- US President Trump signed proclamations to reimpose a 25% tariff on steel and aluminium imports and declared there are no exceptions or exemptions, effective March 12th.

- US President Trump said they are looking at tariffs on cars, pharmaceuticals and chips and will hold meetings over the next four weeks, while they will do reciprocal tariffs over the next two days; Trump also commented that tariffs on metals could go higher and he does not mind if other countries retaliate.

- US President Trump is expected to sign executive orders on Tuesday at 15:00EST/20:00GMT.

- APAC stocks were ultimately mixed after the tech-led gains on Wall St and as participants digested US President Trump's 25% tariffs on steel and aluminium, while Japanese markets were closed for a holiday.

- US equity futures gradually retreated following President Trump's metals tariff proclamations; European equity futures indicate a flat open with Euro Stoxx 50 futures down U/C after the cash market closed with gains of 0.6% on Monday.

- Looking ahead, highlights include Norwegian GDP, EIA STEO, Speakers including ECB's Schnabel, BoE’s Mann & Bailey, Fed’s Powell, Hammack, Williams & Bowman, Supply from the US, the Netherlands & Germany.

- Earnings from Shopify, Coca-Cola, Humana, Supermicro, Upstart, DoorDash, Gilead Sciences, Lyft, BP, Kering & Banco BPM.

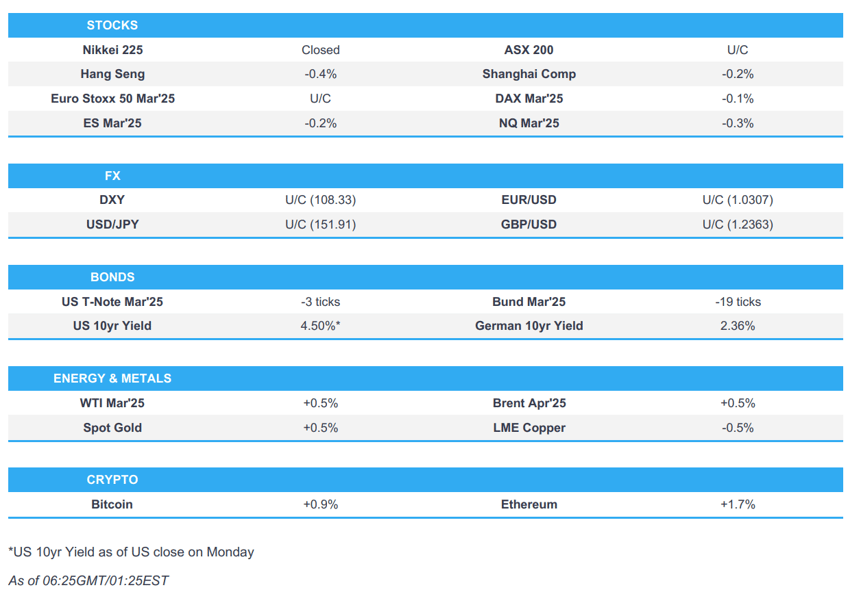

SNAPSHOT

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks gained on Monday despite tariff escalation talk over the weekend, namely that President Trump is to announce 25% tariffs on all steel and aluminium coming into the US.

- NDX outperformed which was supported by advances in the Technology sector with broad-based semiconductor manufacturers' strength as Evercore added NVIDIA to its Tactical Outperform list, while Energy was the best-performing sector amid firmer crude prices on the aforementioned tariff developments and also geopolitical woes.

- SPX +0.67% at 6,066, NDX +1.23% at 21,757, DJIA +0.38% at 44,470, RUT +0.36% at 2,288.

- Click here for a detailed summary.

TARIFFS

- US President Trump signed proclamations to reimpose a 25% tariff on steel and aluminium imports and declared there are no exceptions or exemptions, effective March 12th. Trump said they are looking at tariffs on cars, pharmaceuticals and chips and will hold meetings over the next four weeks, while they will do reciprocal tariffs over the next two days. Trump also commented that tariffs on metals could go higher and he does not mind if other countries retaliate. Furthermore, it was also reported that President Trump is expected to sign executive orders on Tuesday at 15:00EST/20:00GMT.

- Canada's Industry Minister said US tariffs on steel and aluminium are "totally unjustified", while he is consulting with international partners on US steel and aluminium tariffs, as well as noted that the response will be "clear and calibrated".

- UK reportedly sought clarity on Trump tariffs in a bid to avoid steel threat and it was also reported that PM Starmer is to meet with US President Trump before the end of February, according to The Telegraph.

- UK played down the threat of US President Trump’s steel and aluminium tariffs, while Downing Street refused to say if Britain would retaliate and the industry warned that levies on exports would be ‘devastating’, according to FT.

- French Finance Minister Lombard said Europe will answer to US tariff moves as strongly as the position of the US and they are prepared to do whatever is necessary to be balanced, while Lombard added they are ready and noted that the national digital tax is unrelated to the trade war and will not be changed.

- Australian PM Albanese said he had a great conversation with US President Trump and they committed to working constructively to advance Australian and American interests, while he noted that President Trump agreed to consider an exemption for Australia on steel tariffs.

- Hong Kong said US tariffs are inconsistent with WTO rules and it will file a complaint on US tariffs to the WTO, while it noted the US has completely ignored the city's status as a separate customs territory from China.

NOTABLE HEADLINES

- US President Trump said no when asked if he sees VP JD Vance as his successor and stated that it is too soon.

- US judge temporarily blocked the Trump administration’s cuts to universities and medical centres' research funding.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed after the tech-led gains on Wall St and as participants digested US President Trump's 25% tariffs on steel and aluminium which take effect from March 12th, while Japanese markets were closed for a holiday.

- ASX 200 closed flat with gold stocks underpinned after the precious metal extended on its record highs, while the tech sector took impetus from the strength seen in its US counterpart.

- Hang Seng and Shanghai Comp were subdued following US President Trump's latest tariff actions, while he reiterated they will do reciprocal tariffs in the next two days and is also looking at tariffs on cars, pharmaceuticals and chips with meetings to take place over the next four weeks. Furthermore, Hong Kong criticised the US tariffs and will file a complaint on US tariffs to the WTO, as well as claimed that the US has completely ignored the city's status as a separate customs territory from China.

- US equity futures gradually retreated following President Trump's metals tariff proclamations.

- European equity futures indicate a flat open with Euro Stoxx 50 futures down U/C after the cash market closed with gains of 0.6% on Monday.

FX

- DXY traded rangebound after gaining yesterday on Trump's tariff rhetoric although there was a muted reaction to Trump's actual signing of the proclamations on the 25% steel and aluminium tariffs which will take effect from March 12th, while Trump reiterated they will do reciprocal tariffs over the next two days and said they are also looking at tariffs on cars, pharmaceuticals and chips. Nonetheless, participants now look ahead to Fed Chair Powell's testimony to Congress beginning later today followed by US CPI data on Wednesday.

- EUR/USD lacked demand after marginally softening to retest near-term support at the 1.0300 level with the latest ECB rhetoric providing very little to spur price action as ECB President Lagarde stated the conditions for a recovery remain in place and inflation is set to return to the 2% medium-term target in the course of this year but noted risks on both the upside and downside.

- GBP/USD continued to trickle beneath the 1.2400 handle with participants awaiting comments from BoE Governor Bailey, while Mann stated UK inflation is less of a threat and pricing is coming very close to 2% target-consistent levels in the year ahead.

- USD/JPY struggled for direction and stalled around the 152.00 level amid the absence of Japanese participants.

- Antipodeans were restricted amid the cautious risk appetite and mixed NAB Business surveys, while Australia was also hoping for an exemption from the US steel tariffs which PM Albanese claimed President Trump would consider despite the latter declaring no exceptions or exemptions.

- PBoC set USD/CNY mid-point at 7.1716 vs exp. 7.3067 (prev. 7.1707).

FIXED INCOME

- 10yr UST futures traded sideways as participants await the looming key events and with price action also contained amid the absence of overnight cash treasuries trade due to the holiday closure in Tokyo.

- Bund futures were stuck near 133.50 ahead of supply including a Bobl auction later and Bund auctions tomorrow.

COMMODITIES

- Crude futures remained afloat and took a breather following yesterday's advances on the back of Trump's tariff talk and geopolitical headlines with Gaza ceasefire mediators fearing a breakdown of the agreement, while Hamas is to delay the hostage release planned for Saturday until further notice.

- Russia's First Deputy Energy Minister believes sanctions won't hinder oil trade with India and said more time is needed to assess the impact of the latest sanctions, while the official added that Russia has the technology to develop energy resources and will continue to meet market demand for energy.

- Spot gold extended on record highs north of the USD 2900/oz level before wiping out the majority of its early gains.

- Copper futures pulled back after recently climbing to its best levels in four months with headwinds from Trump tariffs.

CRYPTO

- Bitcoin traded indecisively overnight and swung between both sides of the USD 98,000 level.

NOTABLE ASIA-PAC HEADLINES

- US President Trump said he had spoken to Chinese President Xi since his inauguration but didn't provide further details.

DATA RECAP

- Australian Consumer Confidence (Feb) 92.2 (Prev. 92.1)

- Australian Consumer Sentiment (Feb) 0.1% (Prev. -0.7%)

- Australian NAB Business Confidence (Jan) 4.0 (Prev. -2.0)

- Australian NAB Business Conditions (Jan) 3.0 (Prev. 6.0)

GEOPOLITICS

MIDDLE EAST

- US President Trump said if all Gaza hostages aren't returned by noon on Saturday, he would say cancel the ceasefire and let all hell break out, while he added that Israel can override it and thinks Jordan will take refugees. Trump also said the US could withhold aid to Jordan and Egypt if they don’t take refugees, while he might talk to Israeli PM Netanyahu about the Saturday deadline.

- Gaza ceasefire mediators fear a breakdown of the agreement and talks have been postponed until clear indication from the US on a continuation of the phased plan, according to Reuters citing Egyptian security sources. Hamas told mediators that Israel was not serious about carrying out the phased ceasefire and US guarantees for the ceasefire are no longer in place given Trump's displacement plan.

- Israeli Defense Minister Katz said in response to Hamas delaying Israeli hostages that this is a complete violation of the ceasefire agreement and he instructed the IDF to prepare for any scenario in Gaza.

- Al-Qassam Brigades Tulkarm said their fighters, accompanied by the Al-Quds Brigades and the Al-Aqsa Martyrs Brigades, targeted an Israeli force in the vicinity of Tulkarm camp, according to Al Jazeera.

- Washington called on Israel to withdraw from southern Lebanon before February 18th, according to Jerusalem Post.

- US President Trump said Iran is very concerned and very frightened because their defence is pretty much gone and now would love to make a deal with the US, according to an interview with Fox News cited by Iran International.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said US officials are to visit Ukraine this week before the Munich security conference and he plans to have a meeting with VP Vance.

- Ukraine's Energy Minister said Russia launched an air attack on Ukraine's gas infrastructure overnight and in the morning, while emergency power restrictions were imposed to minimise possible consequences.

- Russia's aviation watchdog suspended flights at four airports to ensure safety after officials reported drone attacks.

- Industrial facility in Russia's Saratov region was on fire after a Ukrainian drone attack, according to the regional governor, while Russia's Shot Telegram news channel reported explosions were heard in the area of the oil refinery in Saratov.

- US President Trump said he will speak with Ukrainian President Zelensky this week and special envoy Kellogg is going to Ukraine soon. It was also reported that the Trump administration will push European allies to purchase more US weapons for Ukraine, while weapons approved by the Biden administration are still flowing to Ukraine, according to Reuters citing sources and the US Special Ukraine Envoy.

OTHER

- North Korea said a US nuclear submarine has arrived at a South Korean port, escalating security tensions, according to KCNA. Furthermore, North Korea said Washington's sending of a nuclear submarine to Seoul is a serious threat.

EU/UK

NOTABLE HEADLINES

- BoE's Mann said UK inflation is less of a threat as corporate pricing power weakens and pricing is coming very close to 2% target-consistent levels in the year ahead, while she added that demand conditions are weaker than before and that she had changed my mind on that, according to FT.

- Barclays said UK January consumer spending rose 1.9% Y/Y which is the largest rise since March 2024 and Consumer Sentiment was at +21% which is the lowest since the series began in April 2024.

- ECB President Lagarde said the conditions for a recovery remain in place and inflation is set to return to the 2% medium-term target in the course of this year, with risks on both the upside and downside. Lagarde added the ECB is not pre-committing to a particular rate path and the frequency of shocks is likely to remain high in the future.

- French President Macron said that France is back in the AI race now and the European AI strategy is to be announced on Tuesday.

DATA RECAP

- UK BRC Retail Sales Like-For-Like YY (Jan) 2.5% (Prev. 3.1%)

- UK BRC Total Sales YY (Jan) 2.6% (Prev. 3.2%)