Our latest trade war tracking coverage of critical U.S.-China supply chains shows that China's export manufacturing base has already been severely impacted, with shockwaves thundering across the Pacific. Ports along the U.S. West Coast—particularly the Port of Los Angeles—are now bracing for a sharp plunge in containerized imports in the coming days, if not the next few weeks.

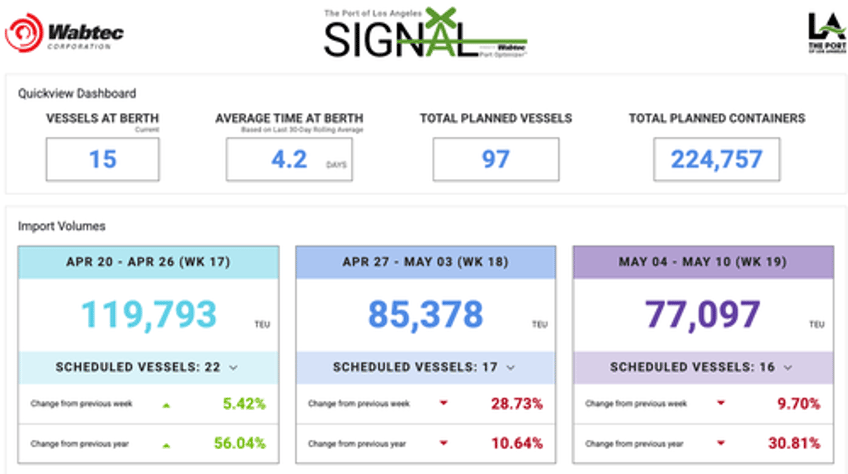

On Friday, new data from Port Optimizer, a tracking system for vessel operators, showed that scheduled import volumes into the Port of Los Angeles are set to decline sharply beginning on Sunday.

Let's review what's transpired this month:

Amazon Cancels Orders, Walmart Pulls Forecast As Tariffs Take Hold

Are China Road Traffic Indicators Set To Collapse As Tariff War Cancels Factory Orders

Chinese Sellers On Amazon Panic After Trump's Tariff Bazooka

Liberation Day Fallout: China's Port Volumes Sink After Trump's Tariff Blitz

Chinese Plastics Factories Face Mass Closure As U.S. Ethane Supply Evaporates

"Our Export Orders Disappeared": Chinese Factories Shutting Down, Laying Off Workers, FT Finds

First Tariff Shock Set To Hit Port Of Los Angeles, With Ripple Effects Across The Broader Economy

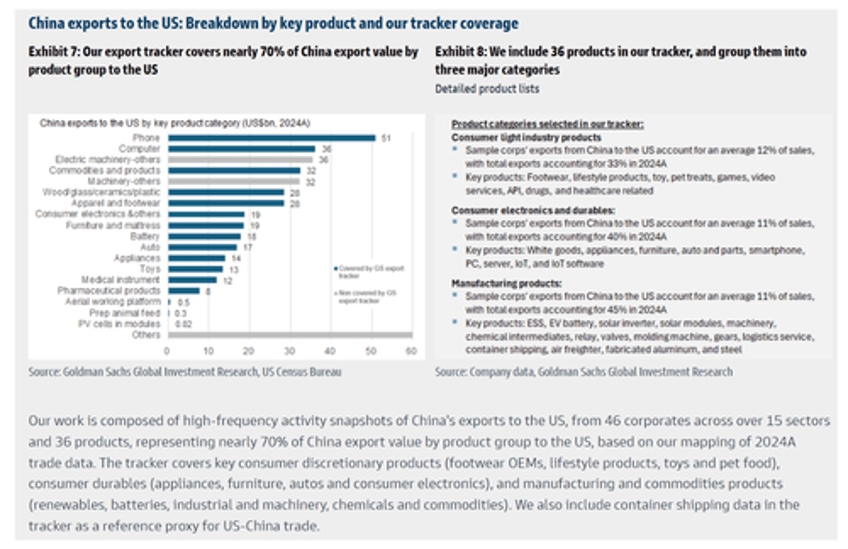

Also on Friday, Goldman's Jack McFerran provided clients with a "China Export Tracker" produced by Trina Chen, head of China research and Asia commodities at Goldman.

"She has created a tracker and working with 46x corporates with products representing 70% of the China export value to gauge the speed and size of changes as they happen," McFerran said.

He said this data provides clients with early reads on trade disruptions:

Early reads suggest substantial impact on Chinese exports to the U.S. While specifics are challenging, feedback suggests 41% have seen above 50% negative impact on their exports (produced in China). The most-impacted products are white goods, appliances, batteries and selected commodities, whilst lesser-impacted products include healthcare, gaming software, and industrial-tech (partly due to current tariff exemptions or FOB pricing systems).

Pricing discussions have started, but no clarity on pass through; some corporates are not seeing enough margin to absorb tariff impact. The pace of changes has been so rapid that most producers haven't been able to mount an effective response yet. However, 60% of surveyed corporates had started discussing new pricing with end users/importers in the U.S., but none of the respondents expect to see an improvement in clarity in the coming weeks.

Ex-China supply chain (particularly Southeast Asia) could provide temporary reprieve. Producers have commented that alternative supply chains could fill the gap, with Southeast Asia, Mexico, and India providing the most alternative supply chains for the majority of products. In the near-term, Southeast Asia activity is picking up in a rush for orders during the current 90-day suspension – the team estimates 20% of Chinese producers surveyed are using their ex-China production facilities in lower-tariff countries now.

Corporates are also pointing to their U.S. inventory buffers, for now. Producers that prepared ahead seem to have a 3–6-month inventory buffer in the U.S., with price-hikes being planned once these low-cost inventories have been depleted.

Forward-looking container shipping data are pointing to a >27% fall by 3Q25. U.S. container imports from China stood at 0.76 mn TEU as of March, and forward-looking estimates for U.S. monthly container imports do imply a +10% YoY growth for 1Q25E, but also imply -15% YoY for 2Q25E, and -27% for 3Q25E.

A breakdown of Trina Chen's key products in her tracker coverage...

The trade war shock is set to hit U.S. West Coast shores momentarily, with the first impacts expected at the Port of Los Angeles.

Imagine what it would be like if the economy showed no growth for 7 years.

— Craig Fuller 🛩🚛🚂⚓️ (@FreightAlley) April 25, 2025

That is how the trucking market feels for truckers right now. Truckload volumes have dropped to 2018 levels as phase 1 of the trade war is showing up in the market. pic.twitter.com/TY3FAHn8LC

Meanwhile, leftist U.S. corporate media, ABC, NBC, CBS, NPR, etc... has been silent about the unfolding economic mess crushing Chinese exporters as Democrats save headlines and quietly hope to pin a potential 'Great Depression' on Trump.