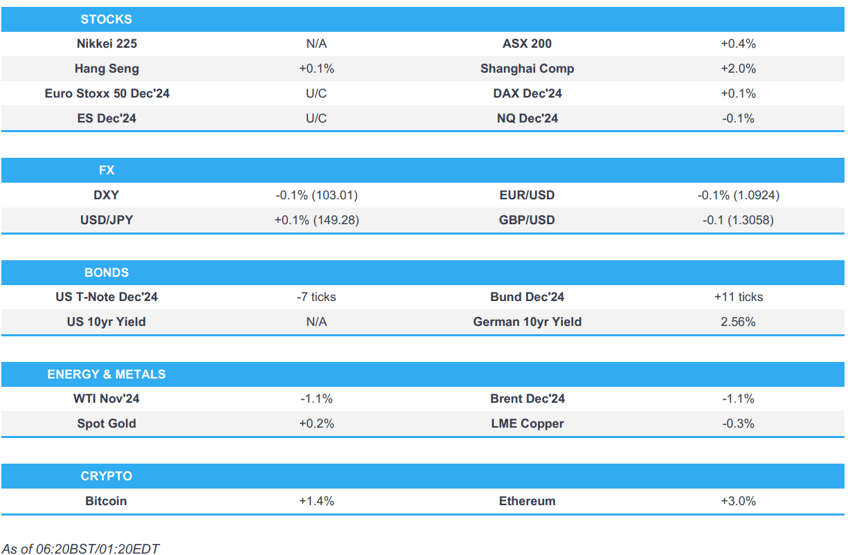

- APAC stocks were predominantly higher but with the upside initially capped amid the Japanese holiday closure, soft Chinese inflation and lack of China stimulus details.

- Upside became more pronounced as the session continued for mainland China, region still awaits trade data.

- DXY in a tight range, EUR unreactive to Fitch on France; USTs softer but with action sparse on Columbus Day

- Crude pressured by the lack of specifics from China's MOF briefing; US to send Israel a THAAD defence system

- Looking ahead, highlights include Canada Thanksgiving Day, US Columbus Day (US Bond Market Closed, Stocks Open), OPEC MOMR, Speakers including BoE’s Dhingra, Fed’s Waller & RBNZ’s Hawkesby.

- Click for the Newsquawk Week Ahead.

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks gained on Friday with outperformance in financials after JPMorgan (JPM), Wells Fargo (WFC), and BlackRock (BLK) benefitted from their earnings updates, while participants also digested mixed PPI data and a weaker University of Michigan preliminary release. Nearly all sectors finished higher although consumer discretionary and tech lagged with Tesla (TSLA) (-8.8%) heavily pressured after its Robotaxi event disappointed investors, while the treasury curve steepened and chopped to the US PPI data and soft UoM survey but ultimately settled in the green as a dovish leaning Logan and lower oil prices supporting the move.

- SPX +0.61% at 5,815, NDX +0.15% at 20,272, DJIA +0.97% at 42,864, RUT +2.10% at 2,234.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Police reportedly thwarted a potential third assassination attempt against Donald Trump after officers stopped a person carrying weapons at the perimeter of his rally in Coachella which the local sheriff said were likely intended for “another assassination attempt”, according to The Telegraph.

- US Energy Secretary Granholm said about 75% of power was restored across Florida and the vast majority of power in Florida is expected to be restored by the end of Tuesday.

APAC TRADE

EQUITIES

- APAC stocks were predominantly higher but with the upside capped amid the Japanese holiday closure, soft Chinese inflation and lack of China stimulus details, while participants await Chinese trade data.

- ASX 200 was underpinned amid strength in mining stocks despite a pullback in commodity prices.

- Hang Seng and Shanghai Comp traded mixed in which the former initially slipped back beneath the 21,000 level with notable weakness in tech and consumer stocks after the Chinese Ministry of Finance's press briefing omitted an actual stimulus size. Conversely, the mainland ultimately shrugged off the lack of stimulus details and softer inflation data, while other government departments also pledged support efforts, picking up further throughout the session.

- US equity futures lacked direction to start the week and mostly held onto Friday's spoils.

- European equity futures are indicative of a marginally lower cash open with the Euro Stoxx 50 future -0.1% after the cash market closed higher by 0.7% on Friday.

FX

- DXY was confined within a tight range around the 103.00 level after thin pertinent weekend newsflow and amid quasi-holiday conditions stateside for Columbus Day, while the US data calendar is also light to start the week with Fed speakers the main highlight.

- EUR/USD remained lacklustre at the 1.0900 handle after the choppy mood late last week.

- GBP/USD marginally softened but with the downside stemmed by support around the 1.3050 level.

- USD/JPY was steady in 149.00 territory with little to drive price action amid the holiday closure.

- Antipodeans softened alongside a weaker yuan and after China stimulus-related disappointment.

- PBoC set USD/CNY mid-point at 7.0723 vs exp. 7.0722 (prev. 7.0731).

FIXED INCOME

- 10yr UST futures were subdued and tested the 112.00 level to the downside with demand sapped amid the closure of cash trade due to the Tokyo holiday and with the US bond market closed for Columbus Day.

- Bund futures remained afloat after last Friday's intraday rebound from a floor near the 133.00 level.

COMMODITIES

- Crude futures were pressured at the open amid China-related headwinds after softer-than-expected inflation data and a lack of stimulus details from the Ministry of Finance's press briefing on Saturday.

- Spot gold returned to flat territory after fading the early declines seen across the commodity complex.

- Copper futures traded lower after the underwhelming key updates from China, while participants also awaited the latest trade figures.

CRYPTO

- Bitcoin gained overnight following a late boost which lifted prices back above the USD 64,000 level.

NOTABLE ASIA-PAC HEADLINES

- China’s Finance Minister Lan Foan said local governments have CNY 2.3tln in local funds to spend in the last three months of the year which includes debt quotas and unused funds. Lan stated that the central government has relatively large room to issue debt and increase the budget deficit, while they will better use policy measures to support the economy. Furthermore, they will implement fiscal and tax reforms in a step-by-step way and will roll out some reforms over 2024 and 2025 but did not announce the size of the stimulus.

- China’s Vice Finance Minister said they will take measures to promote stability in the property market, while they will expand the scope of usage for local government debt and will complete the issuance of CNY 1tln in special treasury bonds in 2024. Furthermore, the official said it is necessary to support large state banks to increase first-tier core capital and will support large banks’ operations and profitability to support the economy.

- China's MIIT said China will launch another batch of specific initiatives in Q4 to promote consumption and expand domestic demand and noted there are currently about 36,000 projects under construction in the industrial field which started during the year and are expected to pull investment of more than CNY 11tln in the next three years. It was also reported that China's Industrial Ministry official said China will roll out supportive measures for equipment upgrades and consumer trade-ins in Q4, while China's financial regulator official said they will lower financing costs of small and mid-sized enterprises.

- China's upcoming local government hidden debt swap could be over CNY 2.2tln, according to Xinhua citing a state think tank.

- China’s MOFCOM said there are still major differences between both sides in China-EU tariff negotiations and a mutually acceptable solution has not been reached so far, while the Chinese side officially invited the European side to send a technical team to China ASAP to continue face-to-face negotiations. Furthermore, MOFCOM said Chinese companies have authorised the China Chamber of Commerce for Machinery and Electronics to propose a price commitment plan that represents the overall position of the industry, and it warned against the European side conducting separate price commitment negotiations with some companies.

- China’s MOFCOM said Taiwan’s Democratic Progressive Party has not taken any practical measures to lift trade restrictions on the mainland, while it added relevant departments are studying further measures based on the conclusions of the ministry’s investigation into trade barriers by Taiwan against the mainland.

- Monetary Authority of Singapore maintained the width, centre and slope of the SGD NEER policy band, as expected. MAS said Singapore's economy is currently forecast to expand at close to its potential rate and it expects GDP growth to come in around the upper end of the 2–3% forecast range for the year. MAS said core inflation has stepped down and is anticipated to decline further to around 2% by the end of 2024, while based on its outlook, the MAS assesses that the monetary policy settings are for now still consistent with medium-term price stability.

DATA RECAP

- Chinese CPI MM (Sep) 0.0% vs Exp. 0.4% (Prev. 0.4%); YY 0.4% vs. Exp. 0.6% (Prev. 0.6%)

- Chinese PPI YY (Sep) -2.8% vs. Exp. -2.5% (Prev. -1.8%)

- Singapore GDP QQ (Q3 P) 2.1% vs Exp. 1.8% (Prev. 0.4%)

- Singapore GDP YY (Q3 P) 4.1% vs Exp. 3.8% (Prev. 2.9%)

GEOPOLITICS

MIDDLE EAST

- US President Biden said he is sending THAAD missile defence to defend Israel, according to WSJ.

- US Secretary of Defence Austin expressed deep concern over reports that Israeli forces fired on UN peacekeeping positions in Lebanon and called for the safety and security of UNIFIL forces and Lebanese armed forces during a call with Israel’s Defence Minister Gallant.

- Israeli PM Netanyahu urged UN Secretary-General Guterres to remove UNIFIL forces from combat areas in Lebanon, while it was also reported that Israel’s Foreign Minister declared UN chief Guterres persona non grata over his Iran stance, according to Reuters.

- Israel’s military said an IDF tank that was trying to evacuate injured soldiers backed several meters into a UNIFIL post in southern Lebanon and once enemy fire had stopped and following the evacuation of injured soldiers, the tank left the post. Furthermore, the Israeli military said no danger was posed to UNIFIL soldiers by IDF activity throughout the entire incident, according to Reuters.

- UN spokesperson said UNIFIL peacekeepers in Lebanon remain in all positions and UNIFIL is taking all possible measures to ensure the protection of its peacekeepers, while the spokesperson added that the UN Secretary-General called on all parties including the Israeli military to refrain from any actions that put peacekeepers at risk, according to Reuters.

- Israel’s military ordered the residents of 22 villages in southern Lebanon to evacuate north of the Awali River, while the Israeli military declared areas around a number of towns in northern Israel as closed to the public, according to Reuters. Furthermore, the Israeli army said Hezbollah fired 25 rockets from nearby positions of UNIFIL forces towards IDF positions and Israeli towns.

- Lebanon’s Hezbollah said it attacked a Golani Brigade camp in northern Israel with a swarm of drones which was reported to have injured more than 60 people and it warned Israeli settlers against staying near army bases in northern Israel until further notice, according to Reuters. It was separately reported that Hezbollah said it shelled with rockets enemy forces in the settlement of Al-Manara for a fifth time.

- Hezbollah promises Israel that what it witnessed in southern Haifa is nothing compared to what awaits it if it decides to continue its aggression against their people, according to AFP News Agency.

- Iran’s Foreign Minister commented on X that they have no red lines in defending their people and interests.

- Iran’s Revolutionary Guards aerospace commander Hajizadeh said Tehran is ready to respond to any misstep by Israel, according to Tasnim.

- French President Macron urged Iranian President Pezeshkian to support a general de-escalation in the Middle East during a conversation, while Macron stressed in another discussion with Lebanon’s caretaker PM Mikati the ‘absolute necessity’ to obtain a ceasefire without further delay, according to the Presidential Office.

- Turkish President Erdogan said Israel is a concrete threat to regional and global peace, while he said it is essential for Russia, Iran and Syria to take effective measures when asked about Israel’s strike on Damascus.

- Pentagon said US forces conducted a series of strikes against multiple Islamic State camps in Syria.

OTHER

- Ukrainian President Zelensky said Russian forces tried to push back Ukrainian troops in Russia’s Kursk region, while he added that Ukraine is holding out positions.

- Ukraine’s air force said on Sunday morning that Russia launched 68 drones and four missiles that targeted Ukraine.

- Russian and Chinese warships conducted joint drills to repel a missile attack in the Pacific.

- Taiwan’s Defence Ministry said a Chinese aircraft carrier group entered the Bashi channel on Sunday and will probably be operating in the western Pacific, while it was later reported that China's military announced the PLA Eastern Theatre Command will dispatch its troops from the army, navy, air force, and rocket force to conduct joint military drills code-named “Joint Sword-2024B” in the Taiwan Strait and areas around Taiwan.

- Taiwan’s Defence Ministry said it strongly condemns China’s irrational and provocative act, as well as announced that it has dispatched forces to respond to China's drills. It later updated that aircraft and ships have been responding to the hostile situation in accordance with the rules of engagement and will not escalate conflict in their response.

- US President Biden's administration official said they are monitoring the PLA exercise and urge the PRC to avoid any further actions that may jeopardize peace and stability across the Taiwan Strait and in the broader region, while it added there is no justification for military exercises and pressure campaigns in response to a routine annual speech.

- North Korea said it ordered artillery corps near the border to fully prepare to shoot after it threatened a "horrible disaster" over the alleged flight of drones over its capital, according to Yonhap.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer is to ask the competition watchdog to soften its approach as he vows to rip out bureaucracy to make the UK more attractive for investments, according to FT.

- UK Business and Trade Secretary Reynolds added to speculation that the government is planning to increase payroll taxes for businesses by raising their national insurance contributions as he insisted that the Labour government’s manifesto had only promised not to hike the contributions for employees, according to an interview with Sky News cited by Bloomberg.

- Fitch Ratings has downgraded France’s outlook to negative from stable, while maintaining France's credit rating at "AA-", citing increased fiscal deficits and political risks; the agency expects government debt to rise to 118.5% of GDP by 2028, following the announcement of the 2025 budget.