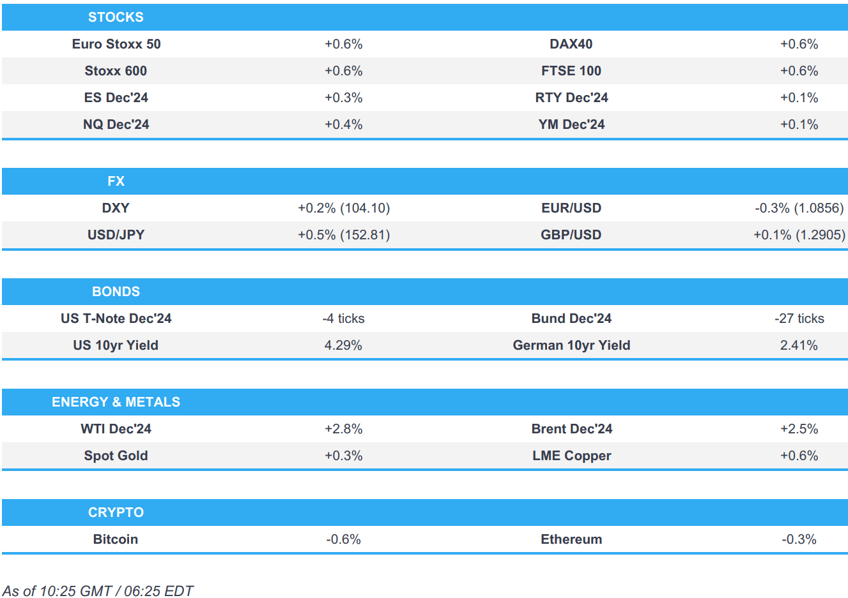

- European bourses are entirely in the green alongside modest strength in US futures following post-earning strength in Amazon/Intel & ultimately outmuscling losses in Apple.

- Dollar is firmer, CHF sinks after the region’s inflation data and JPY pares recent strength.

- Gilts continue to underperform with benchmarks generally softer pre-Payrolls.

- Crude is lower as risk-premium returns into the weekend though participants have NFP to navigate first.

- Looking ahead, US NFP, ISM Manufacturing PMI, Earnings from Ares Management, Dominion Energy, Charter Communications, Imperial Oil, LyondellBasell, Cardinal Health & Cboe Global Markets.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.6%) are entirely in the green, with sentiment lifted following strong results from Amazon/Intel which have ultimately been able to outmuscle pre-market losses in Apple.

- European sectors hold a positive bias. Optimised Personal Care tops the pile, lifted by Reckitt after it received a favourable litigation decision. Energy follows close behind, with oil prices firmer amid heightened geopolitical tensions – as such, Travel & Leisure lags.

- US equity futures (ES +0.1%, NQ +0.4%, RTY +0.1%) are modestly firmer, and with sentiment on a stronger footing after good results from Amazon and Intel; traders await US NFP/ISM Manufacturing later in the session.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is broadly firmer vs. peers with DXY back above the 104 mark. Today's main data highlight is of course the US NFP report whereby expectations are for a cooling in the headline rate to 113k amid weather and strike activity distortions; the unemployment rate is not expected to be impacted. For now, DXY is tucked within yesterday's 103.82-104.21 range.

- EUR is softer vs. the USD after a recent run of gains that have been underpinned by firmer growth and inflation metrics from the Eurozone. EUR/USD has been as low as 1.0858 but is holding above Thursday's low at 1.0843.

- After two sessions of losses vs. the USD in the wake of Wednesday's UK budget, Cable is attempting to stabilise and has managed to make its way back onto a 1.29 handle after drifting as low as 1.2843 Thursday.

- After strengthening vs. the USD in the wake of the BoJ policy announcement and subsequent hawkish Ueda press conference yesterday, JPY has returned to its recent trend of losses vs. the USD. USD/JPY has been as high as 152.83.

- Antipodeans are both marginally softer vs. the USD in quiet newsflow for both countries.

- CHF is the laggard across the majors following soft Swiss inflation data. The release has stoked fears that Switzerland could enter into deflation next year and therefore expectations of a 50bps cut by the SNB have heightened (currently priced at 28%).

- PBoC set USD/CNY mid-point at 7.1135 vs exp. 7.1122 (prev. 7.1250).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are a handful of ticks lower, 110-09+ base matches the week’s opening level and is 6+ ticks clear of Thursday’s WTD base. Focus entirely on Payrolls, forecast range of -10k to +200k, with ISM Manufacturing thereafter.

- Bunds are softer as the week’s bearish action continues but thus far we remain clear of the WTD 131.15 trough by around 30 ticks but still in the red for the week as a whole by over a full point.

- Gilts opened lower by 21 ticks, stabilised briefly before slipping to a 93.45 trough, a low which is just above yesterday’s 93.18 contract low. As such, while the UK’s 10yr yield is elevated it remains shy of 4.5% and Thursday’s 4.52% YTD high.

- UK Treasury official says the scenario currently is very different from the Truss-budget.

- Click for a detailed summary

COMMODITIES

- Crude is on a firmer footing as recent rhetoric brings back risk-premium into the weekend. Focus on an Axios piece that Iran is reportedly preparing a major retaliatory strike from Iraq within days. Brent'Jan 25 currently near session highs of USD 74.94/bbl.

- Spot gold is firmer, though action is minimal with the metal contained into NFP & ISM Manufacturing. Holding just above the USD 2750/oz mark and yet to make any real headway into recovering towards the USD 2790/oz ATH from early-doors yesterday.

- Base metals are firmer, owing to the Chinese Caixin Manufacturing PMI making a surprising return to expansionary territory. 3M LME Copper above the USD 9.6k mark, though the move has paused for breath with the docket now light until the US data deluge.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK Nationwide house price MM (Oct) 0.1% vs. Exp. 0.3% (Prev. 0.7%, Rev. 0.6%); YY 2.4% vs. Exp. 2.8% (Prev. 3.2%)

- UK S&P Global Manufacturing PMI (Oct) 49.9 vs. Exp. 50.3 (Prev. 50.3)

- Swiss CPI YY (Oct) 0.6% vs. Exp. 0.8% (Prev. 0.8%); MM (Oct) -0.1% (Prev. -0.3%)

NOTABLE EUROPEAN HEADLINES

- Moody's says the UK budget creates challenges as it warns of a muted UK growth, according to the FT.

- S&P says UK fiscal position is constrained following budget announcements; new budget decisions, however, do not have an immediate impact on headline budgetary forecasts for the UK

NOTABLE US HEADLINES

- Apple Inc (AAPL) Q4 2024 (USD): Adj. EPS 1.64 (exp. 1.58), Revenue 94.93bln (exp. 94.58bln), Products revenue 69.96bln (exp. 69.15bln), iPhone revenue 46.22bln (exp. 45.04bln), Mac revenue: 7.74bln (exp. 7.74bln), iPad revenue: 6.95bln (exp. 7.07bln), Wearables, home, and accessories revenue: 9.04bln (exp. 9.17bln), Service revenue: 24.97bln (exp. 25.27bln), Greater China revenue fell 0.3% Y/Y to 15.03bln (exp. 15.8bln), Co. expects Q1 rev. growth at low to mid-single digits.. -1.1% pre-market

- Amazon.com Inc (AMZN) Q3 2024 (USD): EPS 1.43 (exp. 1.14), Revenue 158.9bln (exp. 157.2bln). +6.2% pre-market

- Intel Corp (INTC) Q3 2024 (USD): Adj. EPS -0.46 (exp. -0.02), Revenue 13.3bln (exp. 13.02bln). +6.1% pre-market

- Chevron Corp (CVX) Q3 2024 (USD): adj. EPS 2.51 (exp. 2.43), revenue 48.9bln (exp. 48.99bln). +2.8% pre-market

GEOPOLITICS

MIDDLE EAST

- Lebanese Prime Minister Mikati says "the continuation of Israeli attacks is an indication of Tel Aviv's rejection of all efforts to cease fire", via Asharq News

- Iran’s supreme leader Khamenei instructed the Supreme National Security Council on Monday to prepare for attacking Israel, according to NYT citing three Iranian officials familiar with the war planning. Khamenei was said to have made the decision after he reviewed a detailed report from senior military commanders on the extent of damage to Iran’s missile production capabilities and air defence systems around Tehran, critical energy infrastructure and a main port in the south.

- Israel conducted strikes on Beirut suburbs for the first time in days, while a Lebanese news agency reported that dozens of buildings in the southern suburbs of Beirut were flattened by Israeli raids, according to Sky News Arabia.

- Islamic Resistance in Iraq said it attacked with marches a vital target in the south of the occupied territories several times since dawn today, according to Al Jazeera.

- US Defence Secretary Austin spoke to Israeli Defence Minister Gallant and reaffirmed the US remains fully prepared to defend US personnel and partners across the region against threats from Iran, according to the Pentagon.

- US State Department issued a response to Israel's cabinet decision on extending indemnification for correspondent banking between Israel and West Bank in which it stated the short-term extension creates another looming crisis by November 30th and called for Israel to swiftly extend indemnification for essential banking relationships for at least a year.

OTHER

- North Korea's Standing Committee Chairman Choe says we need to strengthen nuclear weapons and improve readiness for a retaliatory nuclear strike.

CRYPTO

- Bitcoin is slightly lower and trading just beneath USD 70k, with sentiment hit following the return of the geopolitcal risk premium.

APAC TRADE

- APAC stocks traded mixed following the tech-heavy losses stateside and heightened geopolitical concerns, while Chinese markets outperformed after further encouraging manufacturing PMI data.

- ASX 200 declined with nearly all industries subdued aside from the commodity-related sectors.

- Nikkei 225 slumped at the open after recent currency strength and the hawkish tone from BoJ Governor Ueda.

- Hang Seng and Shanghai Comp were underpinned after the Chinese Caixin Manufacturing PMI followed suit to yesterday's official release with a surprise return to expansion territory, while the attention was also on recent earnings reports.

NOTABLE ASIA-PAC HEADLINES

- China National People's Congress Standing Committee proposed a law amendment for further refining government debt supervision, while it added the provision state council and above county-level governments should report on debt management progress.

- IMF expects Asia's economy to expand by 4.6% in 2024 and 4.4% in 2025 but noted risks to Asia's economic outlook are tilted to the downside and that an acute risk for Asia is an escalation in tit-for-tat retaliatory tariffs between major trading partners. Furthermore, it stated that persistent downward price pressures from China can hurt countries with similar export structures and provoke trade tensions, as well as noted that China's property sector problems have not been addressed comprehensively, leading to plummeting consumer confidence.

- Japan's Opposition, DPP Chief Tamaki says "the BoJ should not raise interest rates for at least half a year".

DATA RECAP

- Chinese Caixin Manufacturing PMI (Oct) 50.3 vs. Exp. 49.7 (Prev. 49.3)

- Australian PPI QQ (Q3) 0.9% (Prev. 1.0%); YY 3.9% (Prev. 4.8%)